That's What HIMS Said

Yet another SPAC with a guidance vs. reality mismatch.

*** Note: For entertainment and informational purposes only. Not investment advice. Please do your own research. ***

Hims went public via SPAC in Q4 2020. At the time, it was easy to dismiss them as yet another money-losing subscription box company with cheeky suggestive advertising that had successfully raised and burned enough venture funding to skyrocket to $100M+ in revenue.

This 2017 Fast Company article opened as follows: The first time I saw the website for Hims, a new men’s wellness startup, I thought it was elaborate satire.

With ads like this for erectile dysfunction, it was easy to conclude the same.

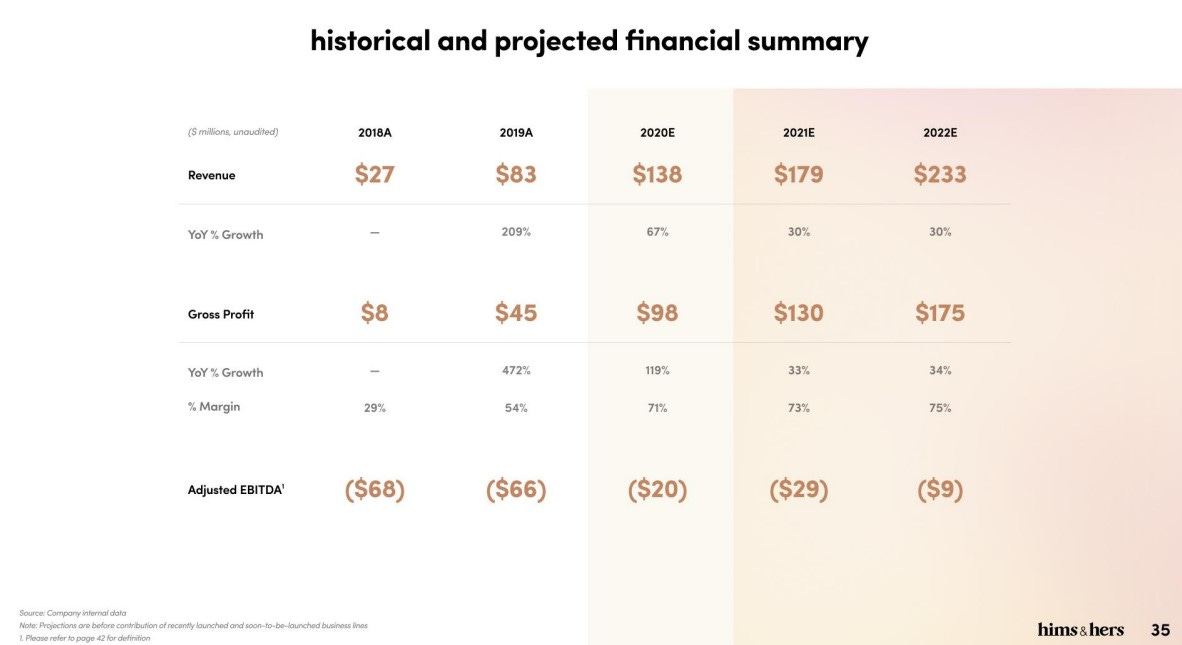

The below projections were what was promised at the time, with guidance for 30% revenue growth over the next few years. They expected 2022 to have $233M in revenue and line of sight toward adjusted EBITDA profitability.

Source: Hims Investor Presentation (Oct 2020)

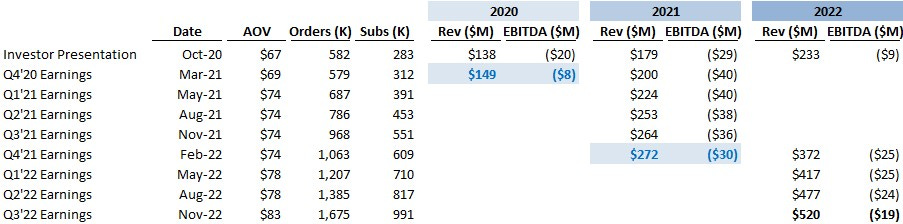

Since the IPO, it’s been eight straight quarters of remarkable beat-and-raise execution. I went back and tracked what management had originally promised, how their guidance evolved with each passing quarter, and what they actually delivered.

The business outperformance has simply been stunning. That 2022E $233M revenue projection from late 2020 was revised to $372M revenue by the start of 2022. They will likely end the year in excess of $500M revenue while crossing into profitability. Those figures do include acquisitions of Apostrophe and Honest Health from 2021, but even so, the company has far exceeded their targets and continue to raise them.

That revenue possesses a high margin with strong potential for operating leverage. Gross margins have been trending toward 80%, and opex has been gradually trending down, dropping from ~56% of revenue in Q1’21 to ~33% in the latest quarter. Note I’ve excluded stock-based comp to minimize the distortion around the IPO.

Marketing expense remains in the low 50%, but much of it is for new customer acquisition. Management has indicated targeting a payback period of under 1 year, with 85% retention thereafter.

