Attached to Latch, smitten by SmartRent

Note: For entertainment and informational purposes only. Not investment advice. Please do your own research.

Two enterprise software startups poised to modernize and transform commercial real estate, rapidly winning broad adoption and owned by the industry’s leading players. Underfollowed and dismissed due to SPAC stigma and seemingly preposterous valuation multiples. Yet, there are intriguing and promising early signs of an emerging duopoly, with potential to become the iOS and Android for a staid but massive industry.

CONTENTS

Introduction

Thesis

Investment Highlights

Why Smart-Enablement Technology is Poised for Adoption

Enter Latch and SmartRent

Who Wins?

Value Creation

Ownership

7 Powers

Valuation Thoughts

Risks and A Note on SPACs

Bottom Line

Introduction

It’s often said that investing in real estate is the path to wealth.

Lately, I’ve been spending quite a bit of time looking for an appropriate real estate play: rental properties, REITs, private equity, crowdfunding platforms. There is no shortage of potential opportunities to explore, and no lack of companies and individuals available to help you along that journey.

Earlier this year, I found myself caught up in the latest commercial real estate deals from such sites as Crowdstreet, RealtyMogul, and Cadre. These appear to be quite enticing at first glance. I had little interest in managing a rental property directly, and the properties in my area were too expensive for investment anyway. These platforms seemed to provide access to previously hard to find opportunities, and I would be able to participate as a passive investor without any of the headaches associated with property management. There were so many different types of deals, asset classes and capital structure areas to pore through, and they all seemed to offer compelling returns from a cash flow and IRR perspective.

After looking through dozens of these opportunities, however, I gradually became less and less enamored with them. I started noticing a common financial profile across the opportunities: 3-7 year hold periods, 50-70% debt levels, 5-8% target cash yields, and 15-20% target IRRs. On the surface, these seemed to offer a great return, but there were a lot of factors to consider: the experience and history of the sponsor, the amount of skin they had in the project, the location and history of the property, the reams of operating agreements to read through, and the layers upon layers of stakeholders and fees. These new platforms all had snazzy interfaces and promised to democratize real estate investing, but it also made me wonder why these deals were becoming accessible to me now.

It also seemed that the most attractive projects were typically snapped up immediately and allocations were scarce. Those that were available for investment implicitly raised the yellow flag for why they were available. Surely, I was missing something, for otherwise, the savvier investors would have claimed the investment already.

What did I know about the prospects for some value-add multi-family or hotel conversion for some Florida suburb? How much could I comfortably put into any one deal? Was it really worth the effort to do the research, not to mention all of the ongoing overhead of K-1 filings, special tax consequences and illiquidity? I concluded that it didn’t make sense.

REITs then seemed to be a cleaner and simpler alternative. But the most desirable companies with the best property portfolios of course all had lofty valuations. Many also had high debt levels and/or would continually issue dilutive shares to expand their portfolios. Apart from the premier companies, the rest seemed to be more or less undifferentiated collections of properties with similar financial characteristics. There were some decent opportunities, but this ultimately felt like an alternative for fixed income rather than true appreciation.

What I really wanted was to find some concentration of power, an area where I could enjoy the compounding effects of a growing business with a defensible moat.

I believe that opportunity exists within real estate technology, particularly in areas where emerging players have started to achieve adoption and investment from the industry leaders and are rapidly de-risking their paths toward becoming the industry standard.

To cut to the chase, there are two companies - Latch and SmartRent - that appear to be the leaders within smart enablement for multifamily.

To me, there are striking parallels to Apple iOS and Android in smart phones, or Mac and Windows in personal computing. It’s a brash claim, but I believe the comparison to platform software is appropriate.

In fact, there are elements here that may make this superior to software. These are sticky, long-term, recurring revenue solutions where the industry has more or less declared the winners. The industry itself doesn’t get much attention and is often dismissed as boring and archaic and destined to fall post-COVID, even though global real estate is the biggest asset class out there (HSBC, NAREIT).

Both companies will have tapped the public markets via a SPAC, an approach to fundraising which has gained a lot of notoriety recently and which is currently in disfavor. The consensus among the financial establishment is that SPACs are a poor deal for retail investors and are generally for low quality companies. I understand the position, but I think there are remarkable opportunities within SPACs for those that care to look.

Between the two, I find SmartRent to be more appealing at this time, but I don’t know which one will ultimately “win.” Fortunately, I don’t think it’s necessary to pick a winner. I think it is becoming increasingly apparent that the two of them will take the lion’s share of the industry. Therefore, I think the appropriate step is to bet on both of them.

Thesis

The commercial real estate industry is an enormous legacy market that is ripe for technological disruption. COVID has accelerated this transition.

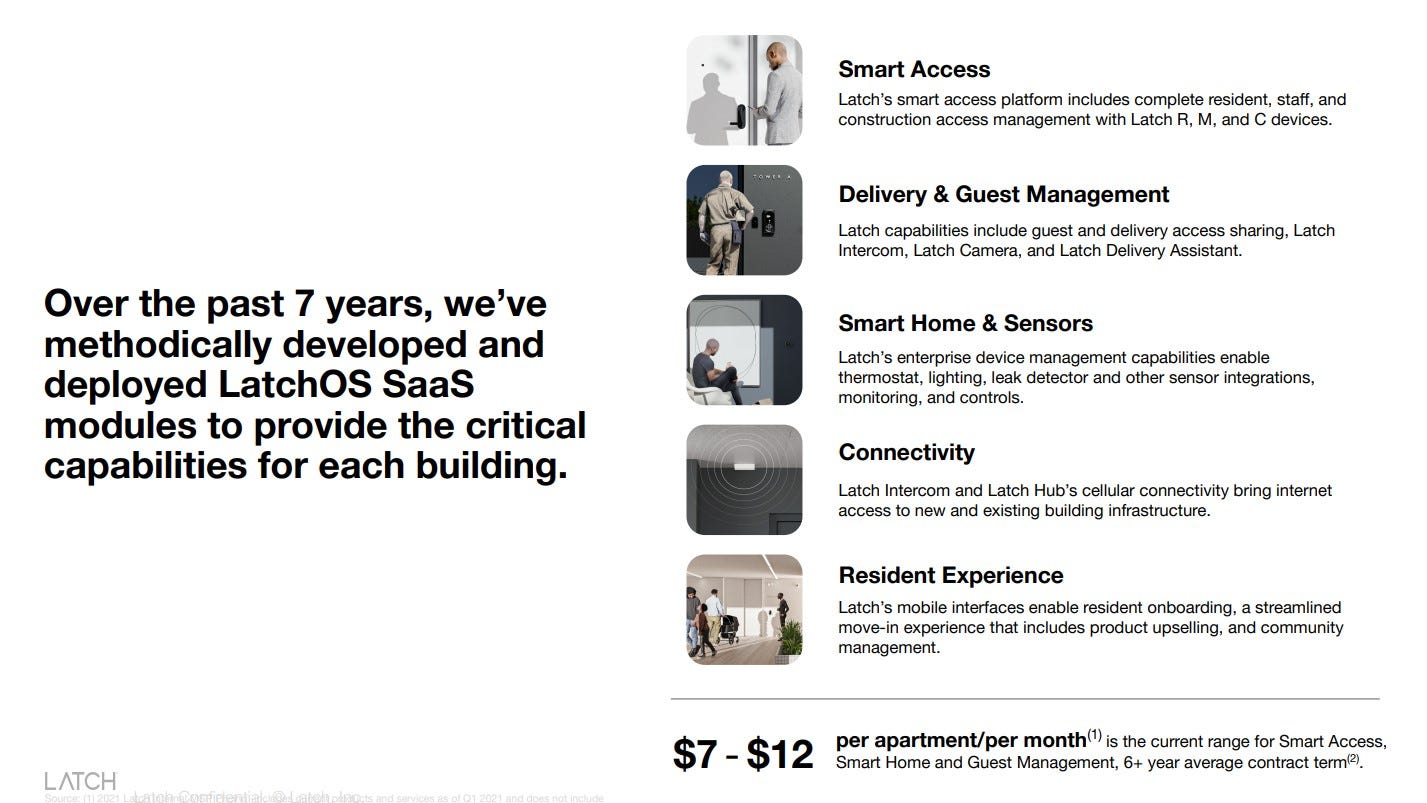

Smart-enablement technology (i.e., an enterprise software solution for multi-user real estate assets) solves critical pain points for real estate owners and operators: access control, delivery and guest management, smart home devices and sensors, connectivity, energy management, parking management, and self-guided tours. A single operating system allows enterprise-level controls for any smart home technology deployed across an asset or a portfolio. This has obvious and tremendous benefits for real estate owners: (1) cost reduction, (2) simplified and superior user experiences, and (3) opportunities for rent increases.

The market is enormous. Per SmartRent, in the US, there are ~43M institutionally owned residential rental units that will likely become smart-enabled in the next few years. Fewer than 500k of those units have any kind of smart-enablement today. In the EU, per Latch, there are 93M units. Beyond residential, other adjacencies include commercial office, student housing, senior housing, military housing, and hospitality (hotel and vacation rental).

Real estate owners, while they recognize the benefits of this technology, are ill equipped to develop their own solutions. This industry is culturally cautious toward early technology adoption and not likely to experiment with unproven solutions. Once a leader in a space emerges, however, they are likely to exhibit predictable behavior and follow the herd. The industry is also relatively small and the majority of assets are controlled by a few hundred players and decision makers. Therefore, the technology solution(s) that do win adoption among the industry leaders will very likely become anointed as the industry standard and have a clear path to broad adoption.

Latch and SmartRent have emerged as the chosen enterprise software solutions. Several leading real estate owners have already adopted and deployed this across their entire portfolios.

The leading RE owners are not only Latch and SmartRent’s most important customers, they are also among their largest investors. Both Latch and SmartRent have or will soon enter the public markets via SPAC, led by key commercial real estate institutions.

Both Latch and SmartRent earn recurring revenue of $5 to $25+ per door per month under multi-year contracts (6+ years) that are typically paid upfront.

The market appears to underappreciate these companies, likely because: (1) property technology and real estate is simply not that glamorous, (2) these companies at first glance appear to be IoT hardware, a space notorious for intense competition, low margins and unrealized potential, (3) the current financials significantly understate the future earnings power given the long installation cycles in real estate and do not adequately reflect the pipeline visibility, and (4) the market currently has a poor opinion of SPACs in general and automatically assumes such companies are of lower quality. These companies are also generally underfollowed by Wall Street initially.

Although Latch and SmartRent are direct competitors, there are signs that they will evolve toward distinct marketing positions:

Latch as the higher-end luxury solution that designs their own hardware and offers a premium aesthetic and brand (i.e., Apple / Peloton) with a founding team out of Apple and Google.

SmartRent as the more versatile, hardware-agnostic and configurable offering (i.e., Android / PC), with an executive team that came from commercial real estate.

I do not know who will win, but I am confident that the market will be won between the two of them. Therefore, I believe the appropriate play is to invest in both.

The “combined company” currently trades at a total value of ~$4B (enterprise value of ~$3B with ~$1B in cash). I believe that valuation is supportable if their solutions are deployed to ~4M doors. I believe that is very achievable and may already be supported by their current pipelines.

If they reach 4M doors and solidify their value proposition, then I think they will have a clear growth path within multifamily and other multi-user commercial real estate categories globally to achieve a 10x+ adoption (i.e., 40M+ doors).

Investment Highlights

Below are the key reasons I think this is such a compelling opportunity.

Powerful market position with rapidly growing moats. Network effects and switching costs within a customer’s portfolio after the software is deployed and hardware installed. Economies of scale as they gradually become the industry standard. SmartRent has process power in their deployment team and hardware agnostic approach that adapts to all price points. Latch is starting to build a premium brand that is being highlighted by their customers as a key marketing point. They have locked up the key RE players as investors and customers. Coupled with being public and having significant cash reserves to fuel their growth, this creates formidable barriers for would-be challengers.

Predictable, recurring software-like economics. Unlike residential smart home which is about selling hardware to consumers, commercial smart home is about the software. The average contract life is 6 years, and most contracts are completely prepaid. Once deployed, the software and hardware is fixed to the building and becomes part of the asset for future owners. Software is charged on a monthly per-unit basis of $5 to ~$25+ per month, depending on modules adopted.

Strong sponsorship and alignment of interests. Their key customers are the leading real estate owners and property managers in CRE and multifamily. The biggest names each control 50k to 100k units.

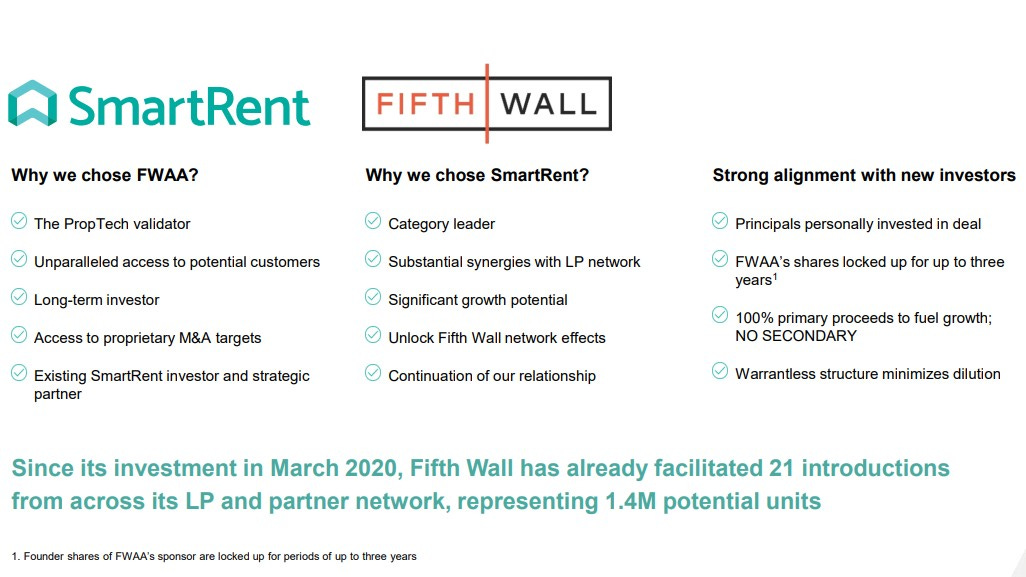

Both companies will have exceptionally strong permanent capital bases. Their key customers are also their biggest investors. Latch was taken public by Tishman Speyer in June and counts Brookfield as an early investor. SmartRent is being taken public by Fifth Wall - the leading property tech VC firm which boasts ~70 global leading commercial real estate companies as limited partners.

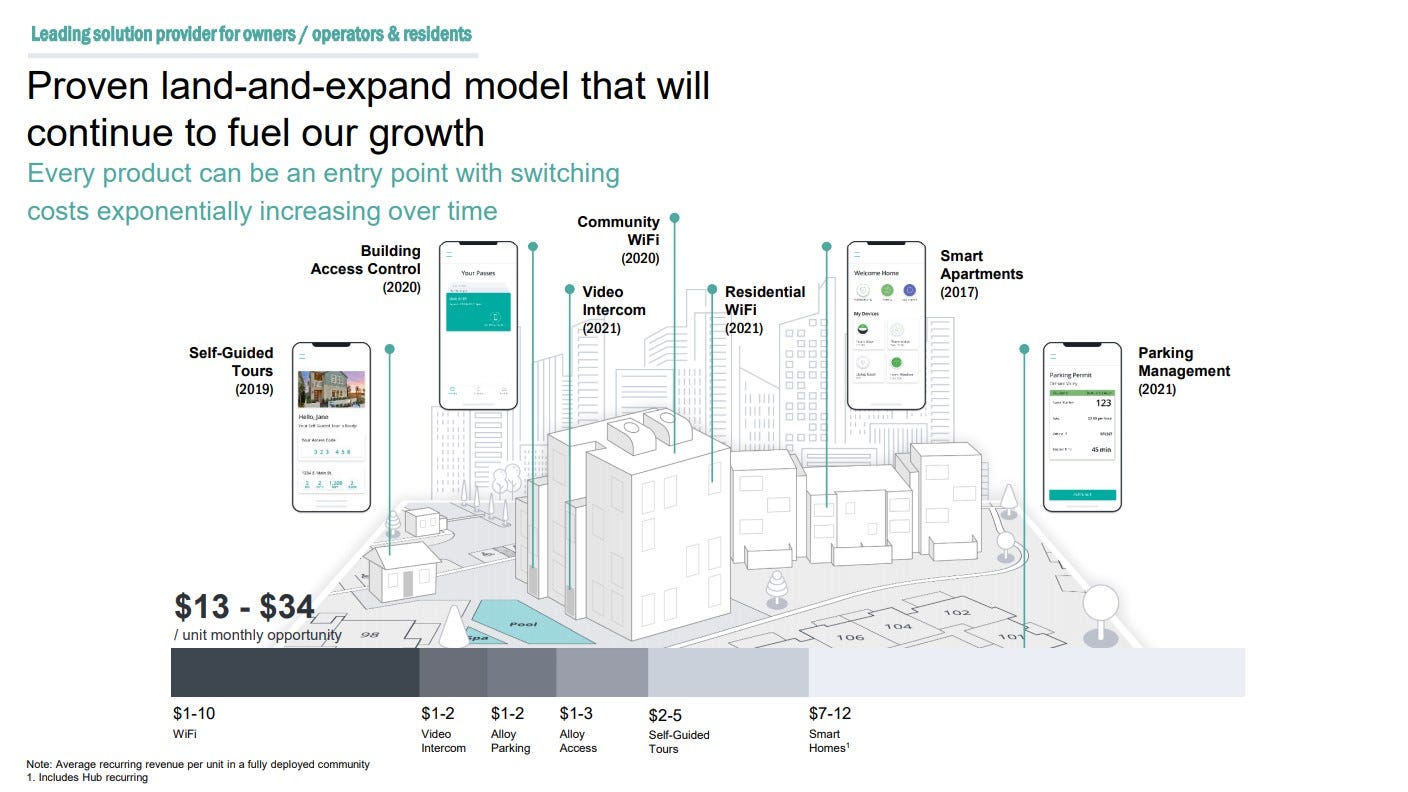

Predictable path to scale and growth. (1) Deploy within existing customer property portfolios. (2) Expand modules within deployed properties (“land and expand”). (3) New customer acquisition efforts become easier and less expensive over time as these two become the industry standard.

Financials are currently understated and underappreciated by the market. Their revenues mask the potential in the software component of the business given the long sales and deployment cycle for commercial real estate. Even though both have several hundred thousand units booked, it will take years for the revenue to ramp. The hard work to convince the industry to adopt has already happened. It is now simply a matter for the industry to steadily deploy the solution across their portfolios. This will become apparent in ensuing years.

