WISHful Thinking

The below is purely for information and entertainment purposes. I may or may not have a position in the securities mentioned. Please do your own research.

CONTENTS

Introduction

So Who Are These Guys?

Busted IPO

Investment Highlights

Financials

Four Common Criticisms and Responses

Key Shareholders

Management team

CEO

Employees

What's The Chatter?

Secret Powers

Valuation Thoughts

Range of Outcomes

Catalysts

Sell Scenarios

Bottom Line

INTRODUCTION

When I started in investment banking in 2004, my boss was very optimistic about a young innovative software company that the firm had just helped take public. It priced its IPO at $11/share that June and popped to $17. That summer, the stock dropped fairly significantly, dipping below $10/share at times. My boss loved this company and its visionary CEO, and he recommended that I buy the stock. Even though we were pitching them as a pioneer case study to every prospective client and I was staring at the share price practically every day that summer, I couldn’t really convince myself to get behind it. The vertical it served seemed very niche, the financials were highly negative, the business model seemed almost like a Ponzi scheme, and the fundamental innovation appeared to be nothing more than a different pricing model. To this day, I still don’t fully fathom Salesforce.com or why it’s valued as high or grown as large as it has. The company has had a quite a run since 2004, returning over 80x since the IPO. In retrospect, I probably should have put a little something into CRM back then. Of course I did not. I put my money in a company called TiVo instead – clearly a company that was destined to change the world.

The thing about asymmetric investment opportunities is that they are only obvious in hindsight. If it were apparent, then the potential would already be reflected in the price. Such an opportunity must be widely overlooked or misunderstood for it to even exist. It might even stare you in the face for a whole summer and even then you might not recognize it. Every once in a while though, the stars align and a remarkable asymmetric opportunity presents itself provided you know where to look and are willing to keep an open mind. 17 years after that fateful summer, I’m noticing astonishing parallels to a company called ContextLogic, dba Wish.

You may or may not be aware of them, but chances are that you are not their target demographic. But they are enormous, they are growing quickly, and they are well-positioned to capitalize on a global trend that is largely dismissed if not outright disdained by their key competitors.

They are also really good at hiding in plain sight.

Wish sponsors Lakers patch for $36M over 3 years, entering into the agreement in 2017, the year before LeBron signed with the Lakers. What fabulous timing. This was “basically, a no-brainer” deal, according to their CEO, even before Lebron and Anthony Davis joined and they won a championship. Note this relationship may likely to end after this season, as the Lakers will likely seek more favorable terms.

SO WHO ARE THESE GUYS…?

This Vox article from 2019 provides a decent primer – Wish, the super popular, ultra-cheap shopping app, explained.

Some highlights:

Last year [2018], Wish says it saw revenue double from the year prior, to $1.9 billion. The company earns money by taking a 15 percent cut of each sale [implies GMV of ~$12B in 2018]

It has raised $1.3 billion since it was founded in 2011, and at its last funding round in 2017, was valued at more than $8.7 billion.

It was also the world’s most-downloaded e-commerce app of 2018, with 161 million installs globally…[Amazon had 134 million installs].

Marketing toward lower-income customers wasn’t part of the original business plan, says Tarek Fahmy, a Wish engineering executive, who joined the company in 2012, but as it saw that customers were prioritizing price above all else, “we recognized that this was a significantly underserved market, especially when it came to e-commerce.”

…the concept for Wish actually comes from something far more old-school: the mall. The app was designed to mimic the experience of wandering and getting lost in a place filled with stuff to buy as far as the eye can see

Once they’ve downloaded the app, Wish users scroll through the app for an average of 20 minutes per day…Wish is resolutely mobile-first, taking cues from Instagram’s infinite feed and popular gaming apps with elements like a daily “Blitz Buy” wheel users can spin to unlock limited-time deals and pop-ups that promise further unspecified discounts if shoppers add an item to their cart.

At this point, if you dare, you should try to install the Wish app (consult the 4.7 rating and 2.1M reviews in the app store). Collect your “free” item (but pay for shipping) and fork over your relevant shipping and payment details. Try the Blitz daily, a 10-minute shopping spree with extra savings. Something might catch your eye, and you may or may not be induced to make an impulse purchase.

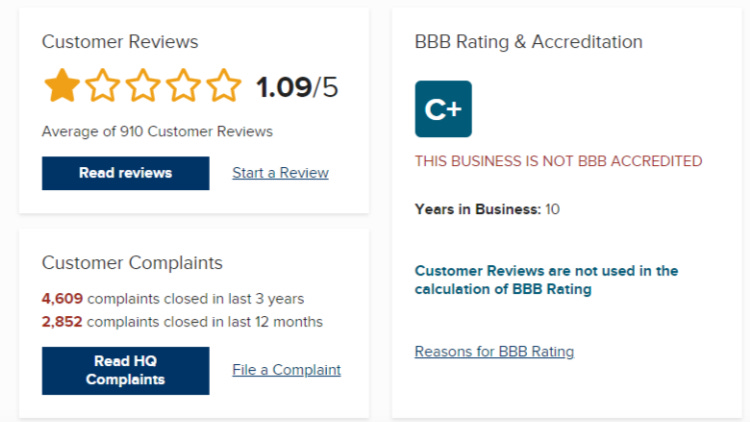

Is this for real? What do you suppose the customer ratings for this are?

There are no shortage of Ripoff! reports. The reviews at Better Business Bureau leave much to be desired.

Over at Trustpilot, the picture looks a bit more balanced, but the “Bad” ratings are still a whopping 26%.

Ultimately I’m not able to conclude anything definitively. The reviews are a mixed bag for Amazon, eBay, Walmart, or AliExpress too. It’s not the best experience, but then it's not their priority, and my expectations are reasonably tempered anyway. When I consider the denominator for these reviews corresponds to roughly a billion transactions per year, it's actually not egregious. In fact, that yield might be considered tolerable if not acceptable.

So is there a business here?

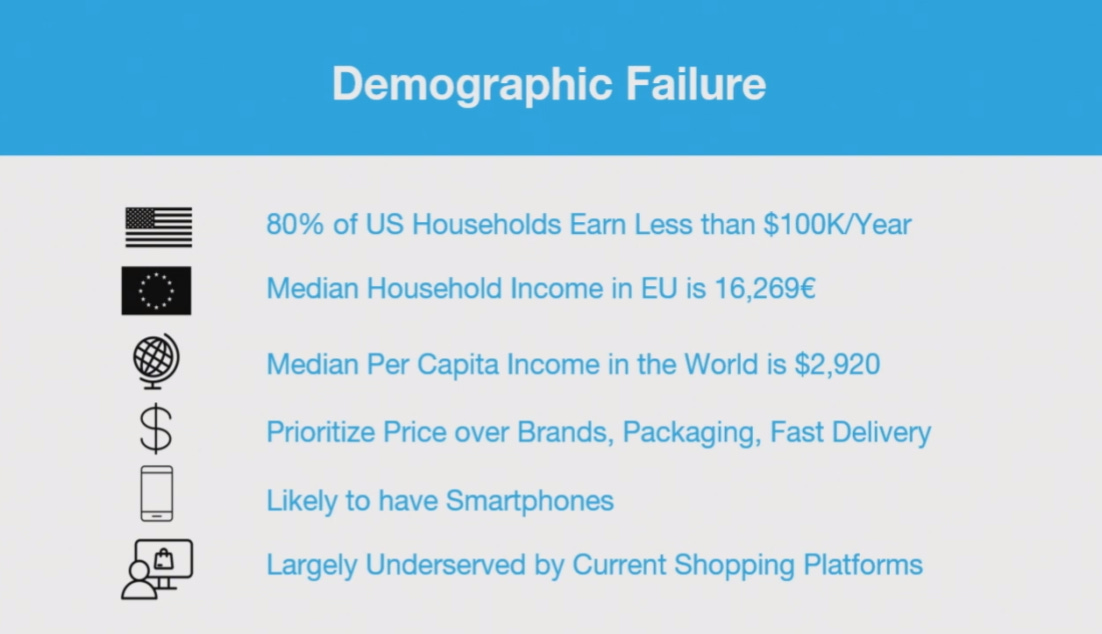

At Shoptalk 2017, Wish’s CEO Peter Szulczewski (I will just call him “CEO” from here) gave a presentation entitled the Failure of eCommerce and outlined two key reasons.

The first is Product Failure.

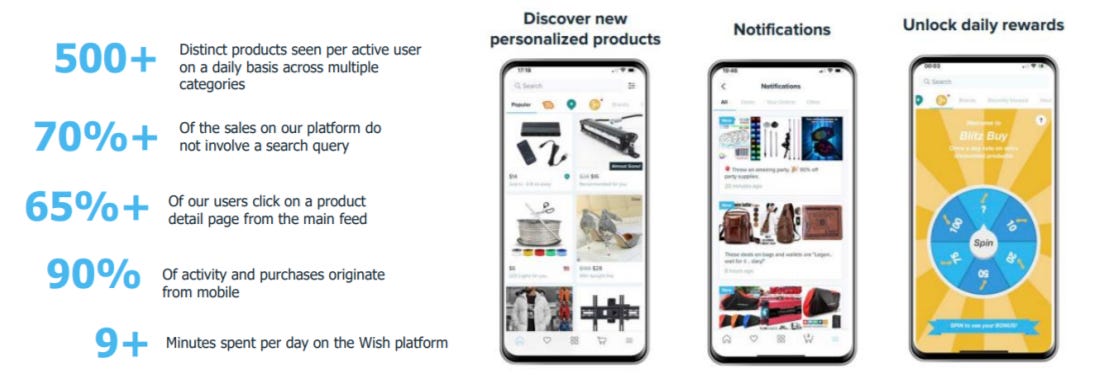

Wish contends that there has been a failure to support a diversity of shopping experiences. This goes back to reimagining the wandering-aimlessly-in-a-shopping-mall experience referenced in the Vox article. The prevailing shopping experience championed by Amazon to great effect is heavily search-based. Most Amazon consumers are not really shopping; rather they are consuming information, communicating, transacting. Most successful commerce players emphasize the search box first, which is effective but critically not the only way to shop. Wish deliberately focuses on vague shopping experiences, don’t-know-what-you-want, discovery-oriented, something that is more casual, enjoyable and entertaining. At the time, their CEO highlighted that <10% of Wish purchases involved a search query, the exact opposite proportion of Amazon.