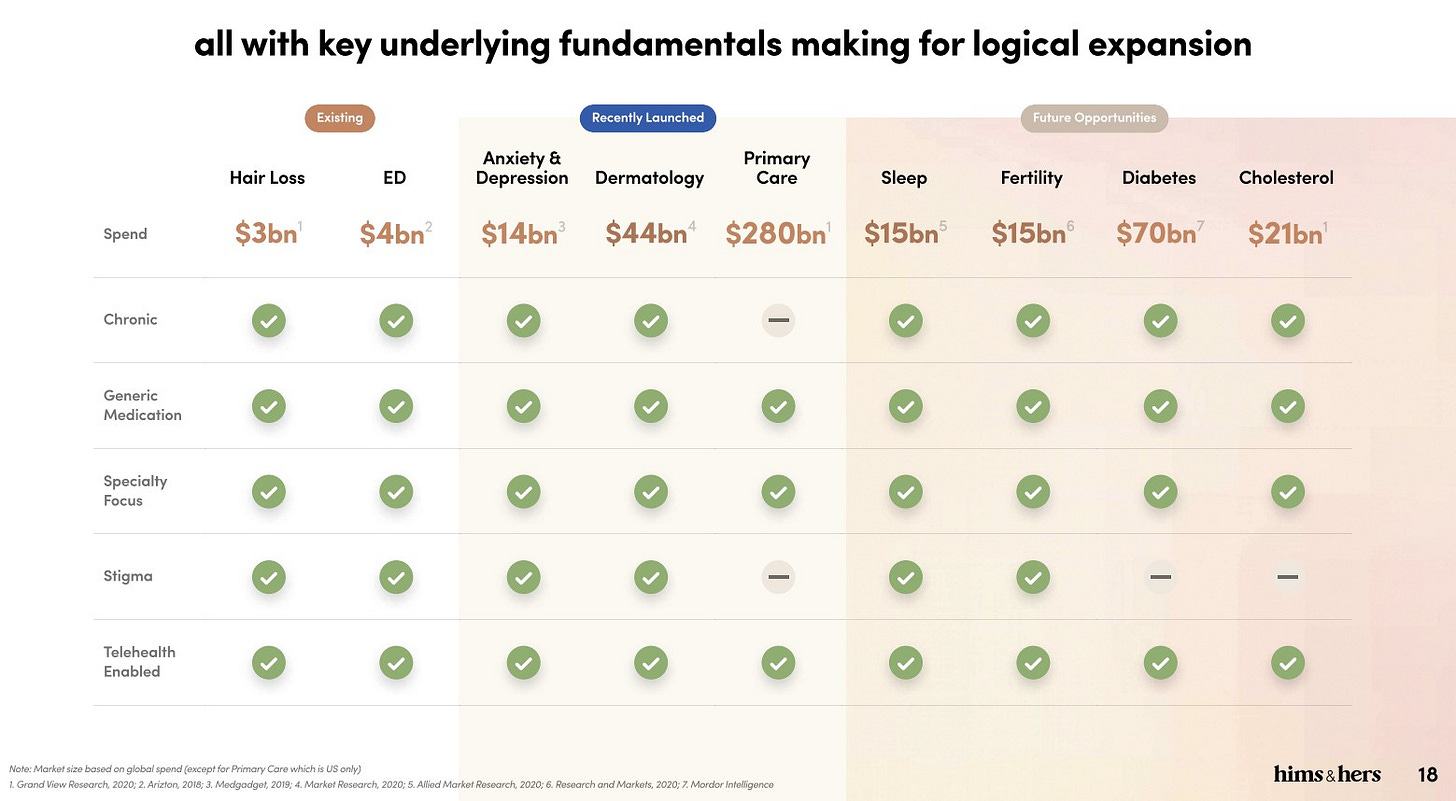

It turns out that strategically targeting chronic health issues combined with a path to effective treatment options through generic medication and telehealth delivery might actually be a decent prescription for a compelling business with recurring revenue and high margin.

Here’s the playbook:

Pick chronic health categories that have natural recurring usage dynamics. Better yet if these conditions have a social stigma attachment or are perceived as less urgent conditions, which means patients are overly refraining from seeking care and which may be less regulatory burdensome for a company to operate.

Favor those conditions with wide generic availability for high margin potential

Differentiate on user experience and ease and convenience, and prioritize online delivery of treatment - either telehealth consultations or e-commerce

Acquire customers when their younger and healthier, then cross-sell into multiple health lines as they grow older to improve stickiness

Stay disciplined on customer acquisition spend

Expand internationally

From the starting points of hair loss and erectile dysfunction, there are actually many health conditions that fit that profile.

Which indicates a pretty long runway for the company to grow along with its customers, and the likelihood of improved customer retention as additional options are selected.

It’s an impressive opportunity set, and one that the company is executing against effectively while staying pretty lean with under ~500 employees. They are crossing into profitability and still have ~$200M in cash available.

So now the bear case.

Ultimately, these are commoditized products with a bit of nifty marketing, slick packaging and a subscription pricing model, and the question is whether that elevated customer experience wrapper is enough to sustain the margin.

There will be much less expensive options available for those that care to look. I was a minoxidil purchaser from Costco for many years, but I’m a much more price sensitive shopper than most. The current economic climate may motivate others to take a similar approach. Perhaps those 1M subscription customers end up going elsewhere.

Perhaps a competitor like Amazon figures something out.

Perhaps something happens in their delivery operations. Someone gets violently ill from their products. Perhaps telemedicine is not robust enough from a care perspective.

Perhaps dilution goes off the rails as they throw stock at acquisitions and hiring.

Perhaps they overextend and overspend on marketing.

The CEO holds Class V shares with 175:1 voting rights. That’s egregious, but hard to argue with the job done so far.

The past year has been painful. I forgot my Substack password and stopped writing. For better or for worse, I’ve continued to hold. It’s been quite brutal out there.

I do seem to have a soft spot for seemingly deep value high growth plays, which often turn out to have been low priced for good reason.

There’s a lot to like with HIMS though. The business outperformance so far speaks for itself. The growth will eventually moderate, and they will certainly miss at some point. But with flipping to profitability, ample cash reserves, and a long growth runway, the current stock price at ~2 to 3x gross profit doesn’t seem too demanding for the potential upside.

I waded into a position over the past 2 years, buying a bit more with each successive earnings report. It helps that the price keeps coming down even in the face of improving business performance. In retrospect, this was a more appropriate way to build a position.