Both companies have compelling valuations and intriguing risk-reward. Latch is ~$1.3B EV. SmartRent is ~$1.8B EV. Each has or will have ~$0.5B in cash post SPAC merger. The “combined” company is ~$3B EV and has ~$1B cash.

Enormous global opportunity across all multi-user real estate asset classes. While both are starting with US multifamily, both are already starting to branch out to other asset classes: single family rentals and student housing for SmartRent and commercial office for Latch. Expansion to other categories is simply a matter of observing what relevant assets are owned by their investors. Beyond the multi-user asset classes, there is also an intriguing opportunity to eventually offer value-add services to residents/tenants.

Why Smart-Enablement Technology is Poised for Adoption in the Commercial Real Estate Industry

Smart home is an incredibly crowded, hyped and competitive space.

All of the major tech players have a smart home system: Amazon Alexa, Apple HomeKit, Google Assistant, and Samsung SmartThings.

Picking from among these ecosystems can be quite overwhelming - just take a look at this comparison or Tom’s Guide.

Diving into specific device hardware opens up even more choices. I was first curious about smart locks / access control, and this quickly became a rabbit hole. As a starting point, Wirecutter has a list for the best smart locks.

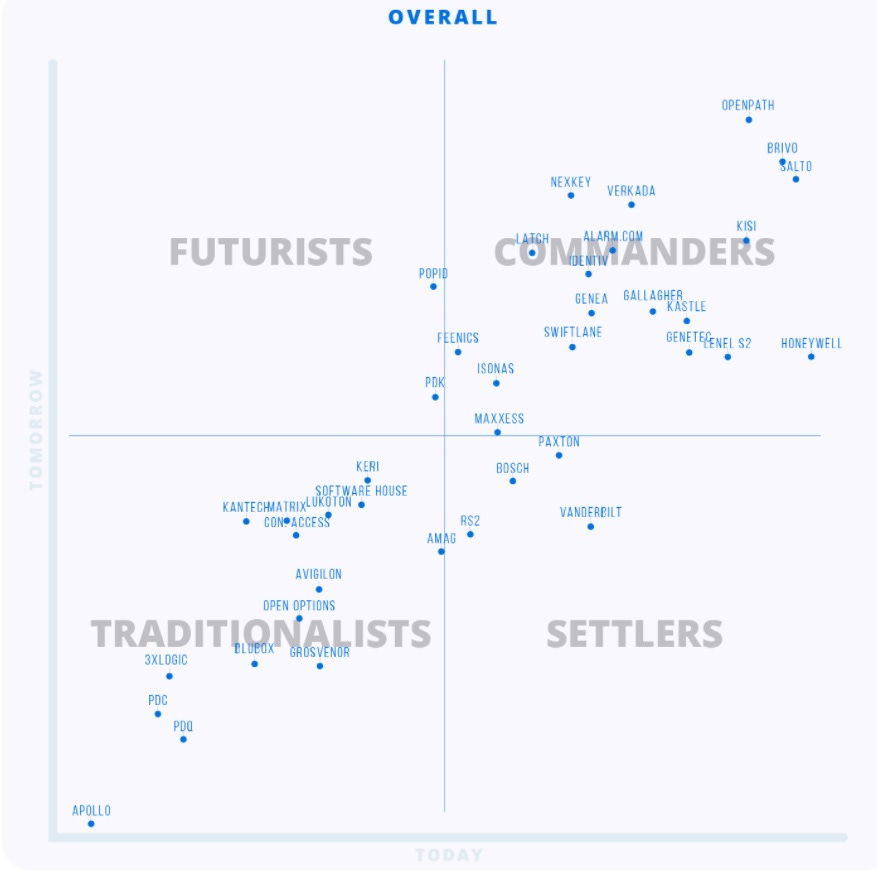

This broader industry breakdown for physical access control by Group 337 provides a glimpse into just how crowded this playing field is.

It will definitely take some time for the dust to settle. It may also very well turn out that even were a winner to emerge, there may not be much profit to be made in this industry. Selling hardware is a notoriously difficult business.

I have no idea what will happen on the residential side. I think the picture is different for commercial.

This apartment manager’s guide to smart locks provides a useful primer to what property managers look for.

In a multifamily building, smart locks have two equally important users: The property manager and the resident. Devices built for single family homes aren’t designed to cater to both.

Smart locks for apartments should meet a few fundamental requirements: the bare necessities. Make sure your smart lock checks these boxes:

Multiple, customizable user permissions

Temporary digital keys

Integration with access control system

Fire Code Rating

Multifamily properties are held to a different safety standards than single family homes, especially for fire safety. Smart locks must meet the same fire safety requirements as other building materials. Unfortunately, this doesn’t always happen.

Building materials used in multifamily construction– including walls, doors, and locks– must receive a fire resistance rating from an objective research group like Underwriters Laboratory (UL). Fire resistance rating is defined by how long a material can survive against direct flames.

This starts to narrow considerably the pool of potential companies when it comes to smart locks specifically.

There are still a lot of options, but one company in particularly starts to stand out when it comes to multifamily: Latch.

They are still a very young company, but they really seem to know what their customer (i.e., the property owner) is looking for.

Even just the smart lock by itself was worth it to this owner of an 18-unit complex in Brooklyn. The first half of the video is an interview with Latch regarding the company and product. The second half includes a view of the installation as well as the cost breakdown and ROI consideration.

There are noted time and cost savings in not having to issue new keys or having someone onsite handle visitors and deliveries. There are also revenue opportunities associated with being able to charge higher rents.

The combined effect is to increase net operating income (NOI) and therefore increased valuations for their assets.

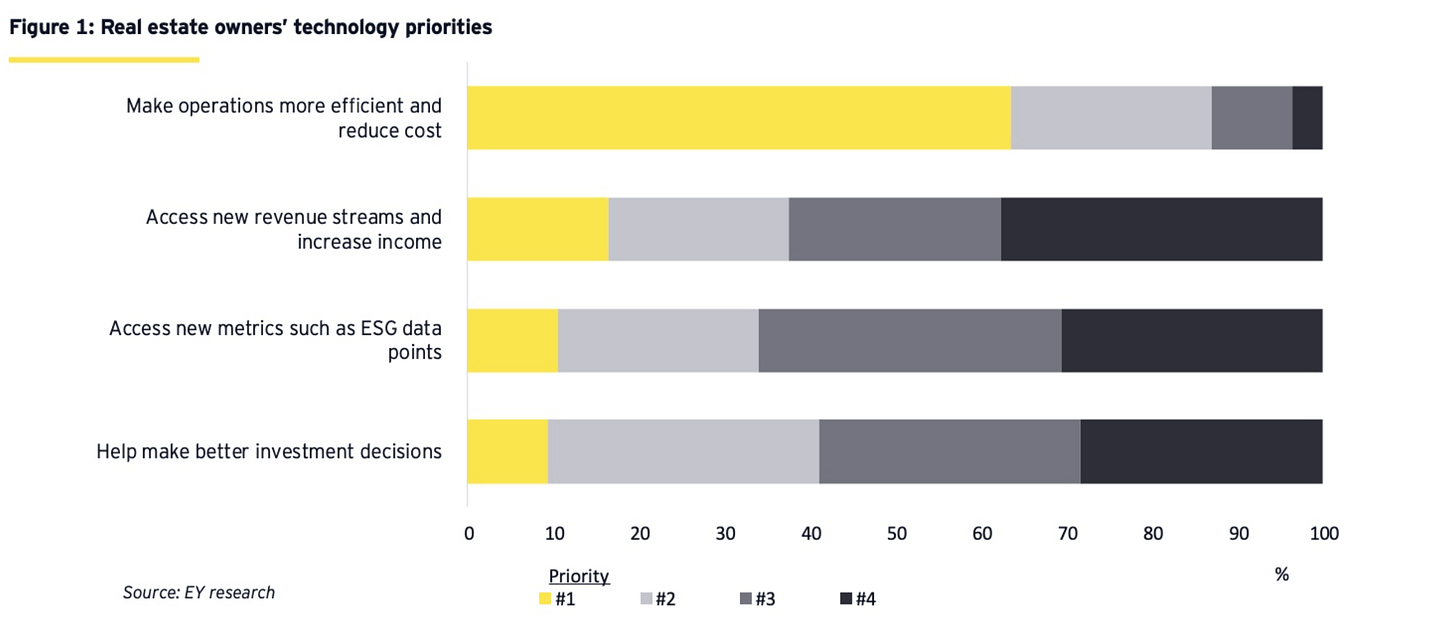

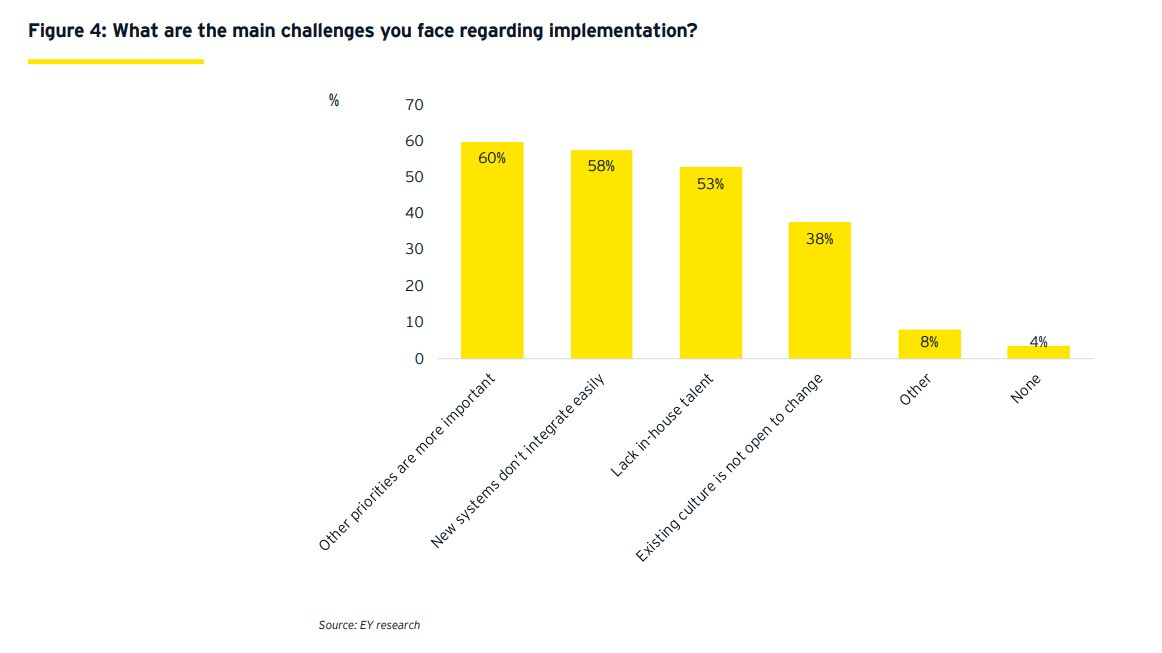

Zooming out on the industry and technology adoption in general, it’s recognized as important, particularly coming out of COVID, but it’s still early. Below are a few charts from Ernst & Young’s report on tech adoption in commercial real estate.

35% of respondents are still piloting, evaluating or assessing the market. The challenges to adoption are understandable:

Other priorities. “Limited resources and competing priorities often trump new technology solutions”

Integration. “Too many companies in the proptech and systems space are not integrated”

Talent. 53% recognize they do not have the required tech talent

Culture. Traditional if-it-isn’t-broken-don’t-fix-it culture toward legacy systems that continue to function, though not as effectively as currently available technology.

On the other hand, ownership of properties and therefore the decision-makers are highly concentrated. Once a technology does pass muster, the rest of the industry will likely adopt en masse.

Enter Latch and SmartRent

These resources provide an excellent starting point:

Latch: Analyst Day presentation (March 2021)

SmartRent: blog post on SmartRent that comprehensively explains the company, opportunity and rationale by their SPAC sponsor Fifth Wall (April 2021)

Below, I’m going to mix materials liberally from these two companies to explain why their solutions are so compelling to commercial real estate owners and operators.

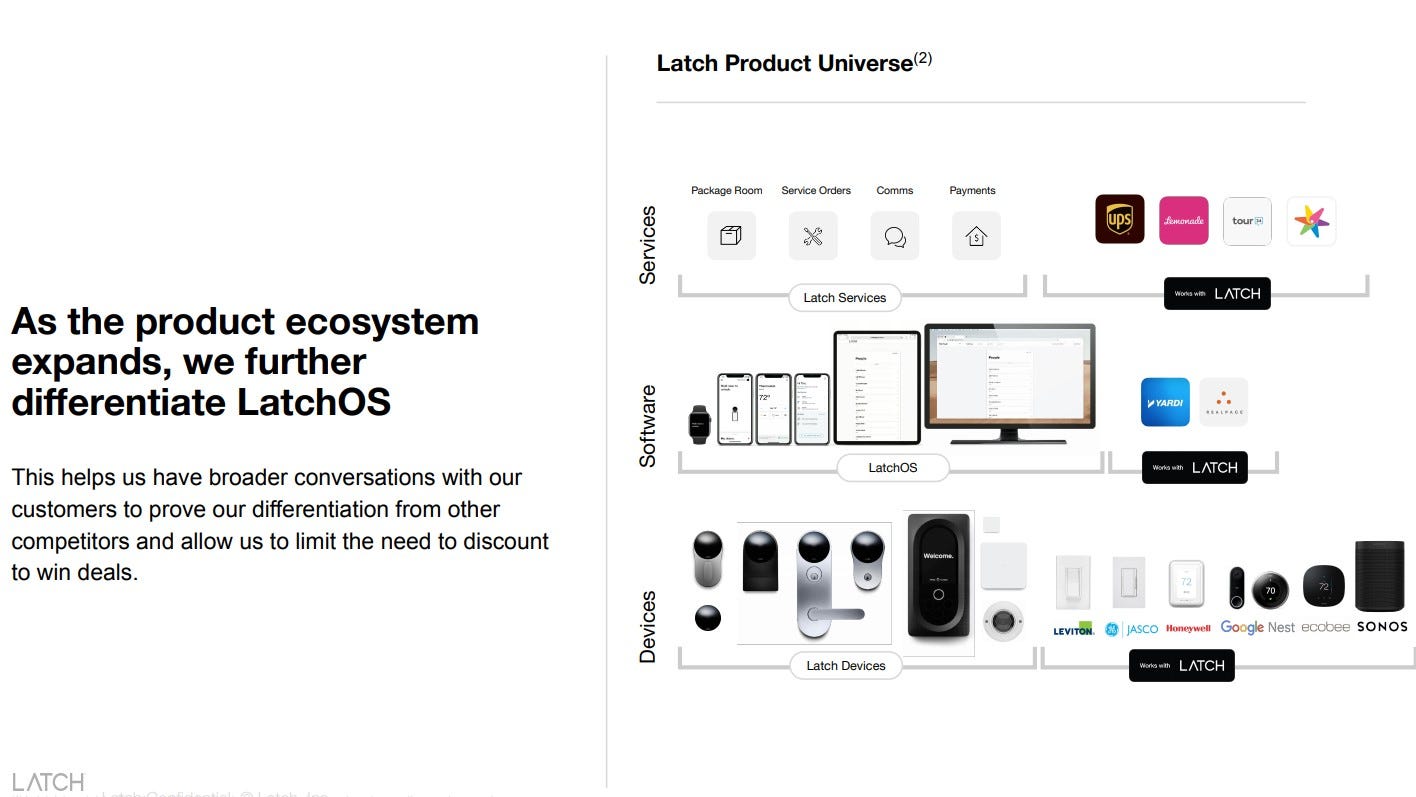

Latch started off as a smart lock developer, but they’ve increasingly expanded their solution to become a platform with LatchOS (enterprise software platform to manage smart devices), LatchID (single ID to enable users to unlock any Latch device), and Works with Latch ecosystem partners such as Google Nest, ecobee and Honeywell.

SmartRent from the beginning was an enterprise software company dedicated to commercial real estate with a hardware agnostic approach. Real estate owners can plug and play the hardware they want based on the appropriate price point and aesthetic for a particular property.

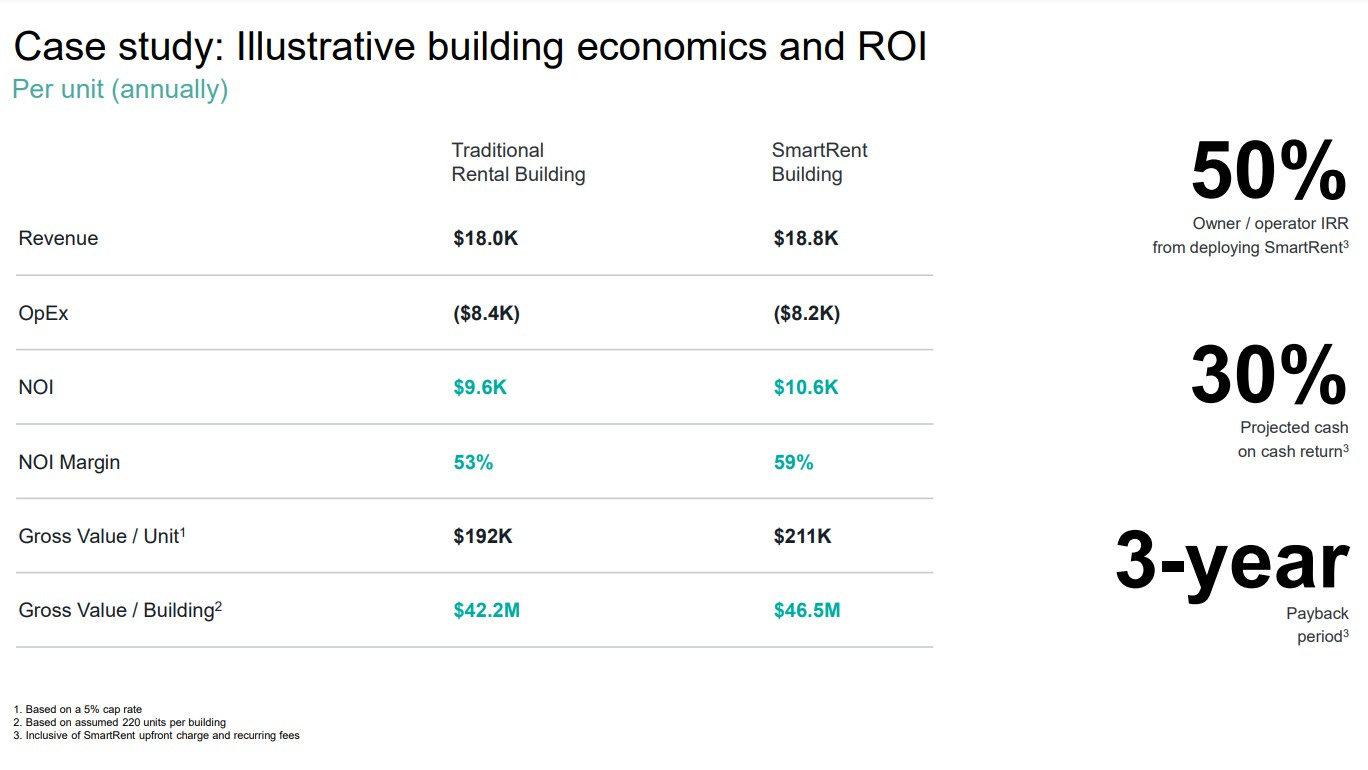

The value to owners and operators is super compelling. Examples include:

70-90% decrease in water damage expense due to connected leak detectors in all units

20-50% leasing cost savings through self-guided property management

20-30% utility cost savings through smart thermostat management.