Take a look at the key metrics supporting their entertaining, discovery-based shopping experience. The metrics that stand out to me are 9 minutes of engagement per day, and 500 distinct products seen per active user.

For a supposedly crappy shopping experience, that level of engagement is surprising and impressive. I have a hard time comprehending this personally, but then I’m not the target customer, so perhaps that is to be expected.

The second failure is Demographic Failure of people that have been left behind. Not everyone is looking for shipping speed. Many shoppers are value oriented, prioritize price over all else, including shopping experience, logistics, packaging, even reliability.

This is counterintuitive, but I am near certain the Wish team has examined this every which way it can. We’re in a fortunate position that this type of inventory is more or less a novelty for us. But huge swaths of the world are not so fortunate, and they prioritize price above all else. And there are a lot of them.

What that means is that humble neighborhoods can in fact be quite lucrative. The below is a nondescript neighborhood outside Miami (circa 2017).

And those neighborhoods are actually quite representative of the overall United States.

Now take those numbers globally, and the opportunity starts to get really interesting. There are a lot of people potentially getting left behind.

BUSTED IPO

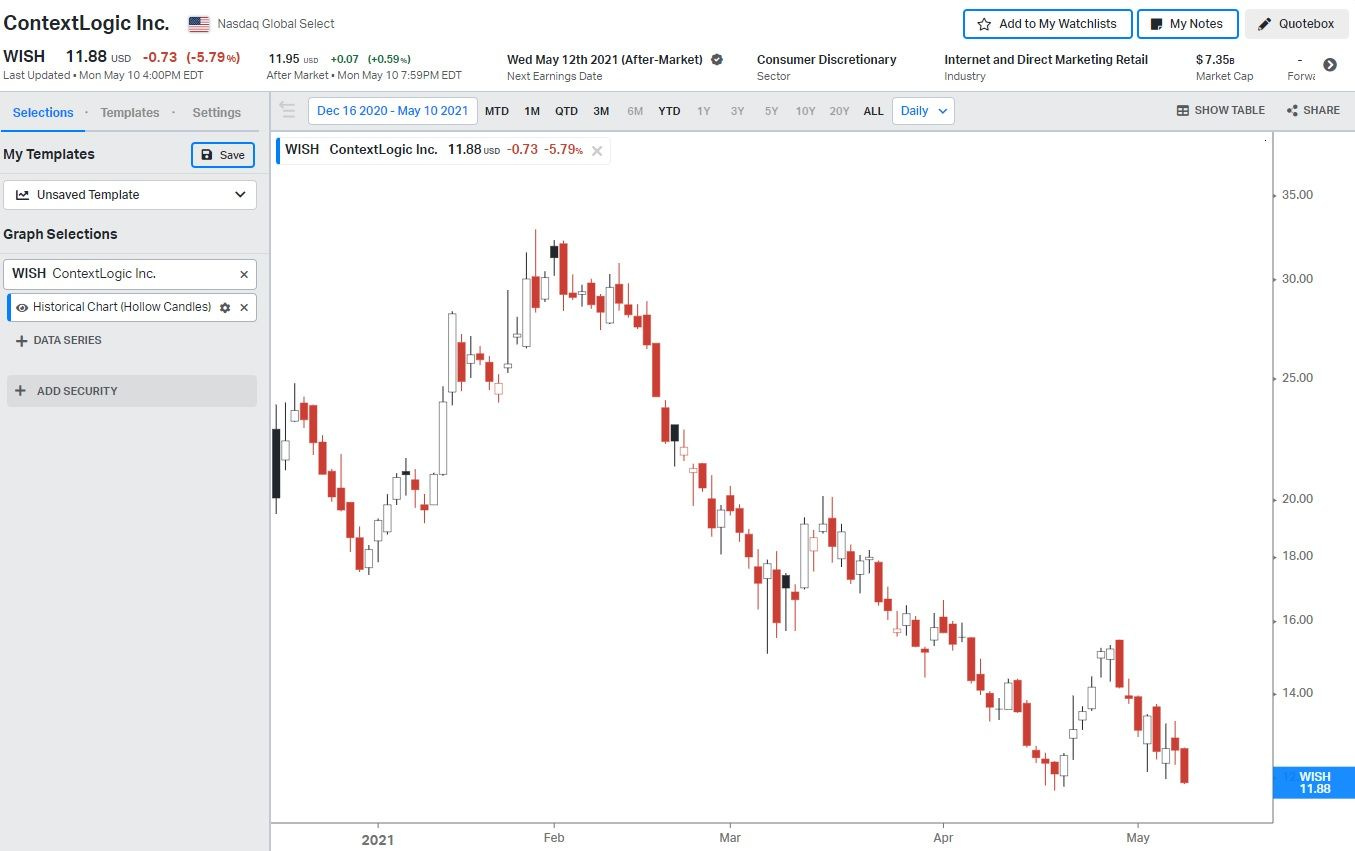

Wish went public in December 2020, shortly after massive debuts by Airbnb and Doordash, in a market where growth names, particularly in technology, were partying like it's 1999. With an offering managed by Goldman, JP Morgan and Bank of America, they priced their IPO at $24 (the high end of the range), raising $1.1B at a ~$17B valuation (fully diluted).

Some key details on the shares:

Dual class: Class A and Class B (20x voting)

Class B shareholders control 82% of the voting rights. Class B shares have a sunset clause where they automatically convert to Class A on the 7th anniversary of the IPO (December 18, 2027).

Current share count: 618M shares outstanding, as of 3/17/2021. This is split between 501M Class A shares and 117M Class B shares

Use of proceeds: …for working capital, operating expenses, sales and marketing expenses to fund the growth of our business, and capital expenditures. In addition, we may use a portion of the net proceeds to acquire complementary businesses, products, services, or technologies.

No selling shareholders at IPO

The stock fell 16% on the first day of trading. After quickly recovering and reaching a high of ~$31 in early February, the stock has experienced a dramatic fall. They currently trade below $12, representing a ~50% discount to the IPO a mere 5 months ago.

Is this a juicy bargain, or is this the deserved outcome for a scammy, nefarious company?

INVESTMENT HIGHLIGHTS

Their Q4’20 Financial Results deck lays out the nominal investment case.

Their stated mission is to “bring an affordable and entertaining mobile shopping experience to billions of consumers around the world.”

In my view, this doesn’t really tell the whole story. The management team readily admits that they did not set out to do the above - see the earlier Vox article. They stumbled onto it, but it masks the company’s true core competency and source of value.

That lies in their business model: Wish relies on cost-effectively adding new users, converting those users into buyers and improvement engagement and monetization.

At its heart, this company is a powerful data-driven machine learning system that optimizes efficient customer acquisition. The mission statement is simply the incidental output of that incredible machine. It has directed them to aggressively pursue a massive, underserved market opportunity in lower-income, price-focused demographic, however counterintuitive or distasteful that may seem to the lay observer.

These are the real investment highlights for me:

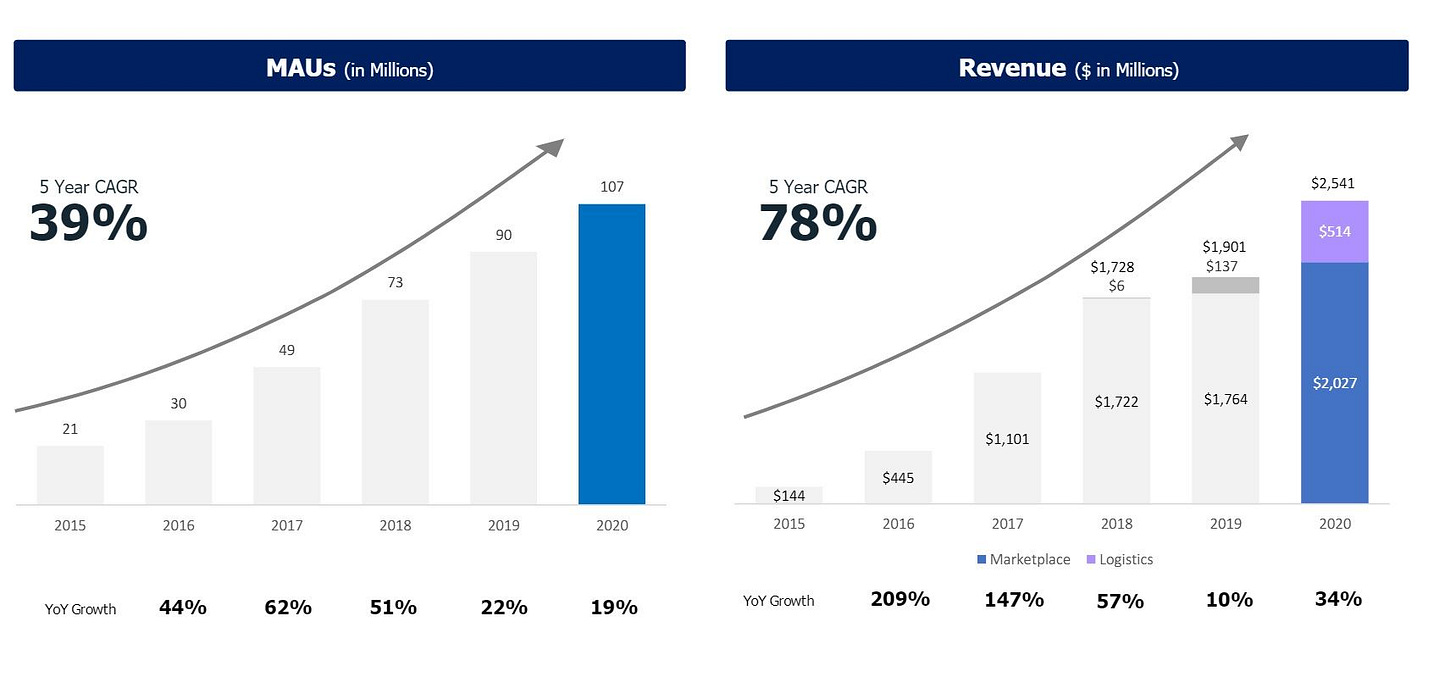

Incredible scale already achieved in a massive, underserved and underappreciated market. They alternate with Amazon as the #1 commerce app in the world for the past several years (Jan 2020 global shopping app rankings, and May 2020 and Jan 2021 (Statista). In 2020, they had 107M monthly active users (+19% YoY); 550k merchants; 64M active buyers (made a purchase within the last 12 months) (+5%). However, they did this while de-emphasizing customer acquisition in certain markets due to the pandemic, leading to a 10% decline in MAU in Q4. When they aren’t #1 or growing massively, it seems that it’s usually intentional (or so they say).

They achieved huge growth while operating at effectively FCF breakeven. They scaled revenue from $445M in 2016 to $2.5B in 2020 (5x revenue growth in 4 years) with cumulative operating cash flow of +$13M. They’ve deliberately been running at a slight GAAP loss since ~2016.

They run a capital-light business and have a solid balance sheet with $2B cash and no debt. They don’t own any warehouses, production facilities, and only minimal inventory (<3% revenue). Their capex is 0.1% of revenue.

Their strong data science and technology advantage claim seems pretty legitimate. 50% of its 875 employees are technical/data science. The CEO worked on Google AdWords in the early days. Revenue per employee is $2.9M. These are very very favorable comps to Google and Facebook at IPO.

The CEO owns 20%+ of the company and has very aligned incentives. CEO founded company in 2010 and owns 20% while taking a low salary. He also has a performance comp plan over the next 7 years that incentivizes a 4x-11x return from current stock levels.

They have an all-star investor roster and board. Founders Fund (Peter Thiel), Temasek, GGV, Formation8 (Joe Lonsdale) who are all 5%+ owners.

They have been trading at roughly half their December IPO price of $24 over the past month ($12-$15). They are trading at <2x EV/revenue run rate multiples. At their current <$8B market cap (with $2B cash), they are actually trading for less than their 2017 valuation of $8.7B mentioned in the Vox article.

Finally, they have a stunning counter-positioning advantage. They ostensibly compete with Amazon, Alibaba and Shopify, which they have identified as their key competitors. With the exception of Alibaba and Ali Express, no one seems to truly prioritize competing with them, in spite of the objective metrics and characteristics of this market segment.

FINANCIALS

Let’s try to poke holes in their numbers and key metrics.

The two key drivers are the durability of their revenue growth and the efficiency of their customer acquisition.

Revenue Growth: While the five year revenue CAGR has been unquestionably stellar, it’s been hampered by softening growth in recent years.

There has been a clear softening in their marketplaces revenue since 2018. They say only 10% revenue growth in 2019, and the growth was essentially flat if you back out the logistics portion of the revenue. Management indicated in their filings that this was due to “intentional moderation of growth resulting from prioritizing the launch of our logistics platform over new user acquisition.”

It is challenging to validate whether that moderation in growth was truly an anomaly given the subsequent impact to the business due to the pandemic. The headline growth returned to a more healthy-looking 34% in 2020, but this was juiced by the uptick in logistics revenue. Marketplace revenue on its own grew only ~15%.

That soft marketplace revenue highlights two key headwinds for Wish: (1) their heavy concentration on Chinese sellers, which represented 94% in 2018, and (2) the impact of significantly higher shipping costs due to the substantial reduction of Universal Postal Union (UPU) treaty subsidies, which affected China-based sellers in particular.

COVID exacerbated those headwinds. Wish saw the biggest impact from COVID in Q1’20 when they suffered an 8% revenue decline. That overconcentration made them the biggest e-commerce marketplace loser during COVID-19 according to Marketplace Pulse (though this assessment was made back in June 2020). Wish subsequently rebounded to 67% growth in Q2’20 as China recovered. However, Q3 and Q4 returned to sub 20% growth.

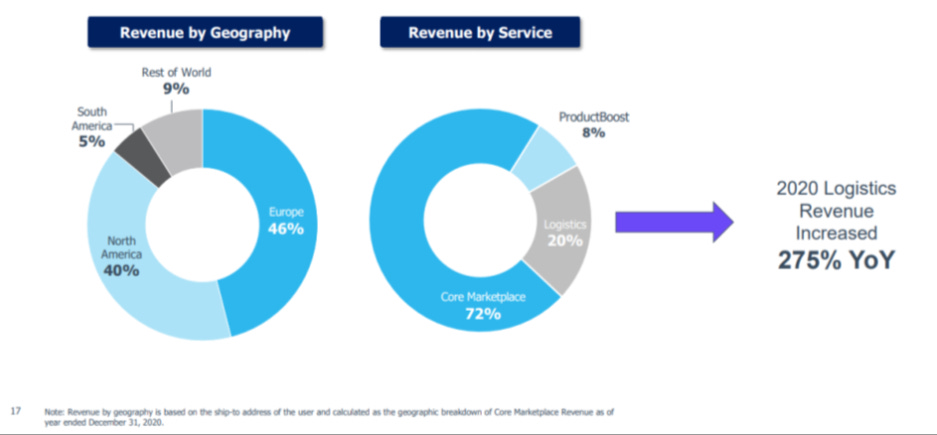

To counter these headwinds, Wish has highlighted their newly launched logistics revenue stream as well as their efforts to grow their seller base outside of China. Logistics has experienced enormous growth, and despite the small base, logistics revenue represented over 25% of their total revenue in Q4.

On the seller front, they have been accelerating NA, EU, and LatAm merchant acquisition (234% growth since 2019). They grew US merchants in the network by 435% YoY in 2020. It’s easy, however, to show a massive growth number from a low initial base. Additionally, merchant count growth may not necessarily translate to increased shave of volume. The signs are good, but it’s still early.

I frankly don’t know how to assess their logistics business at this point. They seem to be creating a local merchant network of pick up points. I understand the appeal to a store owner who will be eager to drive foot traffic, but I am skeptical about how efficient this model can be. They’ve claimed 50k merchants so far, which sounds like a sizable number, but it’s unclear how much volume is actually being driven through this. Thus far, a fair chunk of the local pick-up merchants I saw on the app held only a small scattered handful of SKUs at best. However, management highlighted in the last earnings that this business already comprises 25% of volume for certain markets such as Mexico and Italy. It’s also unclear what the margin profile is for this revenue compared to the marketplace revenue, but intuitively it would make sense for this revenue stream to be less profitable.

The question remains whether the revenue deceleration is temporary or whether the focus on logistics masks an overall weakening in the overall health and volume of the marketplace. It is somewhat curious that the Company does not disclose GMV or transactions on the platform. The lack of disclosure would suggest that the GMV trend is not flattering to their desired narrative. $2B revenue at their standard 15% take rate would imply ~$13B GMV. There may be pressure on the take rate, pressure in retaining or acquiring new sellers, which would negatively impact growth and margins. This will be something to keep an eye on.

The competition is formidable. Wish describes them as follows:

Our online competitors include large, global ecommerce platforms such as Amazon, Alibaba, and Shopify as well as more traditional discount retailers such as Walmart and Target. Our offline competitors also include scaled discount retailers that offer heavily discounted and off-season products, such as Dollar General and TJ Maxx. We are able to compete for Wish users based on our massive product selection, low prices and daily discounts, deeply-personalized and differentiated shopping experience powered by our data science and optimized for the mobile device, and entertainment derived from various engaging and interactive features of our platform.

Their biggest competitors in Amazon and Alibaba have been better positioned to address the headwinds that Wish faces.

Amazon may actually share similar seller demographics. According to Marketplace Pulse, 75% of new sellers on Amazon are from China (US, UK, Germany and Japan), per an analysis of 40k+ new 2021 sellers. The concentration from China has increased in recent years in all of Amazon’s core marketplaces. They’ve been clued in on the China opportunity since at least 2015, per this internal email, when GMV increased from $1B to $4B. China sellers likely represent upwards of $100B GMV of Amazon’s ~$300B GMV from marketplace sellers in 2020.