Such technology deployment also enables owners to increase their rent by $25-$100 per unit per month, so the deployment effectively pays for itself.

Source: SmartRent presentation

These are sold on a monthly recurring revenue software subscription. The stated range is $13-$34 per unit per month depending on modules deployed.

Latch quotes a $7-$12 per unit per month software price, but their set of offerings is currently more limited.

Both are getting adoption from the key multifamily property owners and the reviews have been stellar.

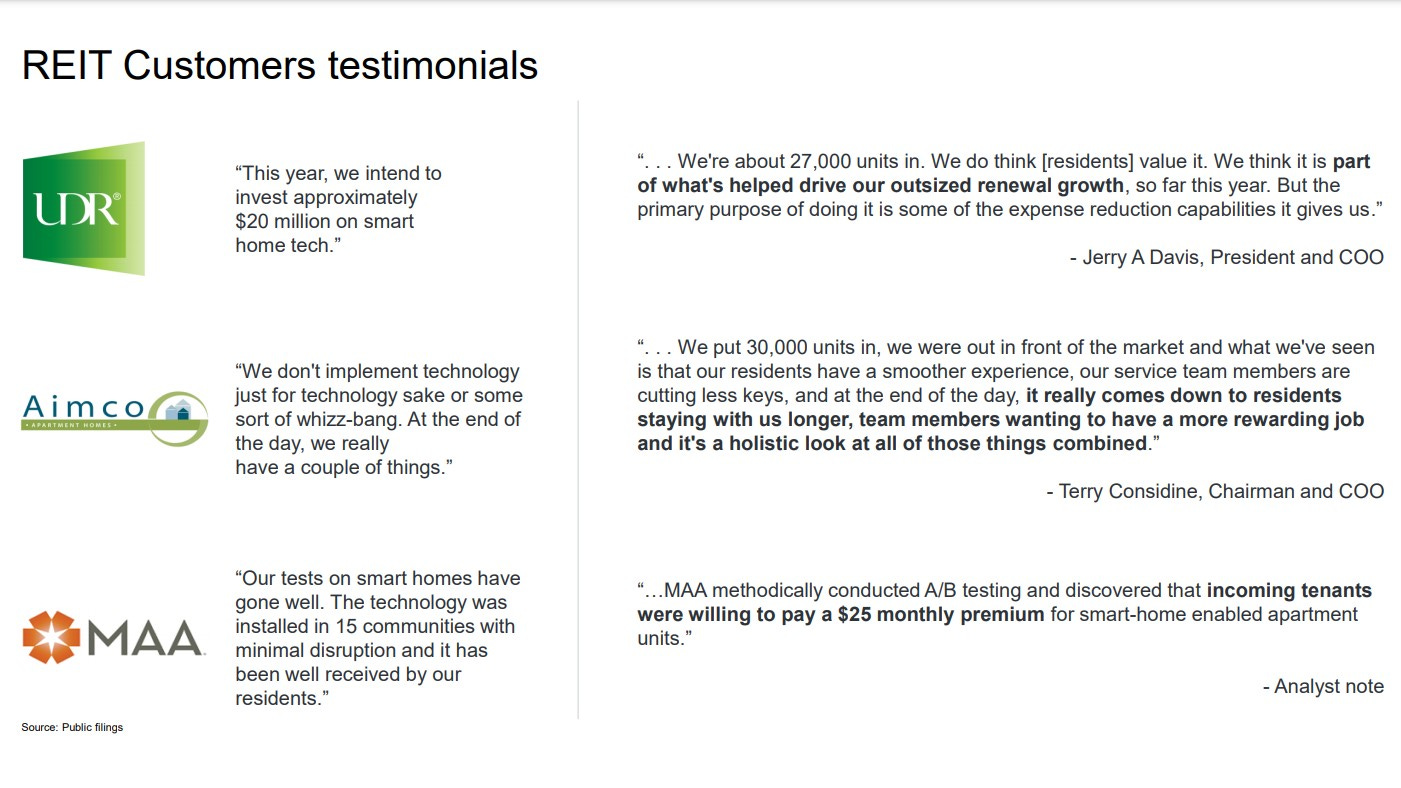

The below testimonials are from some of the largest owners of multifamily in the U.S.

For SmartRent:

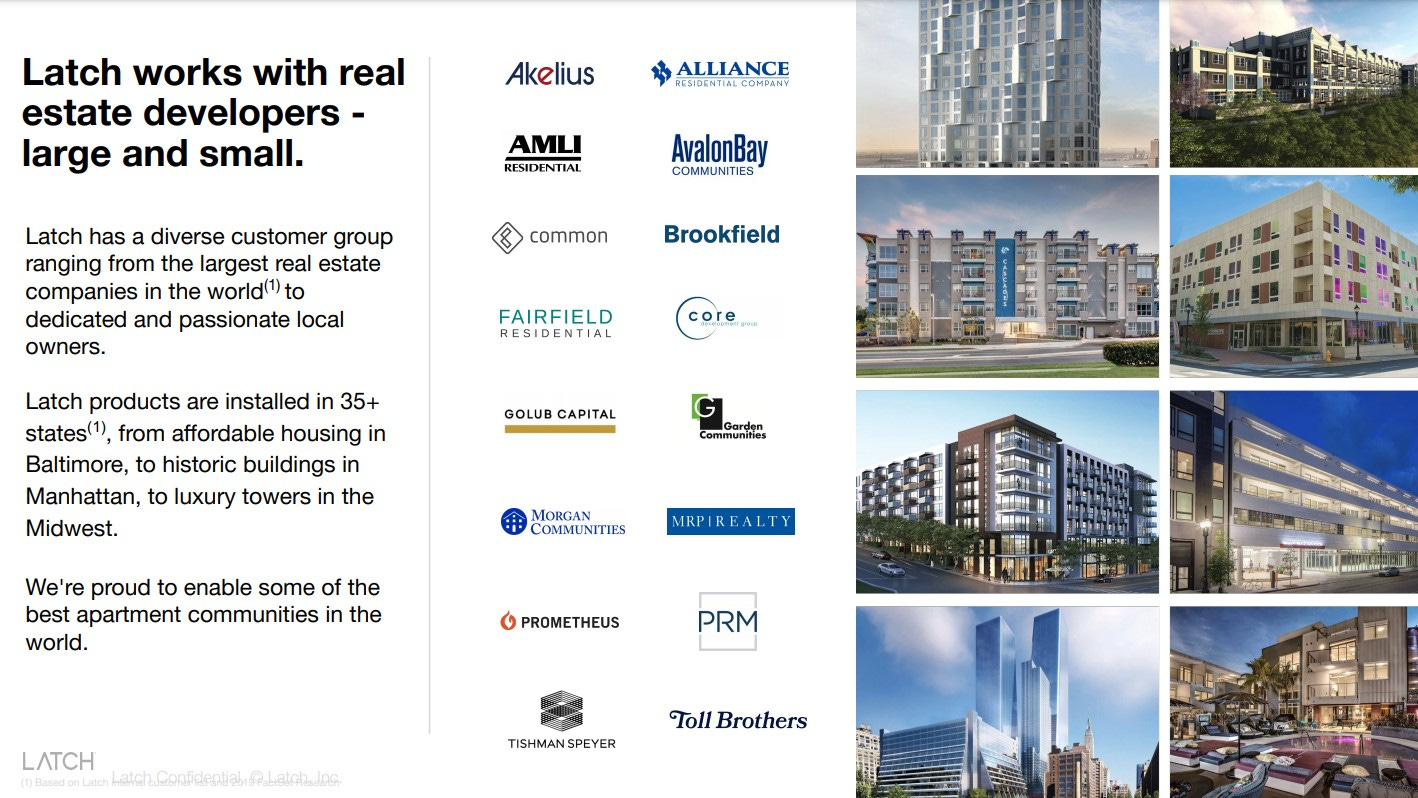

For Latch:

AvalonBay - SVP of Strategic Initiatives:

Brookfield Managing Director talking about Latch, and an article on a retrofit property in Manhattan.

Greystar - launching at Greystar’s Laureat property.

Empire State Realty Trust - launching LatchOS at Empire State Building.

<note: Tishman Speyer had an investor relations site dedicated to the Latch merger which contained additional interview videos, but since the TSIA SPAC merger closed, I’m unable to find that site for links>

This set of management, customer and investor interview transcripts for SmartRent provides valuable context for how critical and valuable this is for the industry.

In particular, this segment on how Fifth Wall selected SmartRent was illuminating:

This is effectively what Fifth Wall does. We are in many ways in the business of trying to know what the real estate industry is going to do before it does it, so to understand its adoption decisions of technology prior to it becoming obvious to the entire market. That comes obviously from the 70 strategic LPs that have invested in Fifth Wall's funds, many of which are on this page today.

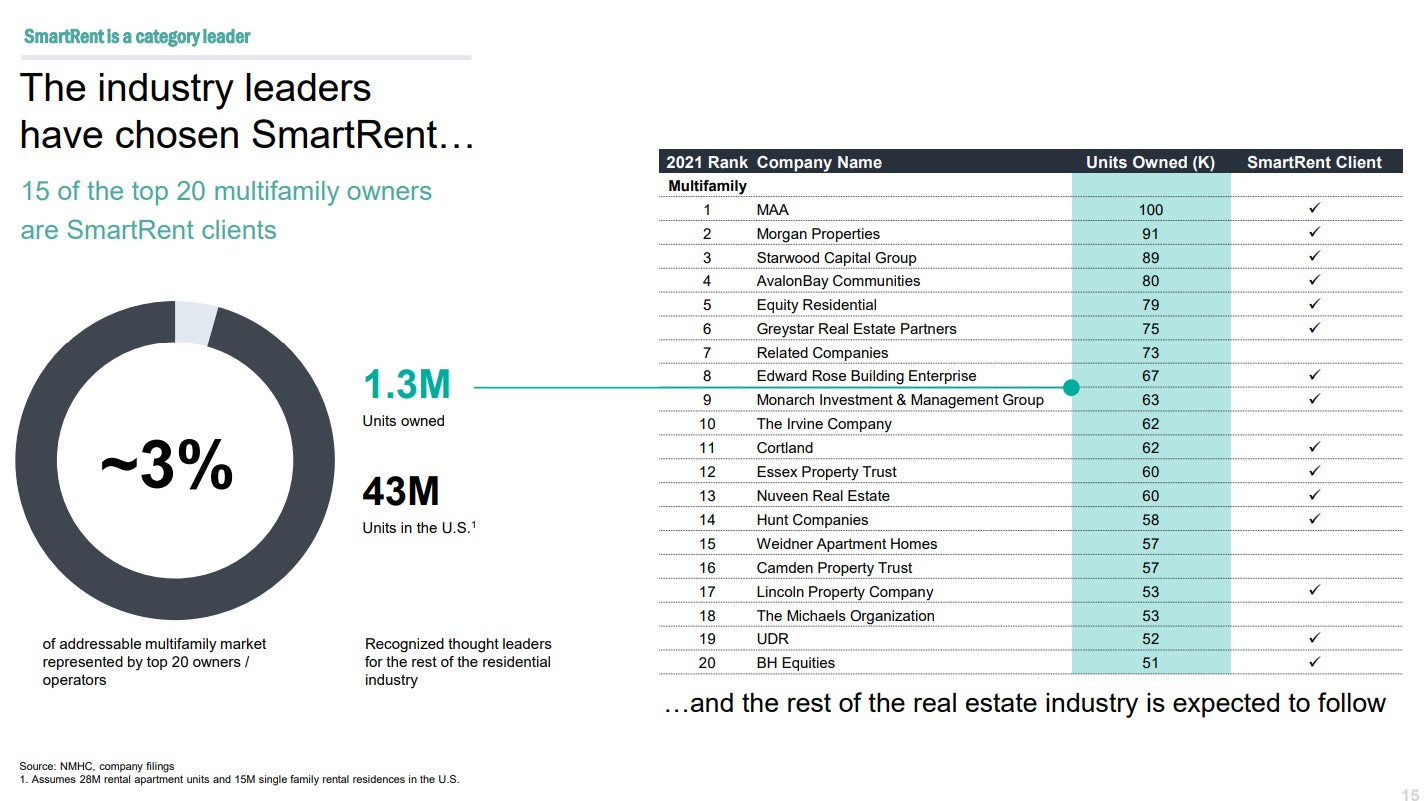

As I mentioned, we ran this RFP looking at the entire ecosystem. About a year ago, it was pretty abundantly clear to us that I think about five of these dominoes had fallen. There are probably five check marks on this page. But having surveyed the rest of the institutional national footprint, owner, operator, developers of multifamily, we recognized that SmartRent was going to be the industry standard solution.

But this is where Latch and SmartRent are different from other smart home companies. They are intentionally going after commercial real estate, specifically multifamily. They are going after the biggest owners and managers of properties. And they are getting adoption.

Latch also has an impressive customer roster:

For reference, these are the critical names in institutional multifamily: NMHC 50 largest apartment owners. Between the two of them, Latch and SmartRent effectively have substantially all of the top names covered.

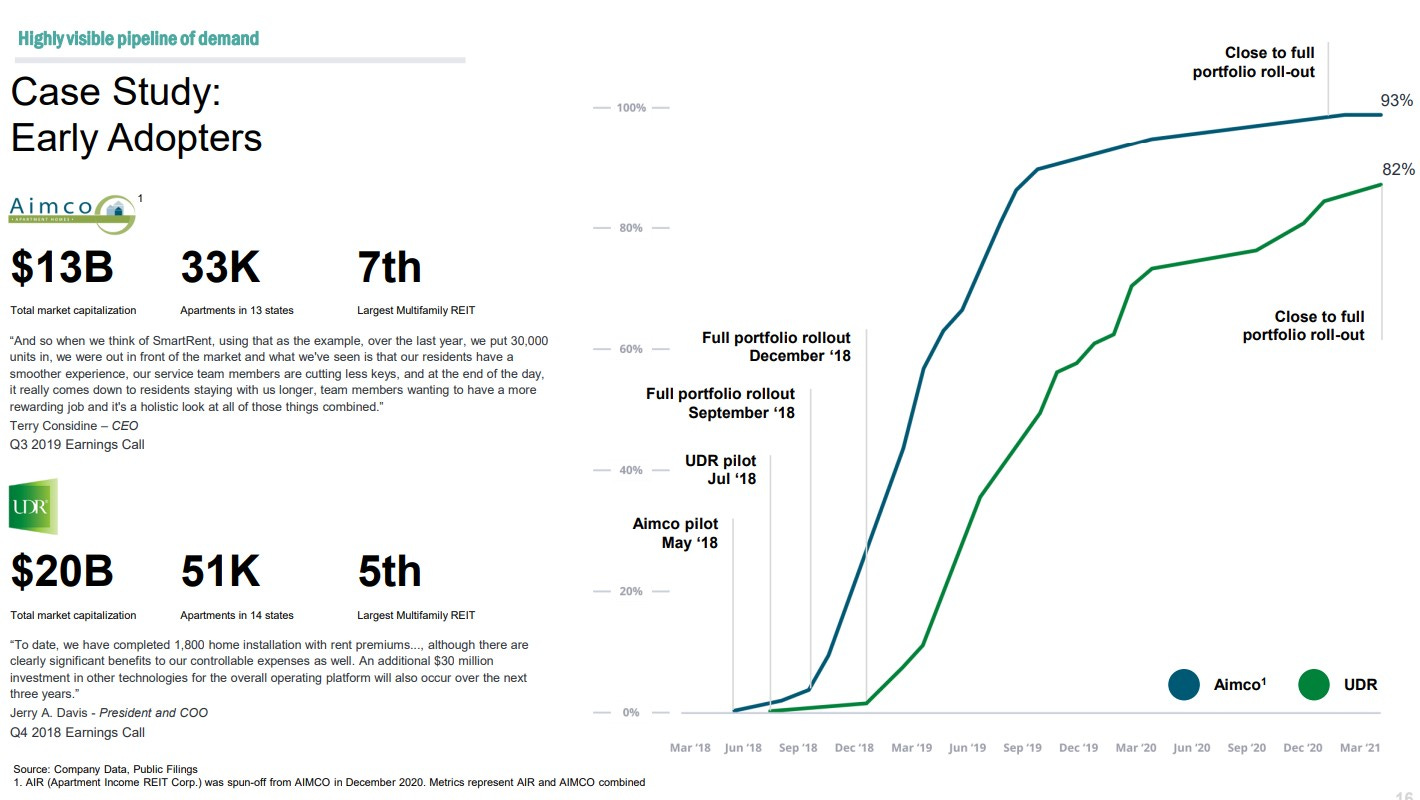

These owners and operators are not just pilot testing on one or two properties. Once they’ve determined that the technology makes sense to roll out, they tend to deploy it across their entire portfolio.

SmartRent shares case studies for two top 10 apartment REITS who went from pilot to near full portfolio deployment in approximately 3 years.