The primary advantage on Amazon is leveraging fulfillment by Amazon, giving the benefit of 2-day fulfillment. The UPU change would have been a non-factor for Amazon selling. Plus, there is simply no contest in brand perception or customer service between these two companies.

AliExpress is the most direct competitor to Wish. There wasn’t any mention of AliExpress in Alibaba’s 2020 Investor Day materials, but they were covered in 2019. For LTM Aug 2019, they had $10B+ GMV and 79M+ active customers, which is on par if not larger than Wish. This comparison between AliExpress and Wish on Quora has some interesting tidbits. AliExpress seems to be concentrated in Russia, Brazil, U.S., Spain and Turkey. There have been rumors of AliExpress Russia going public, with a recent GMV of $3B.

AliExpress also benefits from Alibaba’s global logistics network. In their Dec quarter 2020 release, Alibaba disclosed that Cainiao had deployed more than 200 international chartered cargo flights for AliExpress, which resulted in a reduction of average delivery time by 3.5 days. They also disclosed that growth in GMV at AliExpress had recovered to pre-pandemic levels.

Shopify is also out there, though so far Shopify has been pretty vocal about their plans not to build a marketplace (Shopify Won’t Build a Marketplace), instead doing things like partnering with Facebook. Their leadership has consistently stated that they are looking to help sellers build direct relationships with their consumers, and the marketplace model would not serve that goal.

All of the above does not paint the most promising future for Wish. It’s tough to imagine a more formidable set of competitors. On the other hand, they’ve been contending with these dynamics for their entire existence and have done just fine. Global e-commerce is both intensely competitive and growing fast, and Wish may very well continue to thrive just riding the secular trend. Wish’s strategy to deliberately focus on the low-end makes sense in light of the competition, and it still represents a huge runway for them. A few years from now, it may very well turn out that all of this handwringing will have been over nothing more than a barely perceptible blip, a mere blemish against a glorious rocket-ship growth trajectory. However, this is clearly a concern for the time being.

Customer Acquisition: This is their bread and butter, and their number one risk factor: Our efforts to acquire new users and engage existing users may not be successful or may be more costly than we expect, which could prevent us from maintaining or increasing our revenue.

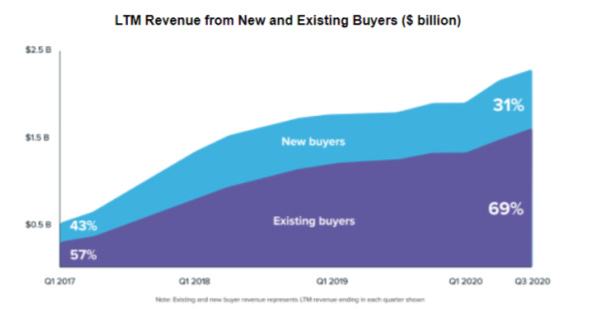

They’ve spent more than $1.5B on sales and marketing in each of the past 3 years, though at declining percentages of revenue, from 91% to 67% in 2020. That’s good.

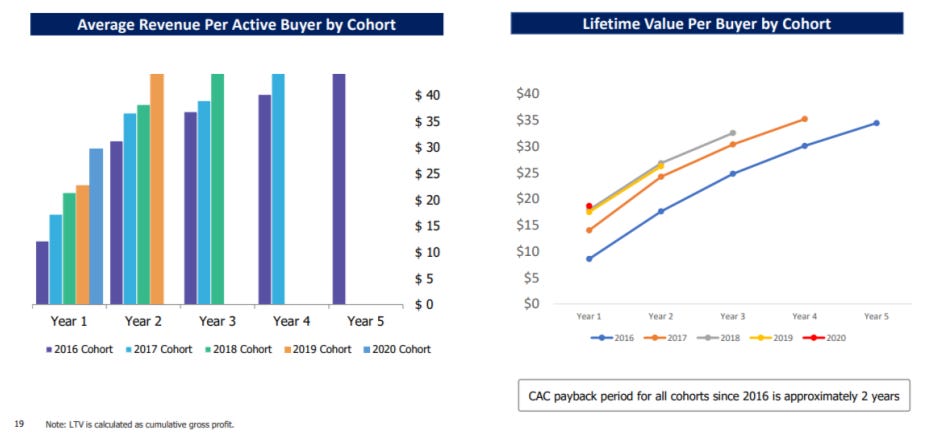

They closely monitor lifetime value (LTV) and customer acquisition costs (CAC, though they call it buyer acquisition cost, BAC). They define LTV as cumulative gross profit. CAC is total digital advertising expense targeting new installations divided by new buyers acquired during that period.

Buyers from recent cohorts have hit ~$30 LTV by year 3, with recent cohorts exhibiting higher LTV per buyer. In the prospectus, the company noted their 2016 cohort achieved a 2.8x LTV to BAC ratio by year 4. Eyeballing the numbers implies ~$10 CAC for the 2016 cohort. The above callout notes the CAC payback for all cohorts since 2016 is approximately 2 years. LTV for year 2 for 2017, 2018 and 2019 looks to cluster around ~$25, suggesting a substantial increase in customer acquisition cost since 2016.

Notably, all of that spend has not seemed to have much impact on their actual buyer count. Their active buyers have been relatively flat the past 3 years, going from 64M to 62M to 64M from 2018 to 2020. That’s not the most encouraging sign.

The $1.7B in marketing spend is a tremendous amount for those LTM active buyer results. It implies they must experience some breathtaking churn. It’s almost as though they need to acquire most of their customers every single year. At the above $25 CAC, that would imply spending $1B on customer acquisition would allow them to acquire 40M buyers. The cost of buyer acquisition at the margin likely increases dramatically, but I am left scratching my head as to why

Their buyers are spending more though. Those 64M buyers generated $2.5B in revenue, or approximately $40 in revenue per buyer. At a 15% take rate, that suggests the average buyer is spending ~$260 on the app. I find that level of spend surprising, considering this is supposedly a lower income demographic. That compares well to the other key marketplaces.

The average eBay buyer spends $540 ($100B GMV, 185M active buyers, 12700 employees)

The average Etsy buyer spends $126 ($10.3B GMS, 82M active buyers, 1414 employees)

The average Amazon buyer spends ~$1,300 ($386B GMV, 300M+ buyers, assumes 200M Prime buyers are 2/3 of Amazon buyers)

While the marketing spend and flat active buyer results suggest that buyers are churning at a high rate, that does not seem to be showing up in the revenue from New vs. Existing Buyers. Existing buyers generate 69% of revenue in LTM (9/30/20), up from 57% LTM (3/31/17).

Existing buyers on Wish collectively spend ~$10B+. Out of that 64M buyer base then, there must be a core group of loyalist buyers (5M ? 10M? 20M?) who actually spend quite a bit on Wish. I wonder who these people are, and I wonder how much it takes to keep them coming back for more. Perhaps many are businesses and resellers sourcing inventory from Wish. Perhaps they're addicted to the Buyer Blitz game and costing Wish in hefty subsidies.

So there you have it. It's a business with rapidly decelerating revenue growth, it competes with some of the largest players in the world, it's heavily dependent on Chinese sellers, and the cost of acquiring the marginal buyer has skyrocketed, resulting in their spending billions on marketing just to run in place on active buyers. No wonder the stock has dropped over 60% in the last 3 months.

FOUR COMMON CRITICISMS AND RESPONSES

Let's keep piling it on.

People just don’t get them it seems. Management recognizes that, noting that its investor base comes from the top 10% of the country, while Wish’s market is targeting the bottom 50% of the world. There’s a lot of education that has happened and needs to happen, but they are quite confident. “It's a long-term journey and as long as we execute and get to our vision, then the markets will reward us for that." These are typically platitudes, but it may be more than that for them.

Educating new investors has been part of the journey. In this Recode interview from Dec 2016, the CEO goes into the four common criticisms that they keep hearing and how they address them. The interview is clearly dated and the data points are stale, the underlying reasoning hasn't changed.

Criticism #1 – Seriously…who buy’s this stuff? Some variation of “I don’t shop on Wish, I don’t understand it, I don’t know anyone who shops on Wish, I can’t believe anyone would.”

This is a misconception. Everyone thinks purchase experience is most important thing (fast, reliable, product quality). Wish’s customers prioritize price above all else and are willing to sacrifice product quality, reliability and shipping speed to get it. It is a massive market, and this is reflected in the numbers (back in 2016):

60% consumers have bought at least 5 items

16 items per year

2M items transacted per day

1B items bought annually

$2B GMV by year 3. More than doubling every year.

70% of DAUs look at 500 items per day.

CEO wrote a post entitled the Invisible Half in 2016, using the election of Trump as an analogue to the consequences of overlooking the underserved masses. Many people thought, “I wouldn’t vote for Trump, I don’t know anyone who would vote for Trump, therefore there is no way Trump can win.” Similarly, they think, “I wouldn’t shop on Wish, I don’t know anyone who shops on Wish, therefore no one shops on Wish.”

Criticism #2 – This is a house of cards dependent on wildly exorbitant and inefficient marketing spend.

This is also a misconception. However, it’s a good question, so being the data driven company they are, they tested it. In 2016, they shut off Facebook marketing for some time to prove unit economics for existing customers. They decided to run 10 months at cash flow positive just to prove that they could. They discovered that customers came back and bought more. They restarted growth user acquisition efforts in mid 2016. Even with those dynamics, they grew revenue 3x in 2016 while doubling gross profit and running at breakeven. LTV in the last 6 months grew 9% MoM while CAC stayed static.

Strategically, it was very critical for them to reach sufficient scale to be relevant to sellers. For marketplace businesses, merchants won’t care about you if you’re not a significant part of their business so Wish needed to drive a lot of volume for them, at least 20% of the merchant’s aggregate volume. Merchants’ margins also needed to be high enough selling on Wish that was comparable to other platforms.

Back in 2016, they already had $1B in cash on their balance sheet and had $4.2M GAAP net income. Their strategy was and has been to operate at breakeven.

Criticism #3: Delivery times measured in weeks? Surely you’re joking...

Conceded as valid criticism. Not great. 15 days -> 6 days. Top priority is logistics. Wish Express – 6 days delivery. Long run, 2/3 of transactions will be delivered in under 6 days.

Criticism #4: Company hasn’t done well at hiring talent outside of engineering / technology / data science.

I suppose there’s an element of truth to this, but this seems to be mostly a humblebrag. Many non-technical candidates at the time were scared away by the other criticisms, but that seems to have been starting to change at the time. Facebook’s head of customer service was recently brought over and customer satisfaction ratings (positive vs. negative) improved from 50s to the high 80s, comparable with Amazon.

To them, the first two criticisms are misconceptions, and they faced that challenge repeatedly during fundraising. There are some big-name shareholders on their cap table that they’ve managed to convince to share that view.

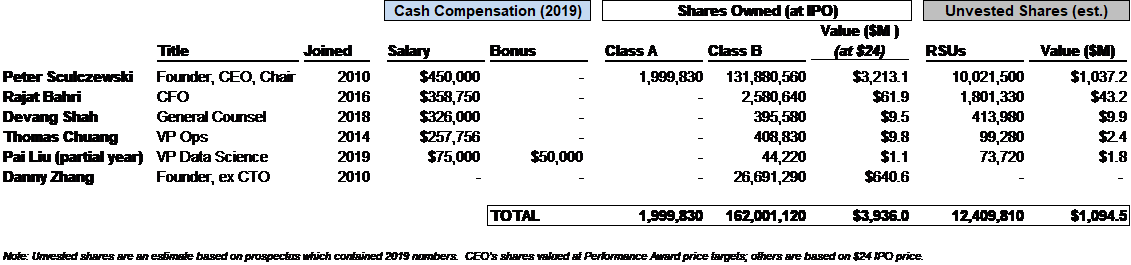

KEY SHAREHOLDERS

Funding History: Crunchbase($2.1B total prior to IPO)

Aug 2019 – H - $300M – General Atlantic

May 2017 – G - $500M - Everbright Fund

May 2016 – F - $500M – Temasek

June 2015 – E - $500M – DST Global

June 2014 – C - $50M – Founders Fund

Other rounds…

Key Shareholders: Crunchbase, Fintel for latest 13Fs

Formation 8 (Joe Lonsdale, BOD): 62.2M shares (12.9%). Co-led $19M Series A in 2014

Founders Fund (Peter Thiel): 46.7M shares (9.8%). Led $50M in 2014

DST Global Advisors : 103.8M shares (21.7%). Led $500M in 2015

Temasek: 26.8M shares (5.6%). Led $500M in 2016

GGV Capital (Hans Tung, BOD): 26.2M shares (6.4%). Co-led $19M Series A in 2014

Peter Szulczewski (founder, CEO, BOD): 134M shares (22%). 59% voting power.

Danny Zhang (co-founder): 26.7M shares (5.3%)

Note: all of them own >5%, which means they have additional 13d disclosure requirements if they ever decide to sell down.

Board of Directors:

Julie Bradley (ex CFO TripAdvisor)

Ari Emanuel (Endeavor CEO)

Joe Lonsdale (8VC, founder Palantir, Addepar)

Tanzeen Syed (General Atlantic, ex-Temasek)

Stephanie Tilenius (ex KPCB, Google, eBay)

Hans Tung (GGV, on BOD of Poshmark, StockX, Xiaomi, etc.)

Jacqueline Reses (ex Square Capital head, ex Yahoo chief BD, ex BOD of Alibaba)

These are some of my observations:

They’ve been at a ~$9B valuation for a number of years now.

They have a history of raising money even though they don’t really need it or use it.

The key shareholders all own 5% of the company or more, but many of the later folks may actually be flat to slightly underwater at these price levels.

If it turns out the key shareholders are not looking to sell, then the float of this stock looks severely constrained. It’s basically the 46M IPO shares, and the RSUs that get sold for tax withholding, so the float is roughly 10-15% of total shares.

MANAGEMENT TEAM

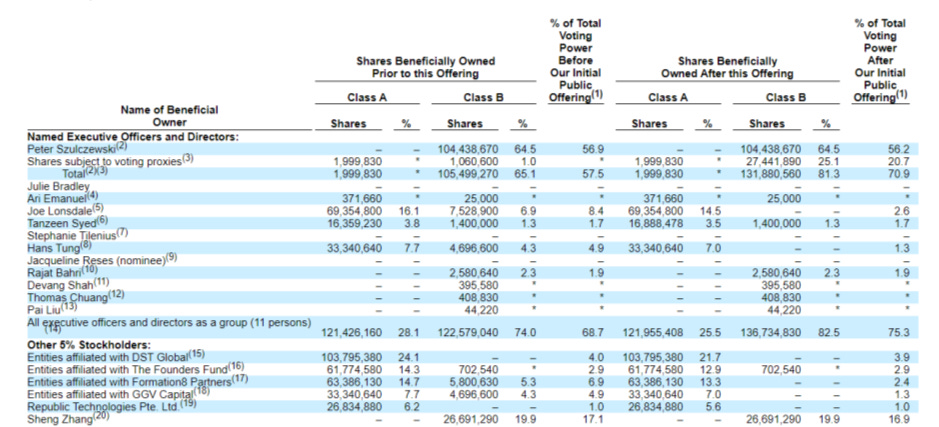

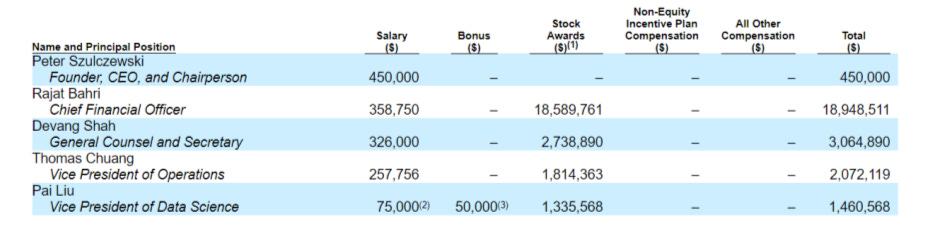

Let’s take a look at the named executive officers:

CEO – Peter Szulczewski (39, ex Google Search)

CFO – Rajiv Bahri (56, ex Jasper CFO, Trimble CFO, Kraft Foods 18 years)

General Counsel – Devang Shah (48, ex Zynga GC, UTStarcom, Longs Drugs, Skadden)

VP Ops – Thomas Chuang (43, Ops and Finance since 2014, GGV Capital, PwC)

VP Data Science – Pai Lu (35, ex Airbnb, PARC scientist, USC PhD)

I compiled data from the various filings to get a view for how much the founders and management team own. Once the 2020 proxy statement comes out, I’ll be able to get a much cleaner view.

The management team appears to have low base salaries, and the compensation is skewed toward the stock. However, even the equity compensation strikes me as lower than I would have expected. Apart from the founders and the CFO, no one is really getting life-changing generational wealth as of yet. The dollar figures assumed the IPO price of $24, so these are currently ~50% down.

The disclosed management team does seem somewhat sparse, but it appears that many key members of the executive team are just not named in the filings or on their website. The company did disclose all of the CEO’s direct reports in a correspondence letter filed with the SEC, which presents a more fleshed out organizational structure.

Clearly, the CEO is the person in charge here, warranting a specific key-man risk factor callout in the SEC filings. The letter goes on to note that he controls 40% of the vote as well as 5 of the 9 Board votes.

Per the earlier table, the CEO owns approximately 22% of the company, his co-founder who is no longer active with the company owns another 4%, and the other named executives own about 0.55%.

While not detailed out specifically in the prospectus, I believe the real secret sauce and talent at Wish resides within the orgs of the five executives in Engineering and Data Science:

· Co-founder and ex COO and CTO – Sheng (Danny) Zhang (LinkedIn). Left circa 2019

· SVP of Engineering – Previously Tarek Fahmy (LinkedIn). 8 years, left in October 2020 to pursue motorsports

· VP of Engineering – Bill Cao (LinkedIn).

· VP of Infrastructure Engineering – Xi (Kevin) Long (LinkedIn)

· VP of Data Science – Pai Lu

· VP of Engineering, Data – Jack Xie (VPE, LinkedIn, 10 years)

Taking a look at Wish’s patents list (Justia), the same five individuals keep popping up on each patent: the CEO, Zhang, Fahmy, Xie and Yuli Ye (Head of Machine Learning, LinkedIn, 6 years).

I hope these individuals are compensated more in line with market, though many of the tech folks do seem to have stayed with the company for a long time. I can understand the founder and SVP leaving to pursue other interests after 8-10 years working there. I also noted the strong tie to the University of Waterloo.