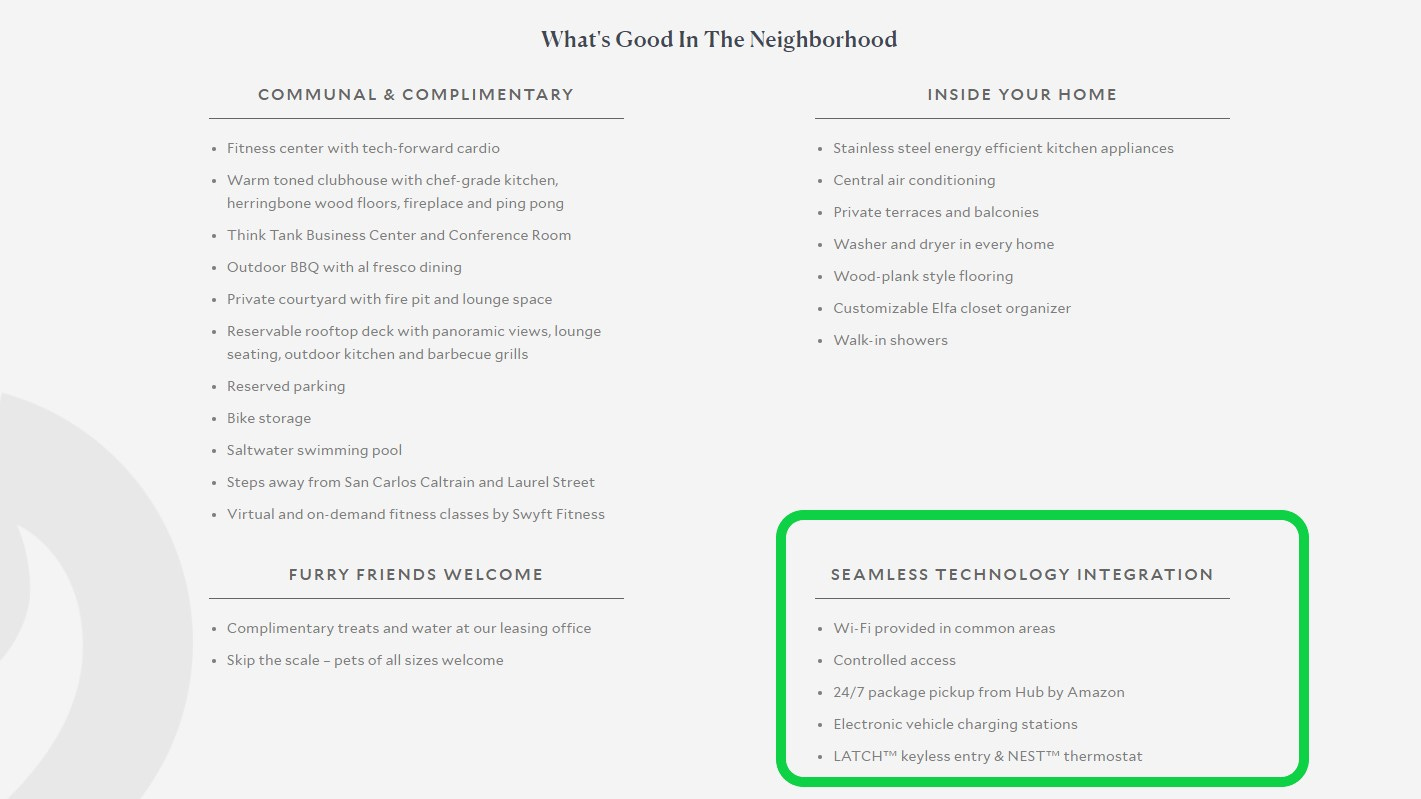

The Latch brand is starting to gain traction. Below is a sample page for an apartment complex owned by Prometheus, a West Coast luxury multifamily apartment owner operator with ~13k units that has deployed Latch.

Practically every Prometheus apartment complex now highlights “LATCH keyless entry” as a technology amenity. The combination of Latch, Nest and EV charging seems particularly potent. Eventually, these types of features (access control, smart home, electric vehicle charging stations) will be table stakes in all apartments.

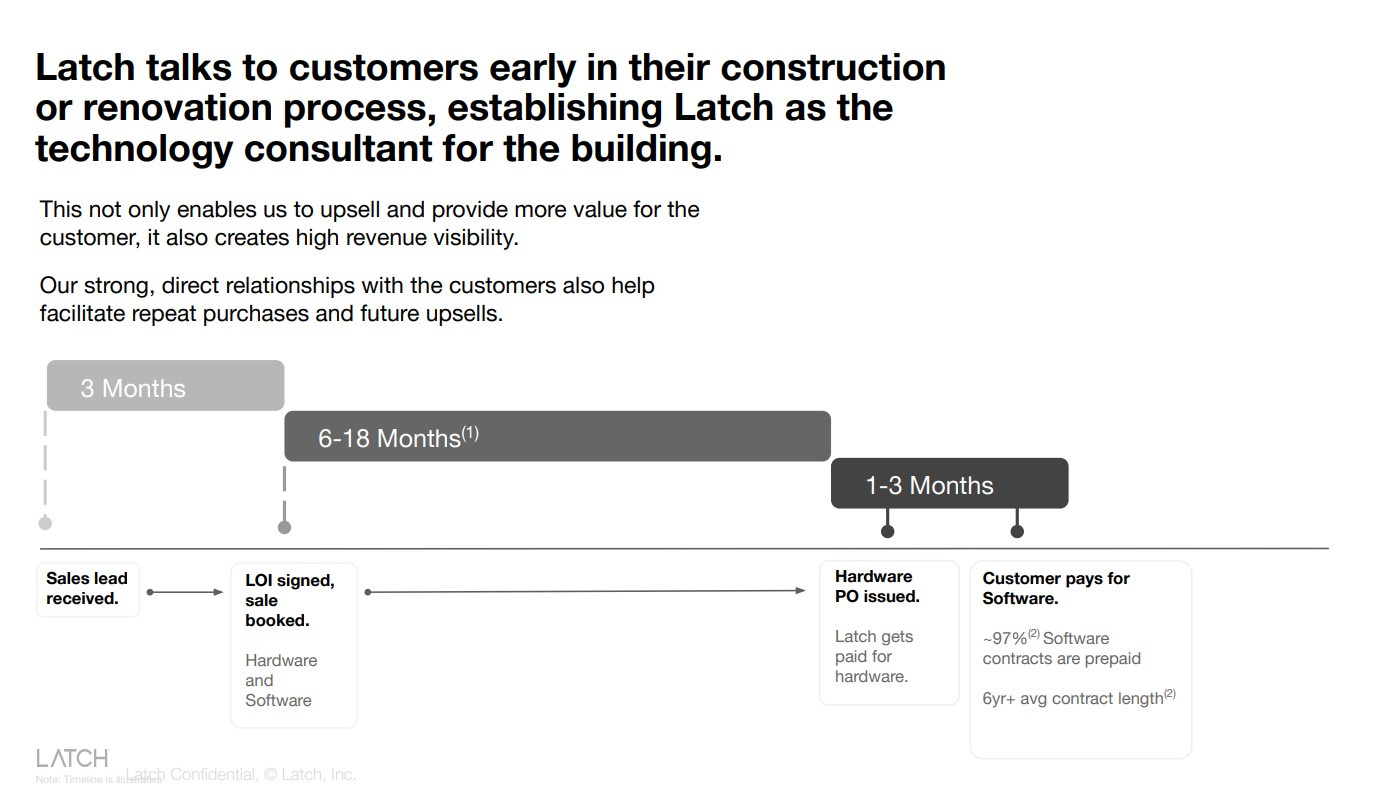

The sales cycle is long though. It can take years to from contract signing and booking recognized, to when the hardware purchase is issued, to when the hardware is installed, to when they start to recognize software revenue.

Latch shares the below:

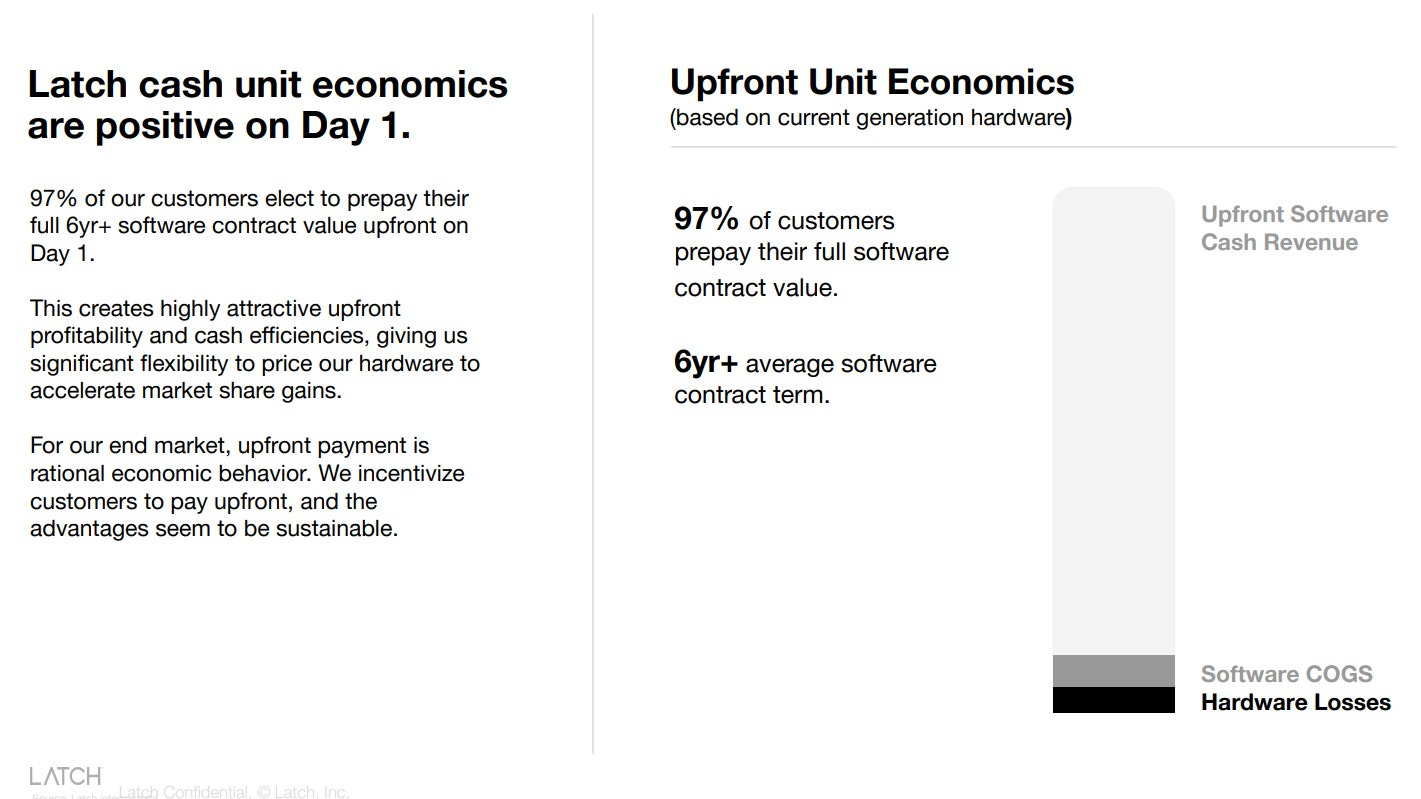

However, once installed, the economics are incredibly lucrative.

Long-term: 6+ years for Latch, 5-7 years for SmartRent

Prepaid: 97% for Latch, 75% for SmartRent

High gross margin: ~90% for Latch, ~74% for SmartRent

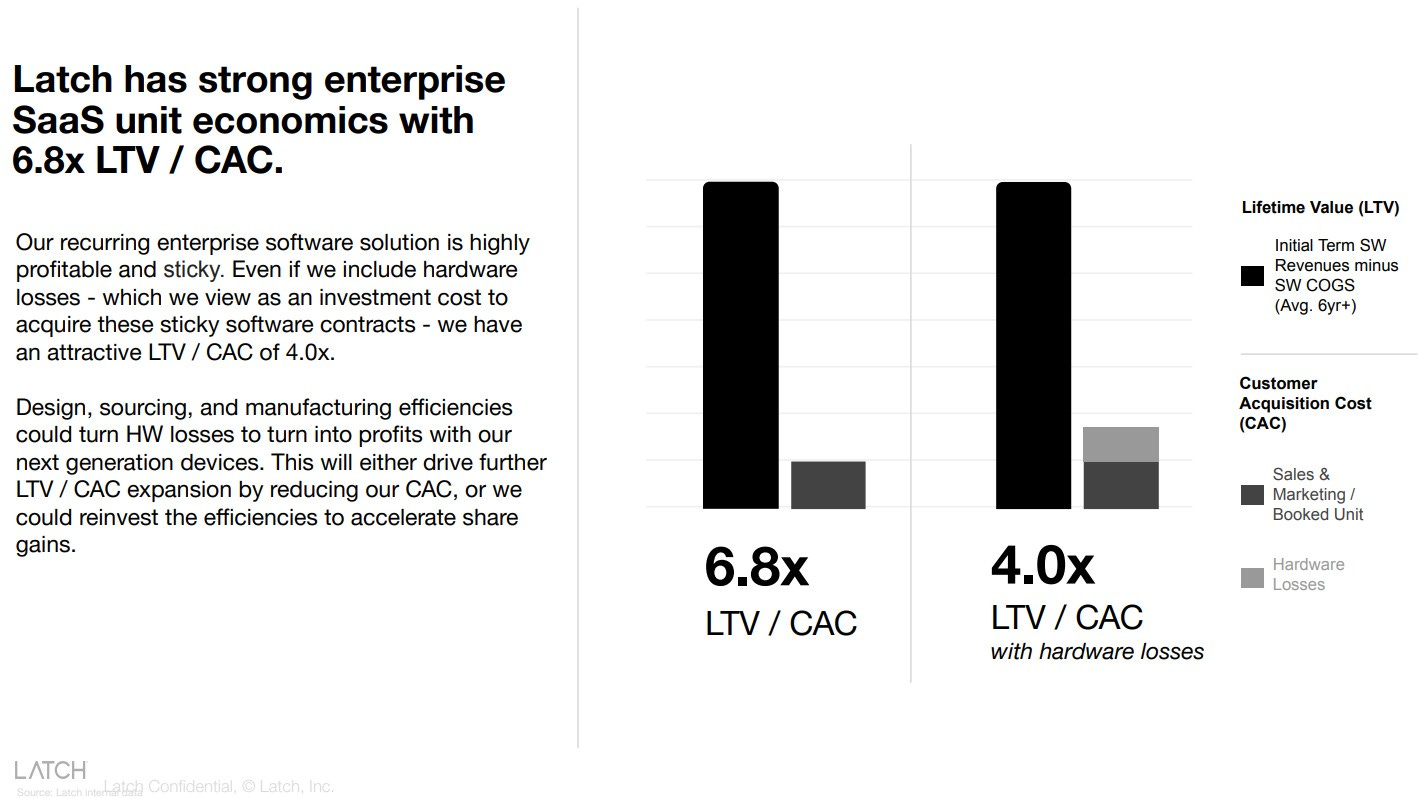

Latch provides detail down to the unit economic level:

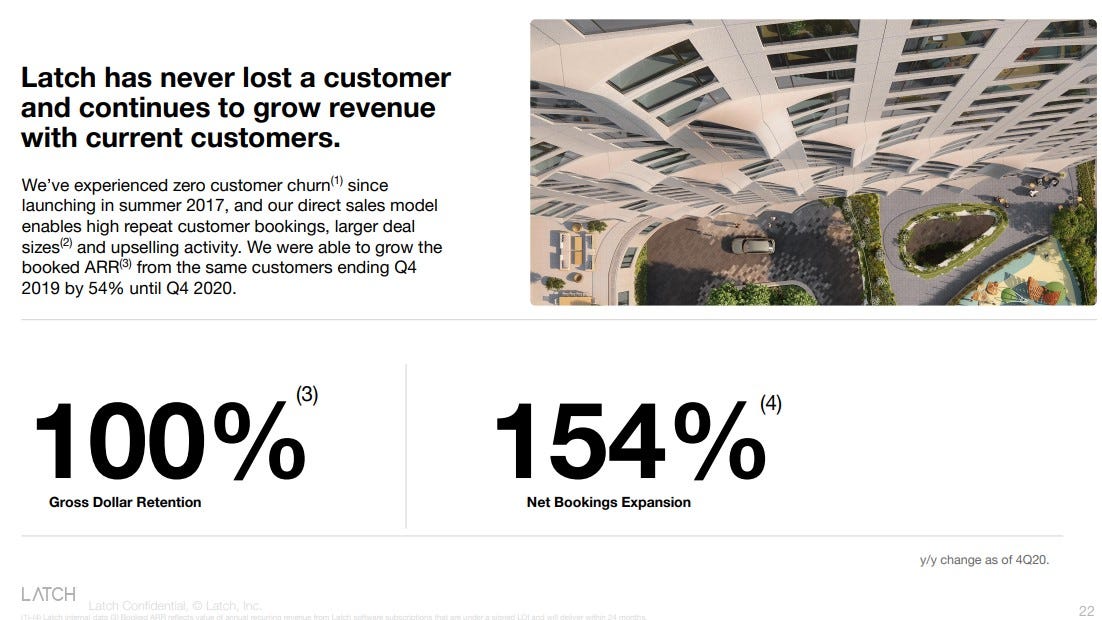

Once a customer signs on and installs the software / hardware, the opportunity to “land and expand” with additional modules becomes straightforward. Latch saw 154% booked revenue expansion from 2019 to 2020.