There seems to have been a decent amount of insider selling in February and March (gurufocus). Most of these appear to be related to automatic selling related to covering withholding taxes for vesting RSUs. My interpretation of the lock-up language is that employees and insiders are prevented from making any direct sales until after the Company’s second public earnings release, which is slated for May 12, 2021. I would be surprised if anyone were to voluntarily sell down meaningfully at these levels, so this would be an area to key an eye on in the coming months.

CEO

There’s not that much coverage around him, but the breadcrumbs that can be scrounged up paint a fascinating and compelling portrait.

I think all you really need to know about Piotr Sculczewski and the company he founded is contained in his short letter to shareholders and partners in the prospectus(page 63). Some excerpts:

I grew up in Soviet-controlled Poland in the 1980’s where I learned first-hand what it is like to not have access to basic goods and services.

After leaving Poland, I went to the University of Waterloo to study mathematics and computer science, and then worked for ten years as an engineer at Google building advertising technology.

I founded Wish to help the underserved who have been neglected by existing ecommerce offerings. This massive population of value-conscious consumers works hard to make a living, but still cannot afford more expensive or branded goods. My goal is to bring affordable goods and services to this underserved population. I also wanted to help merchants and manufacturers – many of which are small family businesses – find new customers around the world.

Our global marketplace is underpinned by data and technology across every aspect of our business. Half of our employees are engineers and data scientists. We built a platform – with the right algorithms, data science and machine-learning capabilities – that just gets better with time and usage.

We are going to continue leveraging our scale, data science, and technology capabilities, and the power of discovery-oriented shopping experiences to: (1) Create the best mobile shopping mall that drives value and accessibility for as many consumers around the world as possible, and (2) Enable brick and mortar stores, brands, merchants, and manufacturers to thrive in the highly competitive retail landscape by providing indispensable services to help grow and run their businesses and by delivering our massive base of value-oriented consumers.

As a company we are relentlessly focused on continuous improvement and measurable impact. We have a deeply ingrained culture of experimentation and testing that we combine with rigorous standards of measurement. Based on data, we will both double down and pull back on various initiatives as we continually pursue better performance and results.

The bold-faced language is what stands out to me. At its core, this is a data science / machine learning / tech company. While I may not always understand the markets they go after or the products they launch, I can very much get behind the idea that these will have been thoroughly vetted, vigorously tested and relentlessly optimized.

Unlike other colorful CEOs and visionaries dominating the headlines, this CEO and company seems to be quietly focused on execution. Engineers inherently think in terms of margin of safety. Each metric and target disclosed would have had to pass a withering level of scrutiny. My sense is that a software engineer / data scientist type is far more likely to sandbag his targets than to overstate them.

The company is personified by the CEO. Here he is in action at conferences and interviews:

· [2020] Discussing the IPO on CNBC and Bloomberg. Key quotes: “wouldn’t say we’re like dollar stores…order values probably much higher than dollar stores”; they transport goods in the underbellies of aircraft, which was impacted by COVID.

· [2017] Discussing the Lakers patch deal with NBA.com. Wish had reached out to Lakers and struck that deal within 6 weeks in 2017.

· [2017] Shoptalk presentation on the Failure of eCommerce. #1 Product failure in terms of finding and purchasing your product. #2 Demographic failure of people that have been left behind.

· [2016]Recode interview discussing their mission and addressing the four common criticisms. They were already on the path back then.

Within the letter and the Recode interview, there are also indications about his long-term aspirations with Wish in reaction to acquisition rumors at the time. The short answer is that I don’t think he’s interested in selling. I don’t think the marginal billion dollars is all that meaningful to him at this point. I think he’s looking to achieve something huge and world-changing, and he likes the hand that he’s been dealt.

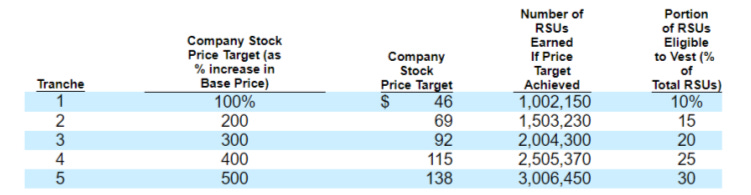

In addition to his existing stock holdings, the CEO has a 7-year Performance Award based on hitting certain stock price targets up to 5x from IPO price that unlocks up to 5 tranches of RSUs.

This table caught my eye and raised a few thoughts for me:

10M shares at the IPO price is already worth $240M.

If you value the received shares at the price targets, the package is worth ~$1.0B

If you value the ~10M shares at the $138, the package is worth ~$1.4B

When you consider the CEO already owns 134M shares, an additional 10M shares doesn’t really even move the needle for him. Why is this even here?

Knowing what we know now about the CEO and his background, his motivations, and how he works, what would you estimate his confidence level is in hitting these targets? What is the probability that he does not hit these targets?

The CEO has mostly kept his shares. In June 2019, he did sell ~$17M in shares @ $12.17 back to the Company. Incidentally, it was reported in August 2019 that he had made a $15M Bel Air mansion purchase. The headline price seems high, but clicking through the pictures in the article, I found myself somewhat in awe by the amount of house he got for his money.

EMPLOYEES

The headcount metrics reflect the concentration in technology. Some key stats at IPO:

· 828 FTEs across 8 countries (primarily SF and Toronto)

· 417 FTEs (50%) in R&D. 32% hires from referrals. For reference, the share of employees in R&D is higher than what it was for Google at IPO. GOOG in June 2004 had 2,292 employees (705 R&D, 1,141 in S&M, 446 in G&A, prospectus GOOG pg 85).

· ~$3M revenue per employee. Facebook in 2011 leading up to its IPO had $4B revenue, 3,200 employees or $1.5M per employee (IPO at $38 in May 2012). Google had ~$2.3B in revenuein LTM June 2004, or ~$1M per employee, at IPO.

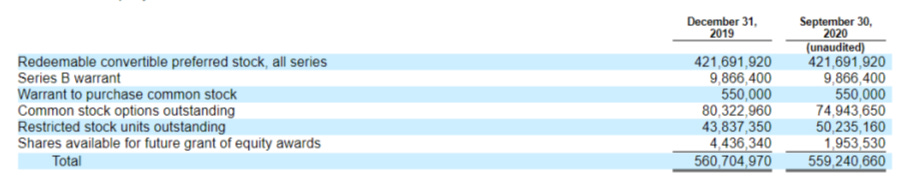

Based on the below table, there are approximately 75M common stock options and 50M RSUs that were outstanding leading up to the IPO. The value to all employees/management: $1.2B in options, $835M RSUs value as of 9/30/20 (F-40 of the prospectus).

However, the named executive officers (mostly the CEO) held ~44M options and ~19M RSUs from that pool. That leaves approximately 30M options and 30M RSUs for the rest of the employees, past and present. The company stopped granting options sometime between 2014 and 2017, so the options will be concentrated among the earliest employees. It’s thus likely that most of the ~800 employees have ~30M RSUs among them. Those 30M RSUs would be worth ~$720M at IPO, now <$400M, which means the average employee has ~$500k to $1M in equity value, at varying levels of vesting. Double those numbers if including the option pool too. After taxes, my guess is that the typical employee can perhaps afford a Bay Area down payment now, with likely a much smaller number who may be able to afford the house outright. It’s solid, but not really life changing money.

The Glassdoor reviews have been mixed (Jun 2020. Apr 2020) to poor (Aug 2020, Jan 2020). It doesn’t seem like a pleasant place to work: poor work-life balance, poor senior leadership, young employees, short-term metrics data-driven.

This may matter from an employee retention perspective for folks who may seek greener pastures and better working conditions. It’s not like companies aren’t willing to pay up for world-class data science and machine learning talent. It’s an area to keep an eye on. In my view though, it would be premature for someone to leave now.

WHAT’S THE CHATTER?

There isn’t that much out there on the interwebs. Here are the usual suspects:

· IPO blog posts. These Substacks have provided the best quality analyses so far. Both of these are negative, but they were both done in the lead up to the IPO. Napkin Math (a solid skeptical breakdown of the S-1), The Diff (raises interesting point about inevitable short selling report)

· Seeking Alpha. Recent articles are mixed to bearish (Apr 2021, Mar 2021), but the comments to these articles are mostly bullish pointing out asymmetric returns and comparisons to Pinduoduo. Key criticisms: margins challenged, concerned about customer loyalty, highly promotional business model, product quality, poor reliability and long shipping times. No clear plan to reach profitability. Low-cost competitors in emerging markets – MercadoLibre in LatAm, Allegor and Avito in Eastern Europe, Shopee and Lazada in SEA, Souq Cobone and Sukar in MENA, and Jumia/Konga/Alibaba in Africa. The regional low cost players are a fair point.

· YouTube: This one provides a comparison between Chinese companies Pinduoduo and Tiktok to Wish, starting with lower-income untapped region. Alex Moazed (Wish is a scam), though the cognitive dissonance on display in this video is amusing – his mind is blown by the reported numbers, but the only rationalization is that it must be a scam. Here’s another video outlining Wish as a Bullish opportunity.

· Value Investor Club. No writeup for the non-members yet.

· Reddit forums. WISH_STOCK. Nothing of note, though this type of company has a lot of ingredients for a meme stock. I would think it should resonate with this community.

SECRET POWERS

Wish provides a fascinating case study of Hamilton Helmer’s 7 Powers, the foundations of business strategy.

There are notable scale economies, network economies, and process power associated with their distribution and massive volumes. There are also, to a lesser degree, elements of cornered resource in their data science expertise, branding with their #1 app positioning, and even switching costs for sellers looking to drive as much volume with Wish.

What intrigues me the most about Wish is their counter-positioning. This is when “a newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.”

The advantage lies in being dismissed and disdained as a very small niche business, similar to how a dominant Blockbuster perceived Netflix, or how the investment management industry perceived Vanguard’s index funds, or how Google was ridiculed for years for overpaying for an unmonetizable video platform overflowing with low quality pirated user generated content in Youtube.

What better business is there than one in which no one else wants to compete with you?

As Peter Thiel put it, “Competition is for losers.” Thiel happened to invest in Wish around the time that article was written and when his Zero to One book was written.

But doesn’t Wish compete with Amazon and Alibaba and a host of others? Of course they do, but then again, perhaps not really.

Amazon, at the end of the day, is looking to sell more Prime subscriptions on the consumer side. Amazon is not likely to venture into geographies if they are unable to deploy the Prime playbook there. I don’t think Wish and Amazon are competing for the same user, even though their respective customer bases may sometimes purchase similar inventory. Wish’s target market is the non-Prime customer, anywhere in the world.

Alibaba could very well be the threat, but their superpower emanates from their dominance in China. The company doesn’t have a great track record in achieving a similar level of success in any of their efforts outside of China yet. While AliExpress may have enjoyed some success in certain geographies earlier on, I’m not sure about their ability to sustain that growth globally, particularly as the universe of addressable merchants expands outside of China. Alibaba also has a lot of competing priorities starting from the very top (Jack Ma, Ant IPO, defending their home turf), which may impact their ability to adapt and compete effectively in this niche.

Most large incumbents, at least in the U.S., are likely to acknowledge but ultimately dismiss or outright disdain the opportunity. There will certainly be pockets within the large players that grasp the potential, but will they be able to mobilize their resources and act the way Wish and their CEO singularly can? The irony is that one of the most compelling and practically inevitable global trends is also found to be repellent. There is an unwillingness to traffic in this quality tier of inventory, engage in this type of tacky social promotion, or pursue such a humble demographic. This cognitive bias is challenging to overcome, not just among potential direct competitors of Wish, but also potential investors in the company.

But the longer the intensity of competition stays relatively dormant, the more time the company has to build and gain share. The attitude and ignorance of the incumbents acts as a protective barrier. As such, there is limited incentive for the company to share more than is necessary to go about their business. They’ll continue to fine-tune and optimize and add value for a large, underserved audience until one day their dominance of this niche will be a fait accompli. It will then have been obvious in hindsight.

VALUATION THOUGHTS

Let’s examine what we need to believe in order for the CEO to hit his targets.

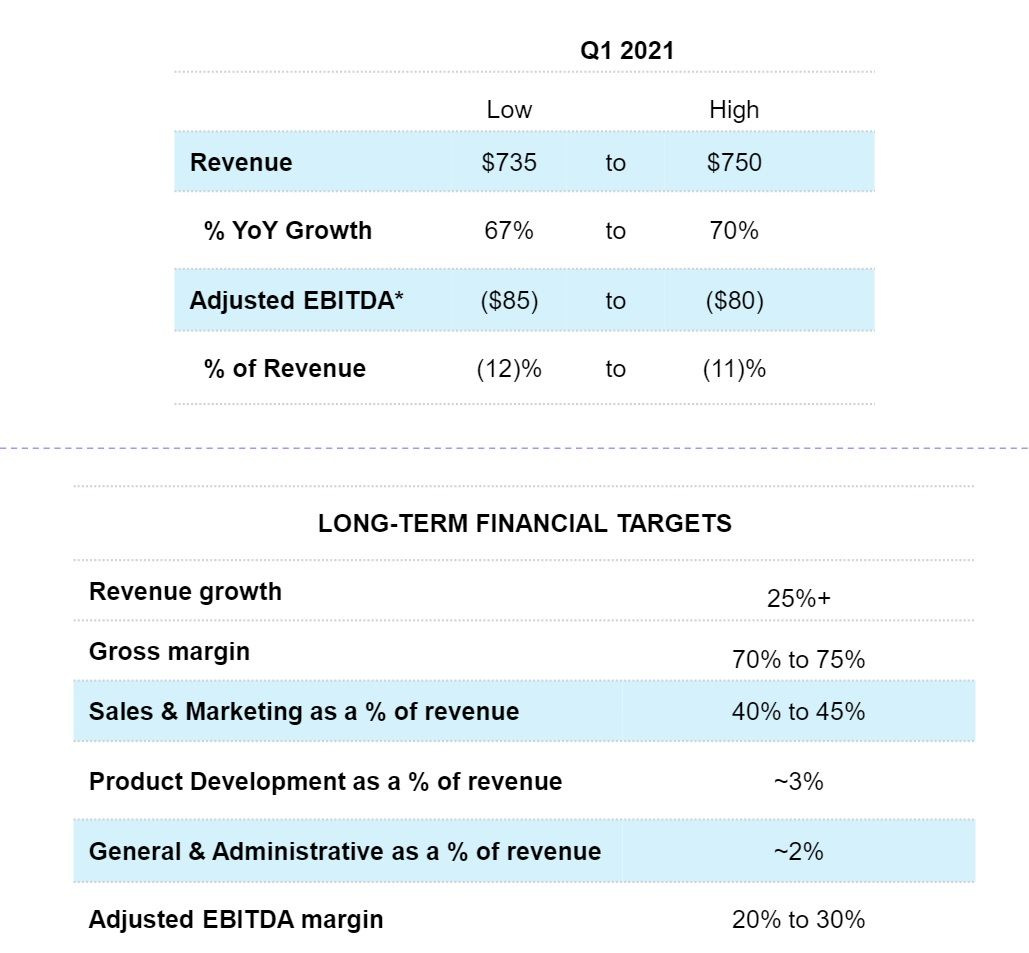

The company has shared the following guidance for Q1’21 and long-term targets:

Such a data driven company would put a lot of care into selecting highly achievable financial targets. What jumps out is the adjusted EBITDA margin of 20% to 30%, which seems high from current levels, but is in line with marketplace businesses.

Adjusted EBITDA is a non-GAAP metric, but in this case, it likely tracks net income very closely. I think the only meaningful difference at this point is adding back stock-based compensation. Since this is a capital light business (little D&A), they deliberately operate at a slight loss (no taxes), they have no debt (no interest expense), the rank and file employees generally don’t seem to be paid very highly (depresses stock-based compensation), this may be a rare case where the Non-GAAP metric actually tracks net income pretty well. Net income would likely line up closely to free cash flow (FCF) including stock-based compensation.

Back in their investment highlights, the company had called out their addressable market of mobile commerce as $2.4T by 2024.

To put that in context, Digital Commerce 360 lists the top global online marketplace by GMV in 2020, with growth of 40-60% for the US depending on whether you exclude Amazon and eBay. Note that the pandemic generally had a positive impact on growth.

1. Taobao (Alibaba): $609B

2. TMall (Alibaba): $593B

3. Amazon: $475B

4. JD.com: $405B

5. eBay: $100B

Wish’s current revenue run rate is ~$3B, which suggests they are currently generate ~$20B annual GMV (assuming 15% monetization). Is it possible for the company to carve out a $100B+ GMV business in the next 5-7 years, even in the shadow of giants?

It all comes down to what they can achieve around revenue growth and margin. There could be a wide wide range here when you factor in all of the earlier commentary and their historical trajectory. The 70% Q1 growth guidance benefits from a terrible Q1’20, so it will be interesting to see how the rest of 2021 plays out.

Below are some high-level sensitivity tables varying revenue growth and FCF margin 6 years out:

Key assumptions:

Base year revenue of $3B (roughly the Q1’21 run rate)

6 year hold period

Market cap based on 15x multiple on FCF (may be conservative for a high growth company)

No adjustment for cash balance

Share price based on 700M shares at exit, which implies ~15% dilution to account for the impact of stock-based compensation. There were 75M options and 30M RSUs outstanding at the end of 2020.

It turns out that the assumptions don’t have to be too aggressive to start seeing a multi-bagger outcome. The share price table also provides a rough approximation for the metrics needed in order to hit the share price targets in the CEO’s performance bonus package.

At the current ~$7.5B market cap, that would suggest the market thinks the company will have ~10% annualized growth and ~10% FCF margins. While they haven’t proven out their profitability yet, that profile still seems really conservative for a marketplaces business. It assumes that the gross margins will stay pressured with the shift to logistics, that the user growth story has already peaked, and the cost of customer acquisition remains elevated and uneconomic. It would be interesting to see what this business could do if management turned its focus toward driving profitability. The guidance of long-term 20-30% EBITDA margins is comparable to other more mature marketplace businesses. The simplest approach would be to reduce the $1.7B in marketing spend accordingly. If the business can do better than that, then the upside potential on this is frankly massive. I like the odds of that playing out.

RANGE OF OUTCOMES IN 5-7 YEARS

These are just my guesses.

Downside (i.e., holding the bag) [~20% probability]. It turns out that user growth flattens and the profitability isn’t there. Reasons could include an escalated and/or protracted China trade war, the business model just doesn’t work, increased competition, prolonged pandemic disruption, fraud, some other black swan event (e.g., suppose China were to invade Taiwan and disrupts foreign trade).