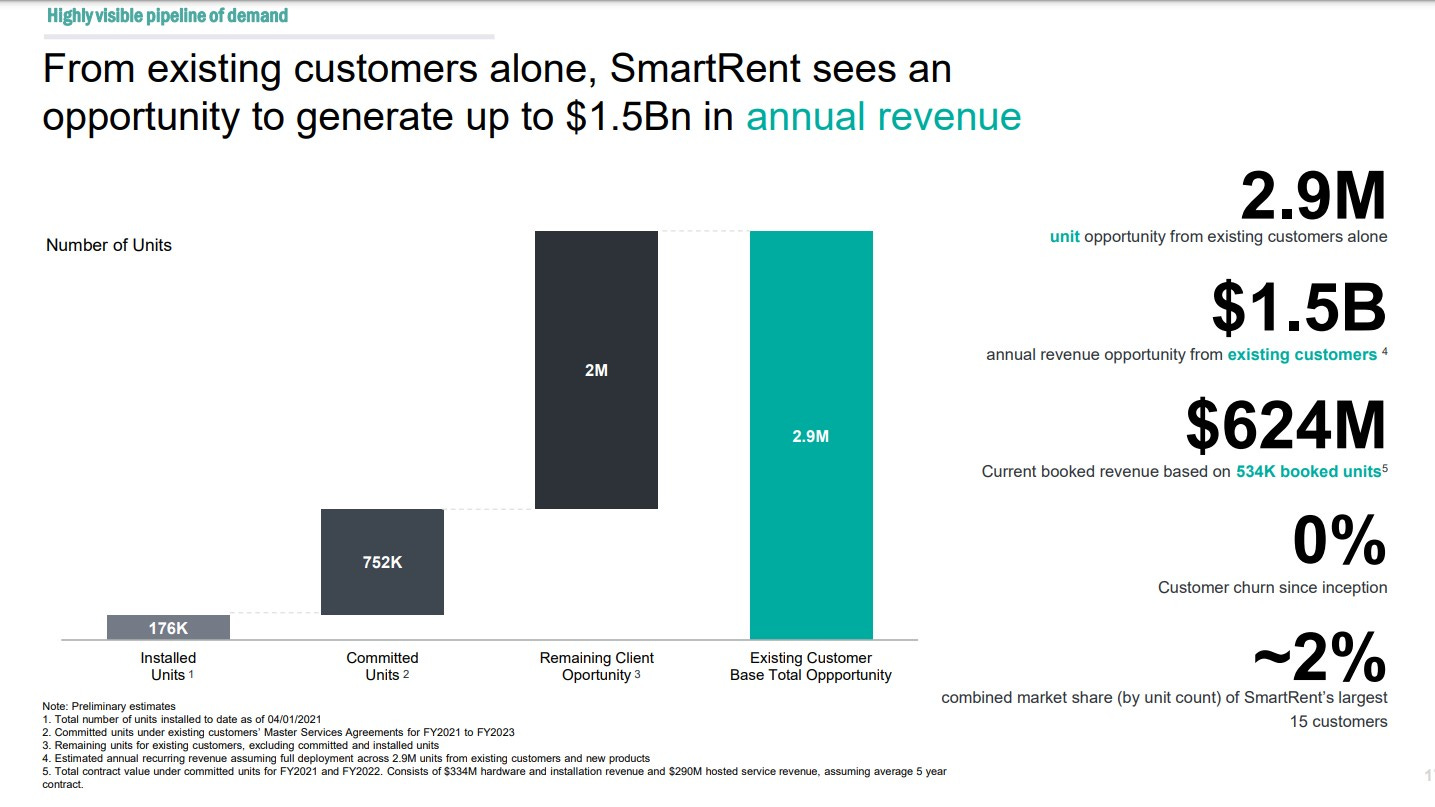

These dynamics also means there is tremendous visibility into the pipeline. Growth can come from: (1) expansion within deployed assets - installed units, (2) expansion across a customer’s asset portfolio - committed units, and (3) further penetration across the industry.

The key influential decision makers in this industry are fairly concentrated, with a few hundred critical customers that control deployment for millions of units. It takes time to sell the first development, but once that is in place, the path to rolling out across a customer’s portfolio becomes smooth.

At some point, if it hasn’t happened already, these companies will become the de facto industry standard. If and when that happens, the cost to acquire the marginal customer should go down dramatically. The cost savings and revenue upside benefits will become apparent to the rest of the industry. The initial customers were expensive to acquire and pilot with, but retaining them should be inexpensive.

Their investors are their both their most important customers and their most valuable business development resource as industry evangelists.

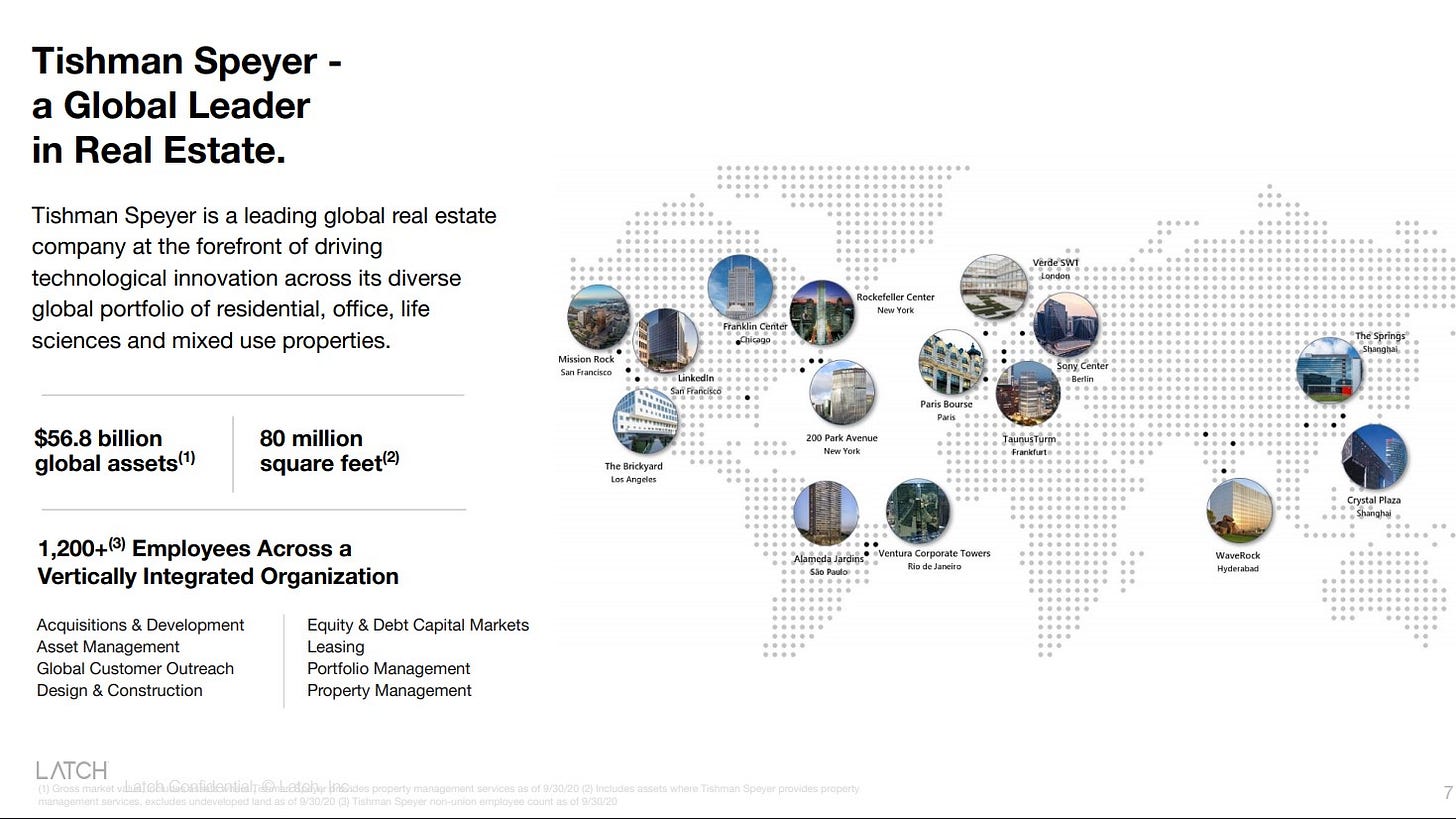

The Latch deal was led by Tishman Speyer. They are a huge owner with global marquee assets across multiple categories - residential, office, life sciences, and mixed use.

SmartRent is led by Fifth Wall, a venture fund whose strategic LPs represent an incredible global real estate network. Collectively, they represent ~2M multifamily units, ~22% of all new single family homes built, and ~1.4B hospitality units owned, operated and developed.

Fifth Wall really drives home the point regarding visibility into the pipeline and the customer ramp:

The same dynamic takes place with respect to enterprise sales to the real estate industry. Which is, whichever company can overwhelmingly sign up and engage the top 20 owners in a given space wins the category. That company quickly is running downhill and becomes market standard for the entire real estate ecosystem. It's an artifact of the fact that the real estate industry is a late-adopting industry, so there are a number of owners that own 10,000 units, 5,000 units. These are smaller regional owners. Typically, what they are going to do is they're going to look to the names on this list to see which smart home operating system have they adopted to ultimately make their decisions. You have this very profound signaling effect and this herding behavior that overwhelmingly leads to one company becoming a market standard technology. When you look at a page like this in light of that dynamic, this looks like game, set, match for the multifamily industry when it comes to a smart operating system. I think the other dynamic that's probably important to call out here is that for the multifamily space, these multifamily assets trade fairly liquidly. They almost trade like stocks between different institutional owners. But what's different about SmartRent versus other kinds of enterprise software is it's both a software solution, but it also is on premise. This is installed. It goes with the asset. So you almost have this negative churn dynamic, where there's this cross-fertilization opportunity, where when one of these large institutional owners trades an asset to a smaller, more regional owner, they obviously get that asset with SmartRent. It becomes obviously almost, like I said, a downhill foot race where you're just growing into the rest in the long tail of the multifamily industry, which is, as you can see on the left side of this page, enormous. There are a lot of units where nothing is installed today. So this early lead, typically, I would say almost categorically, becomes deterministic over time. The same pattern plays out in real estate tech over and over.

Although there are only a few hundred thousand units deployed today, the path to tens of millions of installations appears to grow clearer each day.

Who Wins?

As mentioned previously, I don’t think it’s necessary to predict who “wins” to have a successful investment outcome.

I think this comes down to: (1) management, (2) strength of the product and ecosystem, and (3) ease of adoption.

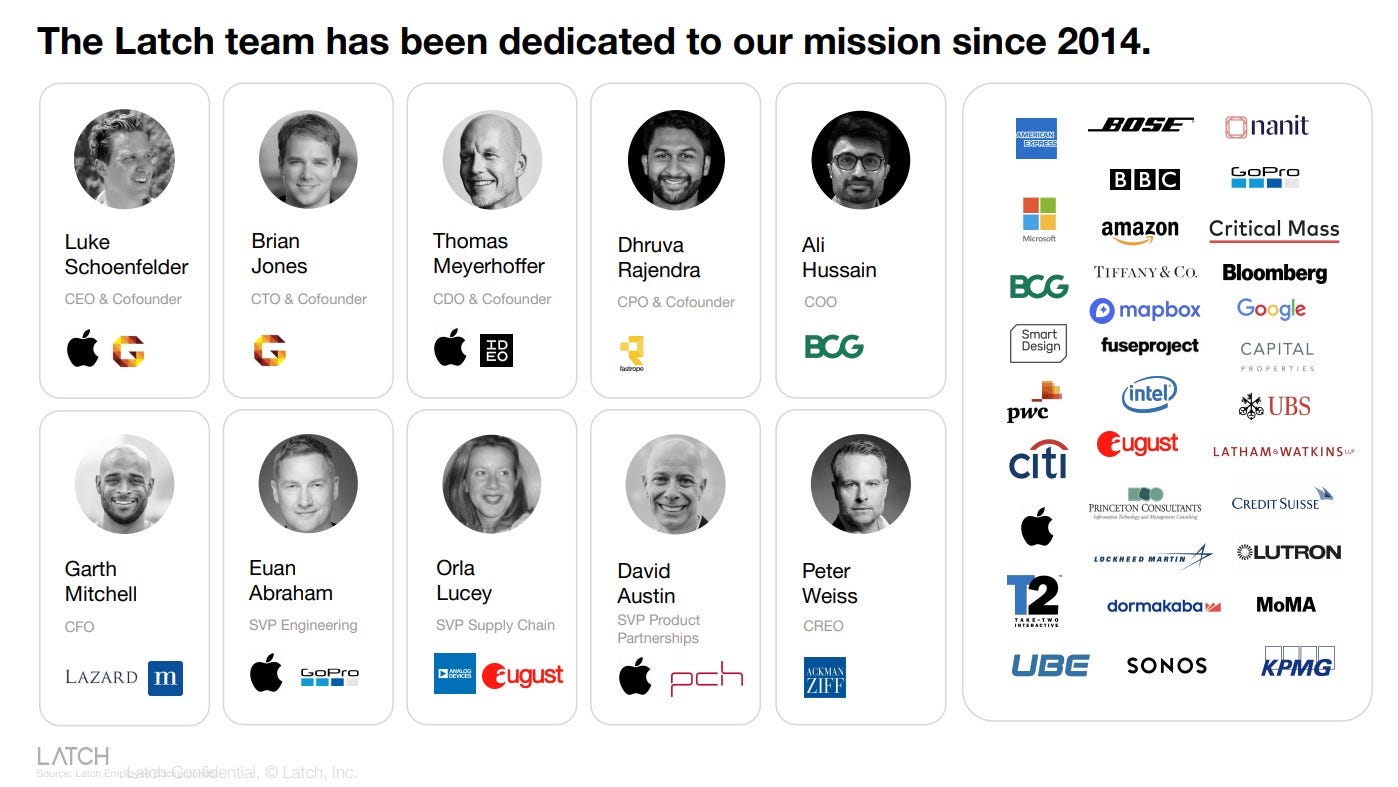

There is definitely a clear difference in the backgrounds of the management teams. For Latch, management is heavily skewed toward tech - Apple and Google feature prominently.

The Apple aesthetic is also quite noticeable in the product design and overall marketing.

What seems to be missing, however, are executives with actual real estate experience.

Latch has been investing heavily in their revenue team this year to go after new customers. This team clearly has an impressive background; however, the issue I see is that their experience is primarily in technology, and less in real estate. There will likely be a significant learning curve to sell into real estate companies and to get the product deployed.

Contrast that to the management team from SmartRent. Their CEO was the former CTO of a multifamily REIT. The deep industry expertise is emphasized.

This is a key point of differentiation, which coupled with Fifth Wall’s LP base, would suggest a wide base of prospective customers.

For product, I’m drawn toward the unified hardware and software solution that Latch provides. This is an approach that has worked well for other companies, notably Apple and Peloton. When paired with a premium brand, that offers an attractive path toward higher margins and viral adoption. It remains to be seen how well that works in a more B2B setting such as commercial real estate, though I did find it intriguing that Latch keyless entry is starting to be highlighted as a selling point (do a search for apartment rentals with “Latch keyless entry” on Craigslist in your area to see for yourself).

On the other hand, I like the idea of a hardware-agnostic platform and can understand the appeal for property owners that would value flexibility and choice. In theory, there are potential compatibility pitfalls that might trip up such an approach. A combined hardware and software solution should tend to be more seamless. Device makers should work to ensure a strong integration with the de facto industry standard, so I suspect that any integration gaps should close over time.

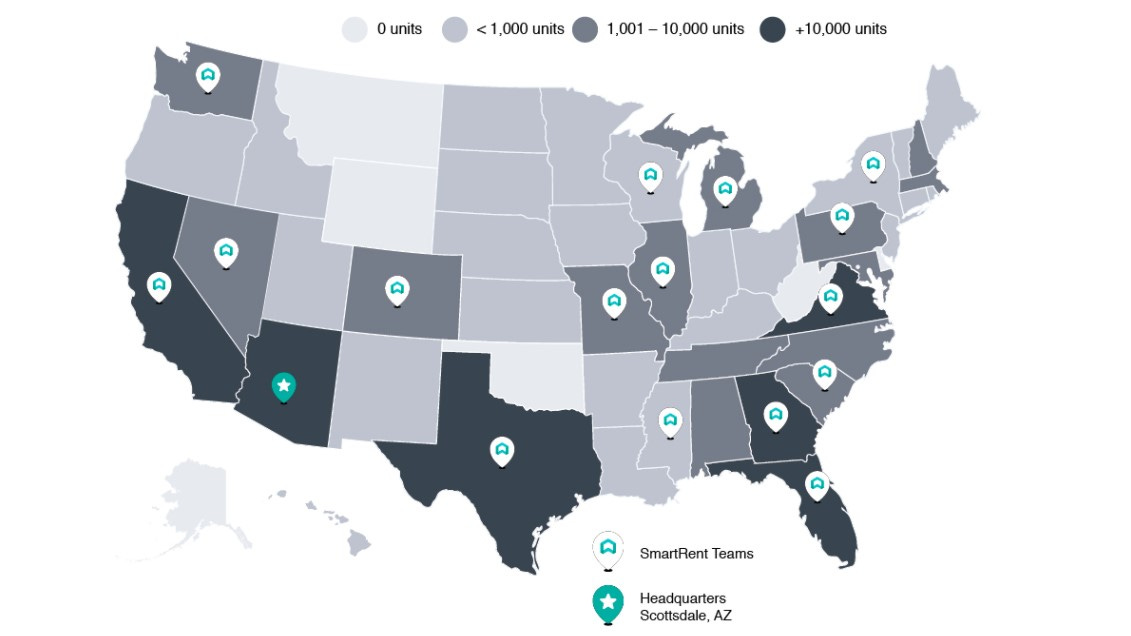

To that end, I like SmartRent’s approach to having their own deployment team, which now numbers over 100 individuals on staff to ensure integrations are handled well. Latch, meanwhile, relies on a network of third party installers. My sense is that the deployment will be a significant competitive advantage in SmartRent’s favor in the near term. From the property owner’s perspective, it should remove any doubt toward a successful integration knowing that SmartRent has invested so heavily in that area. It speaks toward management’s understanding for the pain points that these owners and operators are really concerned about.

Source: FWAA S-1 (pp 134)

If forced to pick, I would expect SmartRent to have more overall units with their technology deployed. However, it wouldn’t surprise me if Latch becomes the more valuable company over time given their premium positioning.

Fortunately, I don’t think it’s necessary to limit yourself here. Both can do just fine.

Value Creation

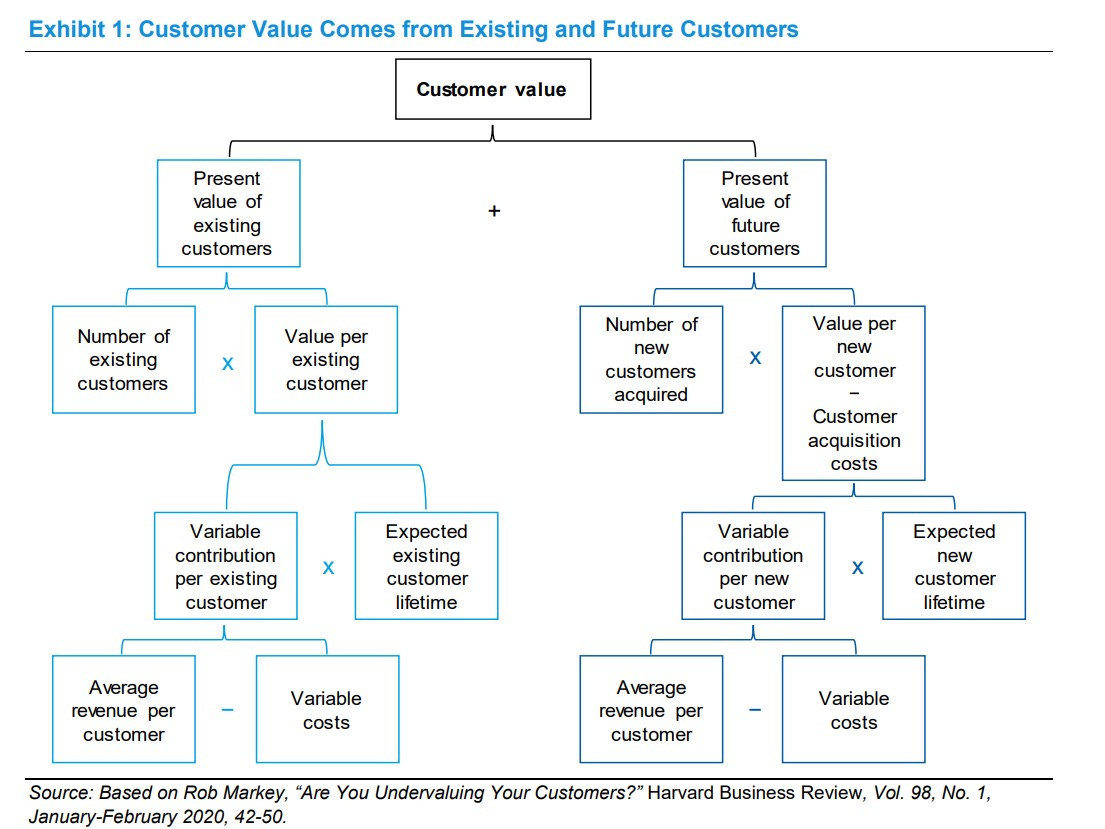

Michael Mauboussin of Morgan Stanley recently put out a fascinating paper - The Economics of Customer Businesses - that I think is very helpful toward understanding the value of Latch and SmartRent.