This business, however, remains a very capital light business. There are still fewer than 900 employees. Even in the worst case where the company has to sustain a period of time of zero revenues, they have the $2B cash cushion to survive for several years with their predominant expense being salaries.

Provided management does not start wasting large sums chasing vanity projects, they could likely still pivot to running this for cash flows and cutting marketing significantly. Recall that ~70% of their revenues are from existing buyers. Even assuming a significant revenue decay, that is still a very healthy cigar butt, as they could probably shave off ~$1B+ in marketing spend per year. A starting base of $2B existing revenue at 20-40% annual decay rates would result in $5B to $10B in cumulative revenues, or $2B to $4B at a 40% margin.

When you consider that their $2B cash balance represents ~$3+ per share, they have operated at effectively breakeven for the past 4 years, and their CEO is likely in it for the long haul, my sense is that the downside is relatively limited from here. Let's not forget that they're still growing for the time being. Even clawing back to the IPO price represents a double from here.

Call this an $8 per share outcome.

Case studies: GRPN, ZYNGA– disappointing long-term outcomes

Upside (i.e., holding the bagger) [~80% probability]. We land somewhere in CEO’s performance comp plan: $46 through $138, representing a ~4x to 11x+ return. Based on the earlier sensitivity table, I think this comes into play if Wish can achieve 20%+ annualized revenue growth during this time period. There is also a real possibility that this goes parabolic beyond that. It’s not an atypical outcome for commerce with meaningful TAM and line of sight to scale.

Case studies: AMZN, ETSY, MELI, PYPL, SE, SQ, SHOP. Even DLTR, DG, TJX, WMT in offline context. BABA, JD and PDD for China.

This will be a volatile ride. The challenging part will be holding through the volatility.

While a Groupon or Zynga outcome is possible, I believe this is low probability. At IPO, Groupon had a fundamentally different business model, relying on a huge workforce (10k+), while enduring a much more contentious SEC review due to some innovative non-GAAP accounting. Moreover, the founders had already cashed out close to $1B prior to the IPO.

Zynga operated in a Facebook game hits driven business (FarmVille and Words with Friends), and a far more competitive environment. But they were quite the player back then, representing 12% of Facebook’s revenue at the time of Facebook’s IPO. It was just tough to sustain that advantage.

Wish has carved out a niche for itself that happens to be incredibly massive and valuable. Their space is dismissed and disdained as the sketchy area dominated by Chinese sellers and dollar stores.

The attitude toward Chinese-based sellers and dollar stores is actually somewhat baffling. There seems to be a pervasive false equivalence that because the quality of the items being sold on the platform may be of suspect quality, then the company behind them must therefore be suspect too.

China, however, is the most competitive and unforgiving e-commerce arena in the world. Sellers that survive and thrive there must be doing something right. The Chinese e-commerce players Alibaba, JD and Pinduoduo are among the most valuable companies in the world.

The dollar store industry is a perfectly fine place to be, particularly in the US. Between the two leaders, Dollar General ($52B market cap) and Dollar Tree ($27B market cap), there are ~30k stores, ~$50B sales, ~5-10% net income margins, 20x PE. Even a smaller player like Five Below with 1k stores trades at $11B market cap on $2B in sales (that's sales, not GMV). Peruse their stock charts, and I'm sure you will have been more than satisfied with a dollar store stock performance outcome over the past 10 years.

But Wish isn’t a retail company. They have no store footprint. It’s an asset light model. It’s global, mobile, local and social. It’s “algorithmic commerce” as described by Scott Galloway, only instead of Walmart plus Tiktok building this eventually, it’s already happening at global scale and at a rapid clip with Wish.

CATALYSTS

This one has been volatile over the past few weeks, and it seems more likely for downward pressure to prevail in the near-term.

[Negative] The impending lock-up expiration may put downward pressure on the stock over the next few weeks. May 12th is their Q1 earnings announcement, and ~90% of the company’s shares will be available to trade a few days afterwards. This traditionally puts downward pressure on the stock, but I’m not sure who would really want to sell at these levels.

[Negative] The upcoming earnings call will be interesting. The key will be their outlook for Q2 and whatever commentary they provide for the rest of the year. In 2020, they had -8% revenue growth in Q1 and 67% growth in Q2. They had already indicated that Q2 will be a challenging comp before seeing Q3 and Q4 return to normalized growth. This was highlighted during the Q4’20 comments, which happened just two months ago. The language seemed to suggest that Q2 might be relatively flat year over year. The large tech names have generally delivered stellar Q1 results, but their share prices haven’t necessarily moved as dramatically. Against that backdrop, my sense is that an underwhelming Q2 outlook will cause the share price to dip further in the short-term. That could provide an attractive level to build the position.

[Negative] A short-selling report gets released per the blog post mentioned previously, uncovering some salacious detail about the inventory, the sellers, the company, or some other unknown. The company does cover a lot of volume without that many people, so it is very possible something will go overlooked on the customer or inventory front. Unflattering PR is going to be an ongoing cost of doing business though. At these depressed levels, I’m not sure if there is enough juice for a short seller to squeeze. The shares short on this does seem to be building up though.

[Positive] The company announces a stock buyback program. It seems like a logical thing to do, especially if the stock continues to trade at these levels. They could theoretically buy back their 46M IPO shares and still have ~$500M+ in IPO cash left over.

[Positive] They flesh out the management team. While the CEO seems to have done just fine getting to this point, imagine if the company were to add a seasoned executive in the mold of an Eric Schmidt or Sheryl Sandberg, someone who had the experience to grow the business, while lending the gravitas to further legitimize the company on the communications and investor relations front. It would also allow the CEO to focus on the technology and optimizing the business. Such an announcement could very quickly shift the perception of this company. Some more diversity in the management ranks could help too. Fortunately, the company already has two strong candidates on their board with Tilenius (ex Google and eBay) and Reses (ex Square and Yahoo).

[Positive] This one is admittedly a long way off, but Wish will get added to the S&P and FTSE indices sometime after 2027 (assuming they’re actually profitable and large enough then to warrant inclusion). S&P and FTSE adopted rules in 2017 that disallowed companies with dual-class share structures into their indices. After Wish Class B shares sunset to Class A in 2027, this constraint falls away and these indices would be required to buy shares. There was a similar dynamic with Tesla in late 2020 after they had achieved their second GAAP profitable quarter and were then eligible to be included in the S&P indices, which prompted a lot of automatic purchasing given their size.

[Positive] Wish has a lot of ingredients (their target demographic, their underdog story, the constrained float, an increasing number of shares short) that could potentially lead to a meme stock Reddit surge at some point. Hard to predict, but tough to dismiss that possibility.

Several of these could potentially get checked off during the earnings call on Wednesday.

SELL SCENARIOS

Company misses their targets more than once. This would shatter my company-is-awesome-at-data-science thesis.

Watch for deterioration in the metrics, which could include: (1) the revenue growth starting to flatten out (e.g., <25% revenue growth for 2 years running), (2) deterioration in cohort performance on either the CAC or LTV front, and (3) reduced evidence in operating leverage, represented by a deceleration in sales & marketing expense improvement, rising cost of goods (which would represent higher logistics costs), or rising capex % which would indicate a departure from their asset-light approach.

Pay attention to their headcount growth and whether they need to invest in more customer care or content moderation.

When the CEO or BOD starts to sell out, steps down, or otherwise indicate less confidence in the business. I would be surprised if this occurred in the near-term though.

Some black swan negative event (e.g., security breach). Something that goes by uncaught that they overlook.

If the CEO hits his comp targets (i.e., after the stock appreciates 10x+), reevaluate.

BOTTOM LINE

Impressive data driven iterative product development. Feel confident in their ability to be nimble, launch, test and iterate and follow where the data points them to and what the customer needs are.

Strongly counterpositioned to both capitalize on a massive opportunity while occupying a space that few want to compete in.

Opportunity to buy in (<$8B market cap) at 2016-2017 price levels.

Bet with the CEO (highly aligned incentives) to see if he hits his comp plan.

Limited downside (frankly don’t see much downside from these levels with roughly breakeven FCF operations while supporting growth, plus the ~$2B cash and no debt)

Hold for 5-7 years. Entry price significantly below the IPO price seems pretty enticing with very decent probability for multi-bagger outcome.

PLAYS TO CONSIDER:

Buy the stock. If you assume the CEO’s first $46 target, then whatever below that which feels comfortable. $15 and below seems like an attractive risk-reward entry point.

Sell cash-secured puts. I found many examples of structuring something where you either get an adjusted entry price at a 10-20% discount, or you get a 20%-30% yield on your cash.

Personally, I find it rare for so many elements to align where it makes sense to dust off the elephant gun.

Other References:

· IPO in December 2020 at $24/share (high end of $22-$24 range), raised $1.1B at $17B fully diluted valuation. Currently trading at $12.

· Wish filings and financial targets: 2020 10-K; Q4’20 report; IPO prospectus

· Commentary: How Wish passed $1B in rev by inverting Amazon’s strategy (Mar 2021); How Wish built a retail empire for shoppers to buy on the cheap under the nose of Amazon (Feb 2020, includes CEO quotes); Wish, the $10B company no one’s talking about (Apr 2018);

· What is it like to sell on Wish? Deliverr blog; CED Commerce: How to Sell on Wish.