The key insight is understanding the customer as the basic unit of analysis from a corporate valuation perspective. The framework breaks down corporate value into two components: existing customers vs. new customers.

The key assumptions lie in the value of a customer (new vs. existing): namely what is the expected revenue per customer and what are the costs to acquire and retain that customer.

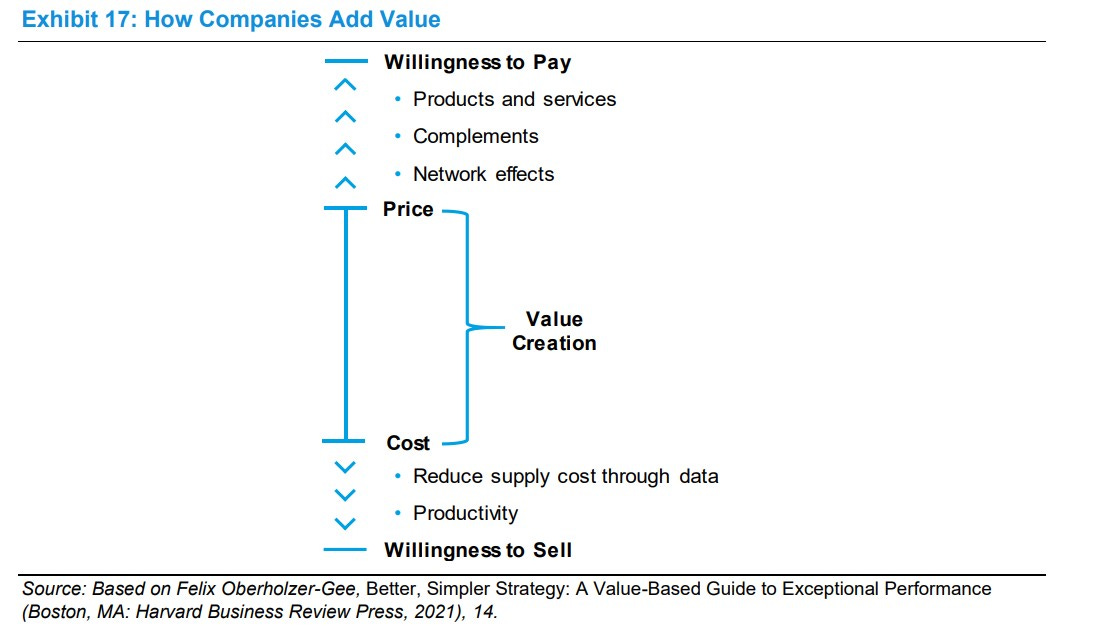

The following diagram breaks down further the four key numbers that factor into the Value Creation that a company such as Latch or SmartRent offers: (1) the customer’s maximum Willingness to Pay, (2) the price that the company charges for the service, (3) the cost for the company to provide that service, and (4) the minimum price that a supplier would accept to provide the good to the company.

Company’s Value Creation = Price minus Cost

Customer’s surplus = Willingness to Pay minus Price

Supplier’s surplus = Cost minus Willingness to Sell

The company’s objective would be to both: (A) raise the customer’s Willingness to Pay by introducing additional capabilities, expanding the ecosystem and bolstering the network effects, and (B) lower the supplier’s Willingness to Sell by reducing their costs or improving their productivity. This would then allow the company to expand their Value Creation by raising or de-risking Price while also reducing their Cost.

I believe there are encouraging signs of this taking place. Both SmartRent and Latch are introducing more modules and expanding into other CRE categories such as office. They are partnering with Google Nest, Ecobee and other smart home providers to improve the value and stickiness of LatchOS. The partner ecosystem also feeds into the network effect. As more buildings within an owner’s portfolio and stakeholders within the owner’s ecosystem adopt the software, that only increases the stickiness further. If all of this results in owners being able to raise their rents, that only improves the cycle further.

On the cost side, I think this is still early. Theoretically, driving more adoption within owners’ portfolios should lead to improved visibility into ramp up and retrofitting and predictable future volumes. For Latch, there is also the economies of scale argument to reduce production costs further. The production cost and reliability should only improve over time. For both Latch and SmartRent, increased adoption will incentivize other smart home device makers to ensure their devices are compatible. The ability to roll out software updates remotely should also help on the cost side.

These cost savings are immensely valuable to the property owner / developer. With cap rates in the 4-5% range for multifamily, each incremental net operating income dollar (whether achieved through cost savings or rent increases) is worth 20-25x in improved asset value at exit.

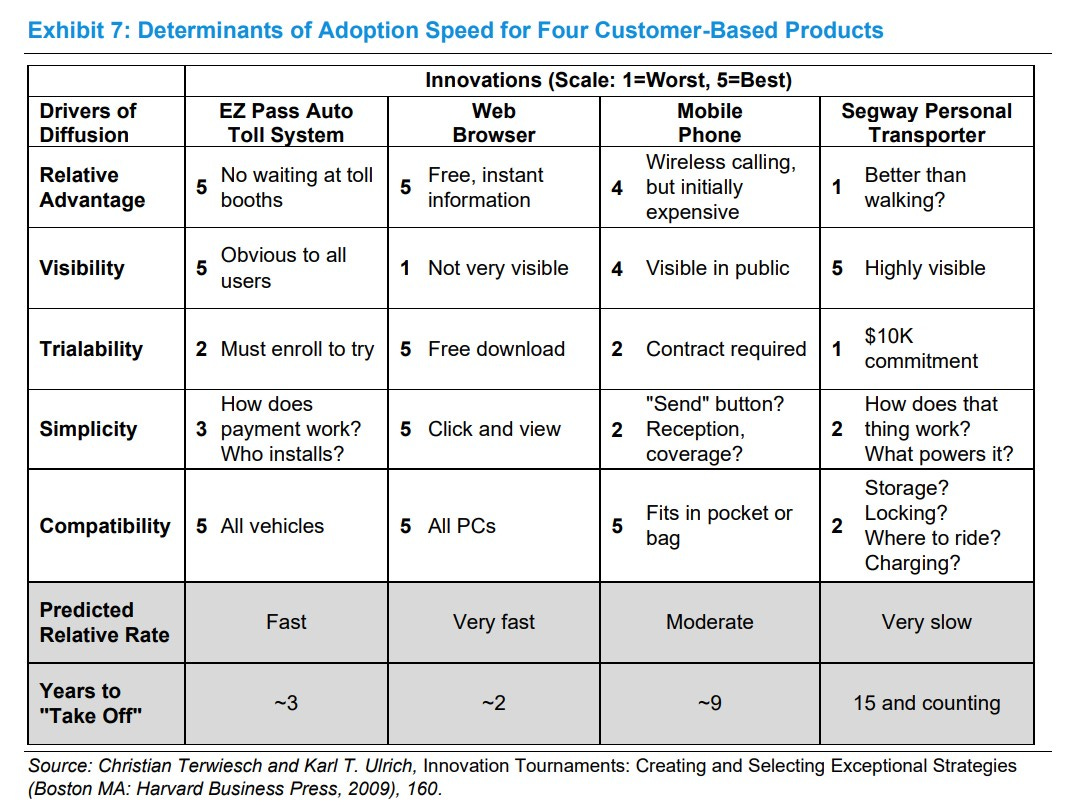

The other critical input is the expected adoption speed for this innovation. The paper includes the below table which outlines five key criteria that inform adoption speed and the number of years to “take off.”

In my opinion, Latch and SmartRent rate well across all five of these dimensions. I would score them as either a 4 or a 5 from the perspective of the commercial real estate owner. The Relative Advantage is apparent from a cost, convenience and security perspective compared to traditional lock replacement. Visibility is also obvious, and Latch’s efforts around branding (a “Latch” building) are important there. Triability is also strong, as residents are mandated to use the app and ecosystem upon moving in. Engaging with a Latch building is also relatively simple - you just go visit someone there. Simplicity is obvious for both. Compatibility should only improve with time to become increasingly seamless.

Relative Advantage: 4 (obvious)

Visibility: 5 (obvious)

Triability: 4 (just go to a Latch building)

Simplicity: 5 (obvious)

Compatibility: 4

This suggests a fast to very fast adoption. Given the apparent ROI advantages and rapidly expanding proof points in the market, it would surprise me if a property owner didn’t want to deploy such a technology as soon as practicable. Latch talks about more than 1 in 10 new multifamily developments adopting their solution, but I would expect this proportion to grow quickly. My guess is that substantially all new developments will soon choose to adopt either Latch or SmartRent.

I also suspect that the cost to acquire the incremental customer may go down over time. Typically, customer acquisition cost (CAC) increases as you move from the Innovators to Early Adopters to the Majority of users. There are elements of that increased marginal cost taking place now as both companies will be ramping up to support their growth efforts. However, I think there’s a strong chance that the brand, network effects and economies of scale will push the CAC down over time. There is a subtle viral element to adoption of smart-enablement technology. The key decision maker is the property owner, but the other stakeholders - residents, property managers, vendors, partners, visitors, etc. - all benefit as well. Engaging with such a building acts as a free trial for new participants in the ecosystem.

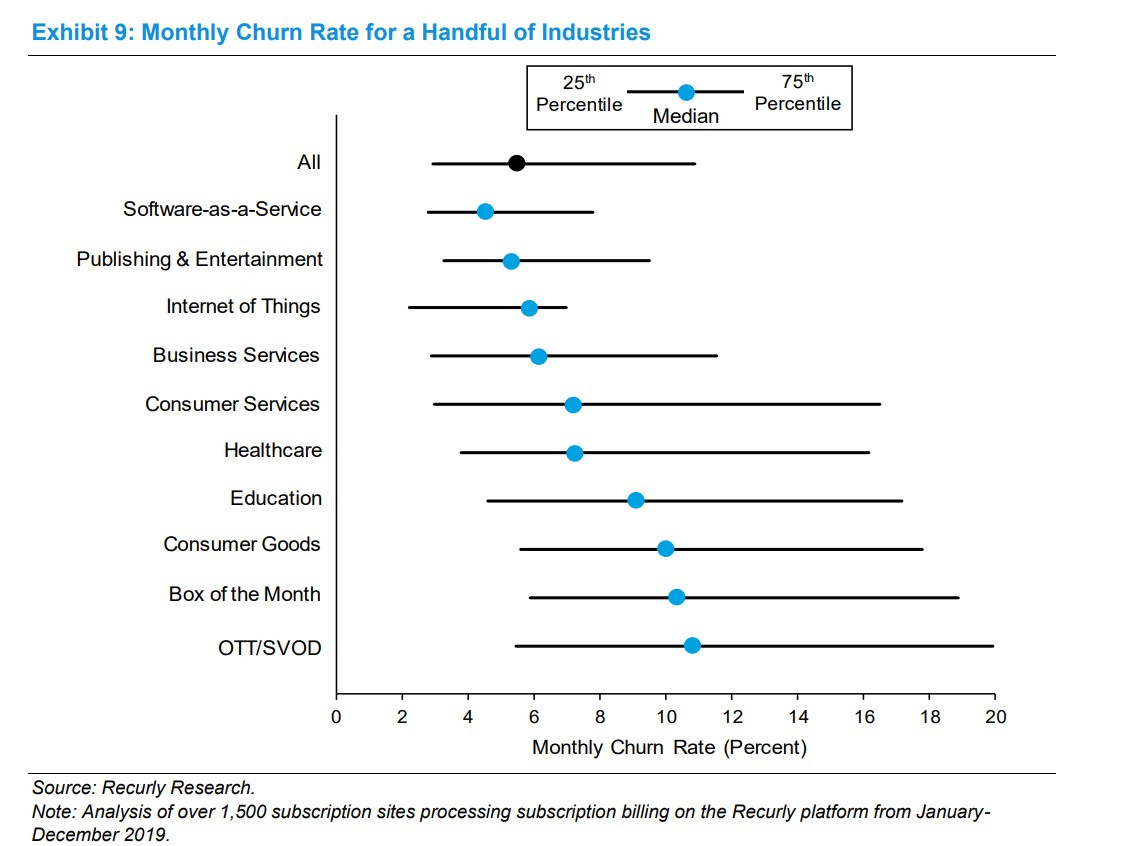

Once those customers are acquired, then the question becomes what does it take to retain those customers. Latch and SmartRent have so far experienced 0 churn. If that continues, then that would be off the charts compared to the typical monthly churn rates that other industries experience.

In summary,

Latch and SmartRent customers will have high willingness to pay given the cost savings and revenue upside potential and ecosystem. This suggests high stickiness of the solution as well as the ability to charge handsomely for the software. They are well positioned to create a lot of value for their customers and also are well set up to capture that value too.

These customers will be quite valuable given long contract terms, the ability to layer on additional modules, low to zero churn, and likely diminishing acquisition costs if and when they become the industry standard.

These solutions possess characteristics that point toward fast adoption, which is a bit unexpected given typical preconceptions for this industry.

All of these factors indicate that acquired customers will be extremely valuable to Latch and SmartRent. As such, it makes sense to spend and invest aggressively to win these customers over.

Even better if your customers also happen to be your major shareholders.

Ownership

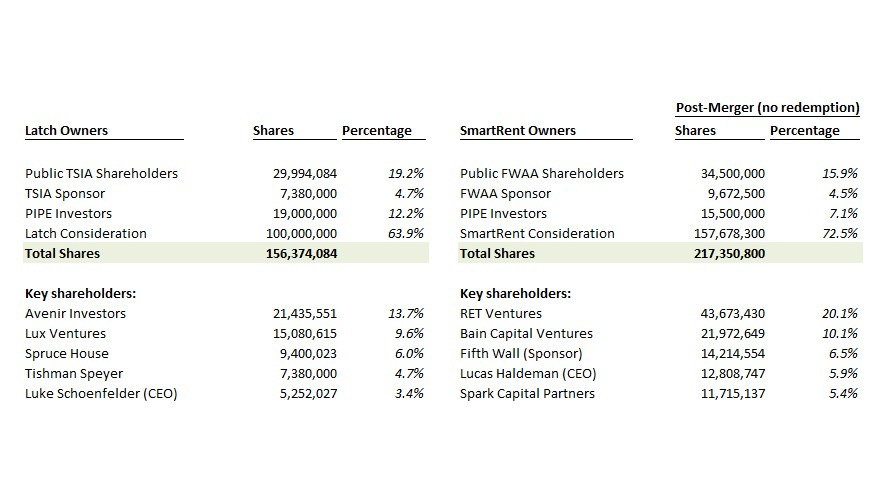

Below is a summary of the shareholder bases for Latch and SmartRent coming out of the SPAC merger. Latch completed their merger on June 4, 2021, and the SmartRent is an estimate assuming no redemption by SPAC shareholders.

Note that the Latch share count excludes ~15M warrants. SmartRent does not have any warrants.

Latch’s main venture shareholders are Avenir and Lux.

Avenir runs a concentrated venture portfolio that reflects their choices for what they consider “The future of ____.” Andrew Sugrue was on the Invest Like the Best podcast in May and described why they were so impressed by Latch:

I think what we found to be so different about Latch is first of all, the hardware is really complicated to build. This isn't something that you can just stand up in a contract manufacturer. When you add in components, Silicon chips, plastics and cameras, etc. into a lock, it combusts at lower temperatures than a traditional hardware-only lock device. Which means for multifamily where you have very stringent fire code regulations, the hardware itself is really complicated to build, which is why there is no other competitive product on the market, despite the fact that Latch has been in business for a number of years.

But I fully assume that our hardware advantages could commoditize over time. What we really want to build is the density of the network. One of the things that's so interesting about Latch is it drives a high ROI to its customer base. When you as a building owner install Latch, you see a real demonstrable ROI. You save costs on the operations of the business from labor in buildings, from placing lost keys from changing out key cylinders every year. But most importantly, you drive higher rents. So there's a phenomenal ROI associated with deploying these devices, which is why you see the majority of the top 20 property owners now on our platform, and that continuing to grow over time, that ability to grow within our customer base. As we've proven out that ROI, people have embraced it. And that's a benefit of selling to enterprises. If you can drive great returns to them that dramatically exceed their cost of capital, they'll deploy your solution.

But I think the thing that I get most excited about with Latch is version 3.0 of what people didn't expect. The first version was this is a hardware device that people think is commoditized. They don't realize the fact that this is a really complex software problem that Latch uniquely solves and becomes very sticky. On average, our customers are paying us 5 years upfront for the software. You can't turn off the product because your doors no longer work. So talk about a sticky customer relationship, a locked-in customer, pun intended there. But what I get so excited about is coming back to our consumer predisposition in the world is the fact that we have an unfair customer acquisition angle. When you move into a Latch building, you have to download the Latch app, right? That's your onboarding flow. It says, "Patrick, welcome to 172 Broadway. Here's your access credentials to the building. Do you have renter's insurance? Your building requires renter's insurance. No? Click here for a Latch offer." If you go look at Lemonade, any of these insurance businesses, renter's insurance businesses, they spend the disproportionate amount of their gross profit dollars on customer acquisition. Because these are very infrequently consumed products. You buy these when you move. They have to advertise to a broad base of customers knowing that people are moving every 7 years in the residential world, every 1.5 years in the multi-family world. You have to catch that person at the time they need it. When we can reinvest those 40% of dollars premium value spent on marketing and instead reduce cost to customers, that's a huge conversion opportunity.

The second thing when you're checking, it says, "Do you want internet installed when you move into your building?" Well, of course, you do. No one wants to wait for the Time Warner Cable guy to come. I think there's a few categories that have lower NPS than the cable industry. We can provide those services at cheaper costs to our customers and drive high conversion on that. So fundamentally, the way I think about Latch is this unfair advantage. You have customers who are using your app 5 times a day. Those are 5 times a day that we can solve more of their problems and monetize it by leveraging this very unique attribute of our business, which is we've got a home screen app with high frequency, and we have density of demand. That is the key to any of these last-mile logistics businesses, key to the on-demand economy is having density of demand. We have that without spending a dollar on marketing.

This is the Lux take on Latch (click below to see the full thread):

Latch’s key real estate shareholders are Tishman and Brookfield, who invested in or led earlier private rounds. This is Tishman CEO Rob Speyer on why he was so keen on Latch - “This is exactly the kind of transaction we had in mind.”

Latch’s key PIPE investors included Chamath Palihapitiya, Blackrock and Fidelity.

Chamath anchored the PIPE. He’s been a polarizing figure of late for his role in evangelizing SPACs. I think it’s important to recognize whether the deal that he is promoting is a reasonable one for retail investors. In general, I find that he’s at his best in identifying companies that have found product market fit, have demonstrated compelling unit economics, and simply need to scale. This is, after all, what he did at Facebook. Importantly, he was not the sponsor for the Latch SPAC but was instead a PIPE investor, which means he purchased shares as any other retail investor and does not have a promote incentive.

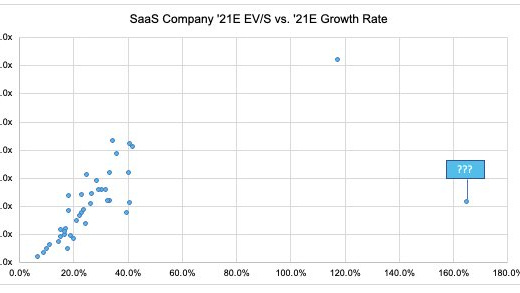

Chamath (in)famously made the claim on Twitter that Latch was the “best SaaS company” he had ever seen or invested in.

This seemed like a hyperbolic claim at the time, even coming from him. However, the dynamics of the business indicate there is very promising evidence to support that contention.

The ownership for Latch strikes me as long-term and tech-oriented. The real estate investors are leading players that own premium assets across multiple asset categories. Eventually, I can see a Brookfield or Tishman rolling out Latch and LatchID across all of their residential and office buildings, enabling their residents and tenants to move seamlessly between home and work.

The ownership on the SmartRent side is also extremely impressive.

Venture investors include RET Ventures, Bain Capital Ventures, and Spark Capital.

The SPAC was led by Fifth Wall, which like RET Ventures, has a property technology focus and counts many real estate companies around the world as limited partners.

The PIPE investment was anchored by leading real estate organizations in adjacent industries:

Starwood - 3rd largest of multifamily units in the US

Lennar - one of the largest homebuilders in the US

Invitation Homes - largest owner of single family homes in the US

Fifth Wall sums up the investment rationale:

What's really compelling and I think unique about the SmartRent story is that this is a company that allows investors to articulate a secular bet around smart home adoption at an enterprise level, selling an enterprise grade solution and capturing that upside with really attractive recurring revenue characteristics in a hardware agnostic way where you get to free ride to some extent on the tailwinds of all of this R&D that is pouring into smarter and smarter devices for homes.

SmartRent will be Fifth Wall's largest investment in prop tech because we are so confident in the business and so confident in its growth trajectory, we've agreed to a very long-term lockup of our sponsor shares. They're obviously an all primary deal.

While some premier players have selected Latch, the rest of the industry has coalesced around SmartRent. Recall the RFP that Fifth Wall mentioned running on behalf of their real estate clients where SmartRent was the clear choice. For large owners of residential units across the spectrum of classes and price points, SmartRent’s hardware agnostic approach is the more versatile and suitable choice.

Again, there appears to be a strong, symbiotic and long-term relationship between SmartRent and their key investors/customers.

7 Powers

This is the rare situation where I think you could plausibly argue that all seven powers are present.

Scale economies. They are both well positioned to take the lion’s share of multifamily over the next few years. With scale, it becomes more cost effective to develop additional modules and improve the technology. Once they get a foothold within an asset in a customer’s portfolio, it becomes likely they become deployed across the portfolio.

Network effects. The software becomes more powerful as additional hardware providers such as Google and Honeywell are linked into the ecosystem. Any new smart enablement hardware player will eventually be compelled to ensure they have seamless integrations into the leading software (similar to iOS and Android). Customers will likely realize additional value by deploying the same solution across their entire portfolio of real estate assets.

Counterpositioning. By focusing on commercial real estate, there is less likely to be competition from other major tech players. As primarily enterprise software software plays for multifamily to start, both are less dependent on the crowded and cutthroat smart enablement hardware market. Both Latch and SmartRent are also arguably counterpositioned against each other (i.e., the Apple and Android).

Switching costs. Once the software is deployed and real estate owners are enjoying the benefits and cost savings of smart enablement, it becomes increasingly difficult to switch to another provider.

Cornered resource. In this case, Latch and SmartRent have preferential access to the leading real estate owners and operators. By having their key customers as their investors, it effectively locks out any other would-be competitor from gaining market share from them. These real estate players will also be less likely to fund a new competitor since they are already investors and customers of the presumptive leaders in the space.

Brand. More applicable for Latch than SmartRent, as Latch is already starting to see their brand being promoted as key selling points in listings. The brand recognition among the industry’s decision makers will be key to driving more cost-effective adoption as well as prevent other new entrants from gaining share.

Process power. More applicable for SmartRent than Latch, as SmartRent has built up a sizable deployment team across the country to ensure that their integrations are smooth and painless for customers.

Is is an exaggeration to claim these are the “best” SaaS companies you’ve ever seen? There’s a lot to like here.

Valuation Thoughts

The investment thesis requires believing the following:

Owners and operators of multifamily and multi-user properties will choose to adopt and deploy smart enablement technology.

SmartRent and Latch will collectively win most of the market. Purchase decisions will gravitate toward the two market leaders today where leading RE companies have already begun deploying at scale.

SmartRent and Latch will successfully maintain their recurring fee model AND they will steadily grow their pricing by introducing additional service modules.

Focus on the recurring software fees. Assume the hardware and professional services costs can be provided at close to breakeven.

I consider these software fees to be like collecting a bit of rent eventually on each smart enabled apartment. That is why this is such a mouth-watering opportunity.

Financials are still nascent

The purported steady state metrics are compelling and attractive: (1) long 5-7 year contract life, (2) high software 70-90% gross margins, (3) 0% observed churn, (4) most customers prepay.

However, it’s still too early to validate the software story from the financials. These numbers are still quite tiny and not fully broken out for software. The gross margin picture is nowhere near 70%+ right now.

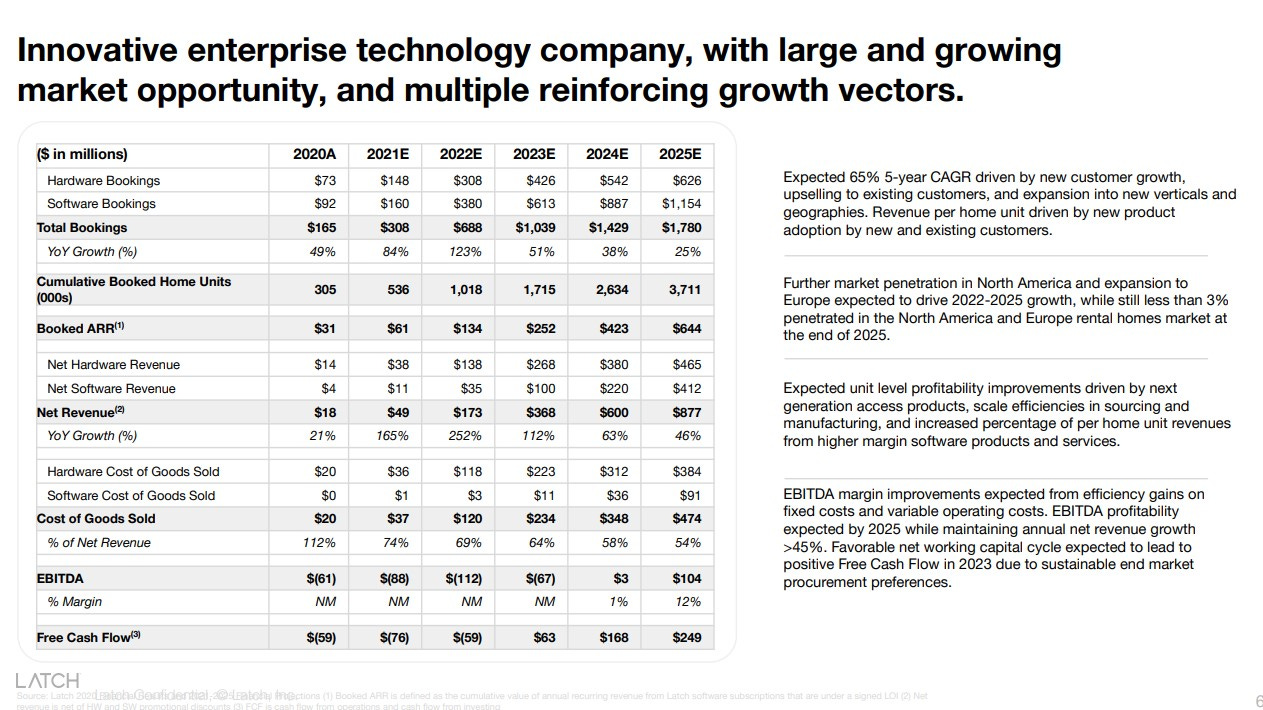

Latch financial projections (Latch investor presentation):

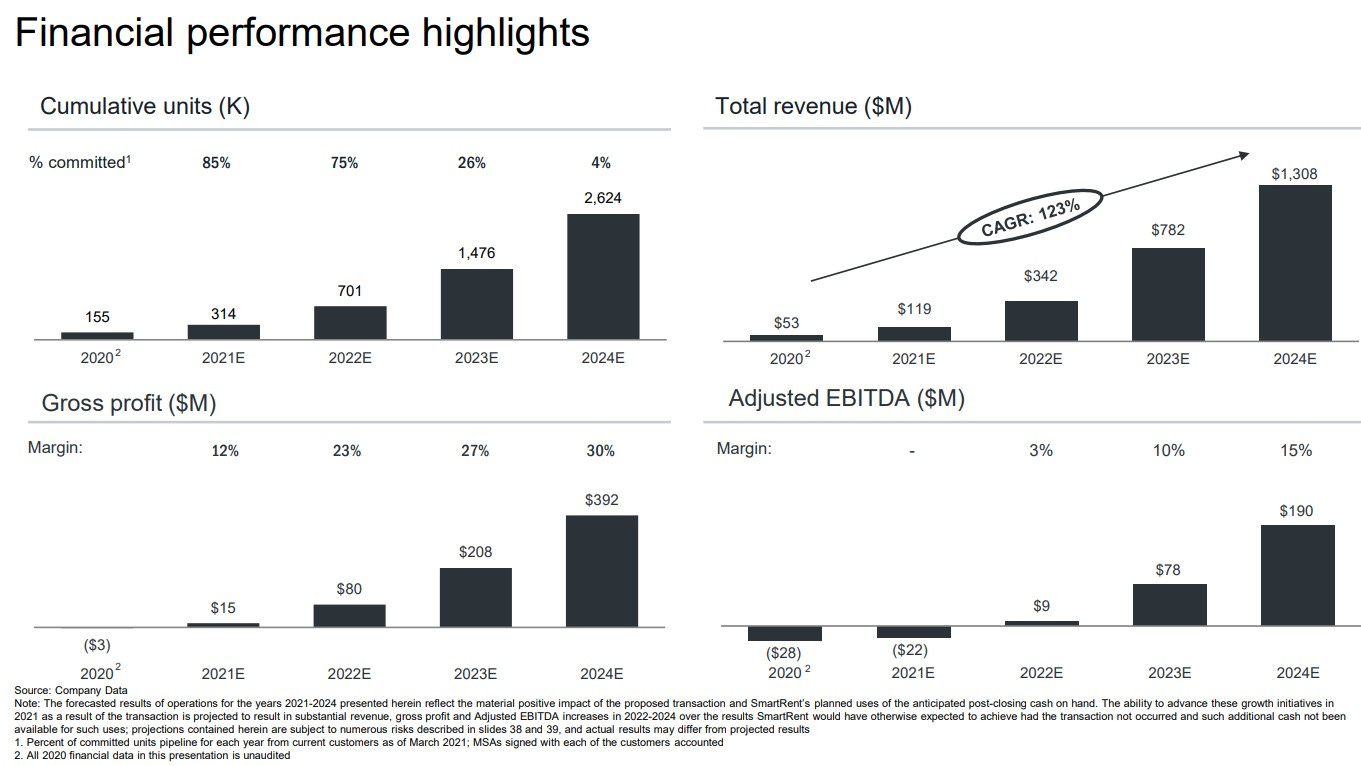

SmartRent financial projections (SmartRent investor presentation):

Both companies are just starting to scale up and will likely grow their software revenues at over 100% for several years to come. This should roughly track the number of installed units. Given the cash flow dynamics of their prepaid contracts, they are also projecting that they will be free cash flow positive starting in 2022 for SmartRent, and in 2023 for Latch.

I would love to see a clear connection from installed units to recurring software revenue to gross profit, but it’s still really early. The software component of revenue is simply too small right now to derive a meaningful signal.

For example, per their Q1’21 press release, SmartRent had $19M in total revenue in Q1’21, but only ~$3.2M of that was software (“hosted”) revenue. They deployed 32k units in Q1 and ended the quarter with 188k units overall. I estimate they made ~$6 hosted revenue per month per unit assuming they had ~500k deployed-unit-months in Q1.

Both companies are just starting up the S-curve in their deployment. Typically, these hockey stick projections would deserve a healthy dose of skepticism. In this case, however, I actually think these projections may turn out to be too conservative. Even though they will end 2021 with under a million units deployed combined, they have already signed up most of the key players. I think the main constraint toward revenue growth will simply be the time and resources it takes to deploy these solutions. They may very well get the commitments to deploy across customer portfolios much sooner. It would not surprise me if the number of committed units and visibility into future revenue turns out much more positively over the coming quarters.

As mentioned above, what really matters is the recurring software revenue. I ignore revenue from hardware and professional services, and I assume these can be provided at breakeven.

Based on the recurring software revenue, I assume each installed unit is worth ~$1,000 in enterprise value.

My math is really high level and I use round numbers for convenience. $5 to $25+ in monthly revenue collected per deployed unit translates to $60 to $300+ in annual software revenue per unit. Based on that range, I assume an average annual software gross profit of $100 per unit. The $1,000 value assumes a 10x gross profit multiple applied to the software component.

There are admittedly a wide range outcomes, and they are presently realizing revenues at only the low end of the range. This will also depend on EBITDA margins over time. In my view, software-like margins ought to be achievable here, particularly as user acquisition costs go down over time as these become the industry standards. You can adjust what makes sense for you accordingly.

Below are some illustrative comparisons. There are notable differences - consumer vs. enterprise, different market saturation levels, and different ARPU, retention and profitability profiles.

Netflix: 207M paid subscribers, $240B EV => ~$1.2k per sub

Spotify: 158M premium subscribers, $50B EV => ~$300 per sub

Peloton: ~2.4M paid subscribers, $35B EV => ~$15k per sub

New York Times: ~8M paid, $7B EV => ~$900 per sub

Assuming you can get comfortable with $1k in enterprise value per installed unit, then that translates to $1B in enterprise value per 1M installed units.

At a current “combined” valuation of ~$4B, this suggests the market believes the two companies can get to ~4M installed units. I believe that is highly achievable given the current customer and investor base and the units that they control. I think they may very well have that visibility today.

What matters in the long term then becomes how many units this can this scale to, and how soon the market will come to this view. Based on ~40M rental units in the US, this suggests a 5x return assuming these two companies reach 50% adoption.

50% likely feels high at first glance. But review their existing customer/investor list and review the list of the top multifamily owners from above. Almost all of these players have already been claimed by these two. It appears that we are at the beginning of a duopolistic winners-take-most iOS/Android dynamic taking place.

This is just within the US. Now factor in global multifamily (93M units in EU per Latch) and other multi-user real estate asset classes (office building, student housing, senior housing, hotels, Airbnb, and military housing), and the opportunity increases quite dramatically. Also factor in the potential to continue to add modules, value added services such as cleaning and pet walking, and advertising to this audience.

The bet is on if and when the market catches up to their install trajectory. Each additional customer signed and installation completed improves those odds.

Historical valuations:

Latch was founded in 2014 and has had a meteoric rise over the last few years:

Jan 2021 - Latch announces merger with Tishman Speyer at enterprise valuation of $1 billion, raises $500M+ [WSJ]

August 2019 - Latch raises $56M round led by Avenir at $400M valuation [WSJ]

August 2018 - Latch raises $70M round led by Brookfield at $250M valuation [WSJ]

Valuation has roughly doubled every 18 months for Latch. It’s impressive, but not unjustified given their impressive growth and performance.

SmartRent was founded in 2017 and has raised ~$100M. I haven’t been able to find publicly available sources for their valuation history, but it is likely they have also seen a rapid uptick in price appreciation.

May 2020: SmartRent raises $60M Series C [press release] led by Spark Capital.

June 2019: SmartRent raises $32M Series B [press release] led by Bain Capital Ventures. Valued at $120M [Pitchbook blurb]

Interestingly, during the SPAC negotiations, they agreed to a significant haircut to the original proposed deal terms to lock in their PIPE investors (Starwood, Invitation Homes and Lennar).

On March 6, 2021, FWAA delivered to SmartRent a non-binding indication of interest reflecting a pre-money equity valuation for SmartRent of approximately $2.5 billion…

In the following days, based on further review of valuation matters and market conditions, the parties agreed to lower the pre-money equity valuation for SmartRent from approximately $2.5 billion to approximately $1.75 billion…

On April 15, 2021, following discussions with a prospective strategic investor in the PIPE Transaction that was interested in participating as an anchor investor at a lower valuation, SmartRent concluded that the strategic and long term benefits to the post-closing combined company of bringing in such strategic investor to anchor the PIPE Transaction would outweigh a reduction in valuation. Following discussions among the FWAA and SmartRent management teams and the placement agents, FWAA and SmartRent agreed that the fully distributed enterprise value for the transaction would be decreased from $1.8 billion to $1.7 billion. As such, the equity consideration payable to SmartRent’s shareholders would be reduced to $1.577 billion.

That’s close to a 40% discount from the original indication of interest. Part of the discount may be a reflection of rapidly deteriorating market conditions for SPACs and high growth stocks during that time, but it’s interesting that the haircut was so significant given Fifth Wall had already been an investor in SmartRent and ought to have been familiar with the business. I understand the appeal for SmartRent to lock in these strategic investors, as it locks them in as potential strategic customers too. At any rate, I welcome the opportunity to invest at these more favorable terms.

How I’m Thinking About These:

I’m very bullish about the combined potential for these companies as public companies. However, since these are public companies, I think my bar for them is also much higher in terms of dissecting their financials. Were these companies raising late stage financings as newly minted unicorns, I think I would be even more bullish and enthusiastic to invest.

There is a case to be made that both of these companies are going public a little too early. Many articles will point to the meager revenues in 2020 ($18M for Latch, and $53M for SmartRent), extrapolate extremely frothy multiples, and quickly conclude that this is simply more evidence that we are in a SPAC bubble.

When I approach these as an IPO, that interpretation makes sense. Yet, I don’t think the current financials accurately capture the incredible opportunity in front of these companies.

If you fast forward a year and they have another year of 100%+ growth under their belts, I think the markets may price these companies much differently.

The downside is that growth slows down and they don’t ever acquire a new customer. Given their traction and their investor base, however, I think that is just highly unlikely. The qualitative elements of the business are too striking. The downside is also muted by the combined ~$1B cash balance.

I can also see these attracting M&A interest. Google, Microsoft, and Apple all seem like potential acquirers for these companies from a software and smart home perspective. Latch and Apple in particular seem to align on many dimensions including brand and user experience. As these companies mature and the cash flow dynamics clarify, I think these will likely also attract the interest of buyers of strong niche enterprise software companies. I’m not sure they’ll be available for sale though. If I were a Tishman or Brookfield or Starwood, I would not want to lose control of what will likely become mission critical software to run my properties.

Both SmartRent and Latch trade at ~$12 per share currently, which I think is an attractive price for such terrific high potential companies. I’m bullish enough now to see a path to 20M+ installs. The question will be if and when the market comes around to that point of view. I think that will very quickly become evident with a few more quarters of public performance.

Catalysts:

Both companies seem to be underfollowed and underrecognized given their industry and that they’re going public via SPAC rather than under the fanfare and sellside support of a traditional IPO. The view that these companies may be the best SaaS companies out there is not a widely held opinion right now.

Latch has been in the news somewhat, but SmartRent has hardly received any coverage at all. They seem to be known within their industry, but not really appreciated or followed outside of it.

Latch’s merger transaction closed in early June. The company received $453M cash out of the transaction, out of a possible $490M from the $300M TSIA SPAC and $190M PIPE.

Latch made a number of announcements in the last few months.

Launched LatchID. This enables a Latch user to maintain identification and authenticated through home through office in any Latch-enabled property. To me, it’s analogous to using Google or Facebook ID to log in to most other sites on the Internet. This strengthens the network effect for users of Latch and encourages those property owners to continue to deploy Latch in their portfolio.

Launched Latch for Commercial Office. This includes all LatchOS modules - smart access, visitor and delivery management, smart device and sensor control, connectivity, and personalization. Visitor access is interesting for the viral effect. This is technically a pilot, but what office properties to start with: The Empire State Building, Rockefeller Center and Brookfield Place. Talk about iconic.

This represents a significant inflection point in my view. Previously, they had only deployed in multifamily. Now they’ve made the leap to another multi-user buildings, and also signed a new customer in Empire State Realty that is focused on office.

SmartRent’s merger transaction is slated to close sometime in Q3. Until the shareholders vote on the transaction, there is always the risk that the merger falls through. I suspect that risk will be very low for SmartRent given the merger agreement specifically calls out Supporting SmartRent Stockholders who represent the majority of votes (57% of common, 78% of preferred) who will vote in favor of the transaction.

In the meantime, SmartRent is also showing signs of expanding to other verticals, with recent hirings for a student housing business unit.

The most potent catalyst will be from increased visibility in operating in the public markets. Both companies simply need to deliver a few quarters of continued performance and growing traction. Keep strengthening the ecosystem with new products and integrations, keep deploying units at 100%+, keep demonstrating expanding revenue within existing customers, keep showing ~100% customer retention, and keep collecting ~6 years of contract economics upfront.

If that happens, then it seems inevitable that they would grow out of their current valuations.

Risks

But first, however, they’ll need to grow into their current valuations.

1. The financials do not yet reflect the opportunity, and there is a lot of room for improvement in the disclosures.

Revenues right now for both companies are miniscule relative to the valuations.

There is a lot of noise in their numbers right now. Most revenue is coming from hardware and installation, rather than software. There is also not that much in the way of disclosures to isolate the performance from software.

SmartRent (Q1 earnings release) had $19M revenue in Q1, and $3M in software revenue.

Latch (Q1 earnings release) had $6.6M revenue in Q1, and $1.6M in software revenue.

What matters are deployed units and bookings and how that translates to annual recurring revenue (ARR).

SmartRent:

Deployed units: 32k units in Q1, 188k deployed units overall

Bookings: 45k units in Q1. Total committed units over 600k. Dollar volume not disclosed

ARR: $5.3M in Q1. ARR was $3.4M at the end of 2020.

Deferred revenue: $64M (unclear of share from software revenue)

Latch:

Deployed units: not disclosed. 369k Cumulative Booked Units

Bookings: $71.7M ($43M of software bookings).

ARR: not disclosed. Booked ARR of $39M (based on signed LOI)

Deferred revenue: $18M

For SmartRent, I can infer an annual contract value of ~$60 for the Q1 units based on the 32k units deployed and the net increase in ARR of ~$1.9M in Q1. This is consistent with the ~$5 per month initial deployment, though the expectation is that they will be increasing contract value with additional modules over time. There is no data to suggest that is happening at this point, but it is still early.

For Latch, I’m not really able to tease out how they’re doing on the software at this point. Frankly, their disclosures are too convoluted and not that helpful. It’s hard to tease out whether the software growth thesis is playing out based on what is available. Sharing booked ARR rather than ARR inflates the state of the business, since there are lengthy (~1-2 year) lags from the time of booking to when the units are deployed and revenue is recognized. $39M in booked ARR is indicative of ARR two years out. Current ARR is likely only ~$7M based on their current software revenue.

At any rate, current ARR suggests an implied enterprise value to ARR multiple of ~200x-300x. That is simply preposterous.

The numbers are small though, and these two have already made significant and critical headway with most of the key industry players as customers. We just need to see this progress reflected in the ongoing performance.

For each quarter, I would like to see:

How many new units were deployed?

How many new unit commitments were signed?

What was the net increase in ARR? How much ARR is coming from new deployed units versus revenue expansion from existing units?

How much are they spending to win that new ARR? David Saks of Craft Ventures has an excellent article on appropriate efficiency for SaaS companies (The Burn Multiple). The burn multiple for both companies are off the charts bad right now, but likely a justified investment in my opinion if they do manage to secure the leading property owners, operators and developers.

Given the runway, there is potential to grow deployed units by 100%+ annually for the next several years. There is potential to grow ARR among existing units by significant amounts (~50%) as well.

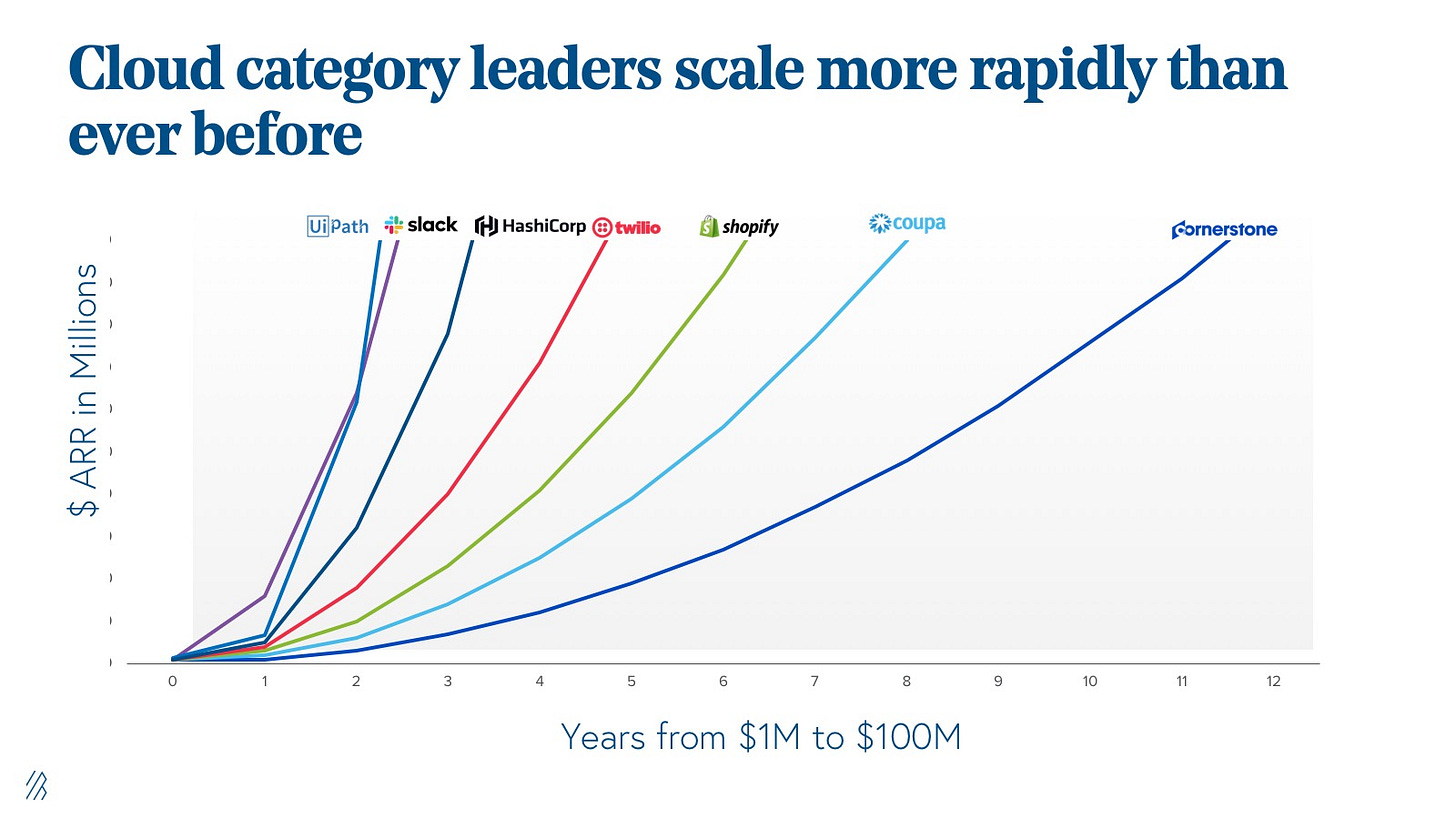

Assuming that plays out, then the ramp in ARR could prove to be quite dramatic. Based on Bessemer Venture Partner’s chart below illustrating years to scale from $1M to $100M ARR, they could be in some strong company. $100M ARR translates to $100 annual contract value for 1M deployed units.

My expectation is that this will be reflected in the financials soon enough, but it may be worth waiting to see if this comes to fruition. This may be too many layers of assumptions for most.

2. SPAC is a four-letter word.

There is a lot of skepticism associated with SPACs, and they are generally not viewed as a good bet for individual investors. This is for good reason, as many SPACs are structured to benefit the sponsor at the expense of the shareholder. Companies that have gone public via SPAC have generally been of lower quality and less mature than companies that go public through traditional underwritten paths.

The following paper (A Sober Look at SPACs) goes into great detail about the various ways that investors may suffer. Most of the damage comes from dilution of the investor’s shares, stemming from the sponsor’s promote shares, underwriting fees, and warrants. The median cost of dilution across SPACs is roughly 50%, though there can be a wide range of outcomes.

However, I understand why Latch and SmartRent pursued the SPAC path. They get massive growth funding injections, they get to go public faster, and they were able to select and lock in critical long-term investors who happen to also be their strategic customers.

SmartRent has relatively favorable terms from a retail investor perspective as far as SPACs go. The promote shares are subject to price targets and a 3-year lockup. There are no warrants available. The core investors are all major prospective SmartRent customers.

Latch also has a strong investor base and had relatively low redemptions (<5%).

Since Latch and SmartRent will be lumped in with other SPAC companies, there will likely be a lot of volatility in their share prices in the beginning. This volatility will provide attractive opportunities to build a position.

3. These are young companies and will endure growing pains.

While they have achieved remarkable success in winning adoption among the key players, there is also risk that it could all go away.

A nightmare scenario would be a security breach that provides unintended access to an intruder or reveals tenant privacy information. A loss of trust in their technology that compels their customers to rip out their software, and it’s effectively game over.

Delays or difficulty in installation would also turn off their customers. This may be a more significant challenge for SmartRent as they enable support for more third party devices, but they are also investing heavily in their deployment team.

Both also need to pay better attention to their tenant experience. While tenants are not their primary stakeholder, it’s not in their interest to turn off the customers of their customers. The app store ratings leave much to be desired. Both have decent ratings (4.5, 4.7) on the Apple app store, but recent reviews have been pretty scathing - Latch reviews and SmartRent reviews.

A recurring problem is that the app doesn’t always work and requires users to restart the app multiple times. For Latch, the sheer number of recent 1 star reviews leaves me scratching my head as to how the average is still a 4.7.

Testimonials from real estate owners tell a different story: they absolutely love it. However, if prospective tenants start to actively complain and move out, then that opinion among owners and operators could reverse quite rapidly.

This may be a symptom of lack of focus. On the Latch side in particular, it seems that they are rapidly pursuing in many growth paths at once, with LatchID and office pilots as examples. This is fantastic aggressive growth, but might be a double-edged sword if they neglect the fundamental user experience.

This will also affect the employee experience. Based on Glassdoor reviews, SmartRent appears to be the better company to work for:

Latch has a 3.9 rating, 68% recommend, and 76% CEO approval

SmartRent has a 4.5 rating, 93% recommend, and not enough data on CEO.

There will be growing pains, and they’ll need to strike the right balance. The good news is that these issues should be solvable.

4. Why this could all go wrong…

Their product just doesn’t work - faulty integrations, poor user experience, unacceptable vulnerabilities.

Real estate owners and operators and developers choose to not adopt smart enablement for whatever reason.

There is a huge delta between their rack rates and realized revenue (i.e., they need to discount their contracts heavily in order to win business).

They don’t provide clean financials in an attempt to obfuscate the true performance of their software business.

Another competitor steps in with a superior offering and wins over their market, including their existing customers. It turns out their 0 churn was not durable.

For SmartRent, they may not successfully close their SPAC merger.

They make poor investment decisions, lose focus, and bleed users, customers and employees.

Bottom Line

Despite the risks mentioned above, I’m very bullish on these two and like the potential for a multi-bagger outcome in the long-term.

The dynamics of the business are incredibly attractive and lucrative, and the investor and customer base provide a lot of confidence in the growth trajectory. I believe a real estate owner will only pick one solution, and once that solution is installed, it will prove to be incredibly sticky and difficult to displace. As a result, I think this will be a winners-take-most industry in the long run.

Compared to other, more traditional real estate plays, I find these to be much more interesting and with much better upside. Why pursue a complicated illiquid private equity development deal or settle for 3-6% tax-inefficient yields in a debt-laden REIT when I can invest in founder-led software businesses that occupy strong positions to become entrenched within the entire industry?

I like how they are currently underfollowed given their industry and how they may be overlooked or dismissed since they are SPACs.

I think both are at attractive valuations at their current price of ~$12. This may be a controversial take. They are on the surface ridiculously expensive by any measure based on their current financials. But I really like the odds for their eventual positioning in this industry. Were they never to drop below their current price again, I would regret not having bought more based on what I’ve learned.

That would be unlikely though. As SPACs and as younger companies, there is a good chance that both companies trade lower in the near term. There is a lot of volatility and little investor awareness in the early days. Many investors will not consider investing until after the SPAC merger is completed, and many will not follow until after a few quarters of public data. This would be the prudent path, but it’s hard to predict whether that is what will actually happen. My approach is to gradually build into my desired position over the course of a few months and quarters. Prices at $10/sh and below would be an outstanding buy in my opinion.

Bear case, these companies basically play out their current hand with their existing investor and customer bases and never sign another new customer. Perhaps the technology doesn’t work well and opens the door to other players for the industry to consider. Their deployment numbers would flatten and peak at just a few million units. This seems to be what the market is pricing in right now, as though it’s waiting for the data to confirm the path to wider adoption.

Base case, for me, is 50% of US multifamily, which suggests a ~5x business in 5+ years. This may be on the aggressive side, but I believe the evidence is there to suggest widespread adoption will happen.

Upside case includes: (1) expansion to other service modules to increase monthly revenues, (2) expansion to other multi-user real estate asset classes, (3) expansion to international, and (4) the introduction of value added services. A 10x+ multiple ($40B combined valuation) would not be out of the question.

My rough guess, which may be overly optimistic, is 20% probability for the bear case, and 80% probability for base case or upside case. I expect the probability for base case or better to increase with each passing quarter.

These feel like hold forever investments. The growth path is long with ample compounding reinvestment opportunities. They have the lead and have been anointed by the industry. Apart from the founders exiting the business completely or something nefarious occurring that makes me lose trust in the leadership, I’m not sure there will be a reason to sell.

These companies control their own destiny. I’m excited to watch this play out.

Note: For entertainment and informational purposes only. Not investment advice. Please do your own research.

Resources

SmartRent (FWAA, to become SMRT)

SmartRent [site]

Fifth Wall blog post announcing SPAC transaction - READ THIS [link]

Investor Presentation announcing SPAC transaction (Apr 2021) [link]

SmartRent Q1’2021 Earnings [link]

SmartRent customer and investor interview transcripts [SEC filing]

SmartRent S-1 [link]

Latch (LTCH, formerly TSIA)

Latch Investor Call transcript (Jan 2021) [link]

Analyst Day presentation (Mar 2021) [link]

Latch Q1’2021 Earnings [link]

Latch S-1 [prospectus]

Avenir Capital interview (Invest Like the Best podcast) [transcript]

Industry

Ernst & Young: How commercial real estate firms use technology to secure a future [link, report at bottom]

Deloitte: 2021 commercial real estate outlook [link]

NAR: Commercial Real Estate Trends and Outlook 2021 [link]

Writeups

Reddit: The Apartment Manager’s Guide to Smart Locks [link]

SeekingAlpha - SmartRent: The Android of Real Estate and Comparison Vs. Latch [link]

SeekingAlpha - Latch: The Apple of Real Estate [link]

Chamath Latch PIPE investment 1 pager [link]

SPACs

Buyer beware. [A Sober Look at SPACs]